Mandatory Climate-related Financial Disclosure Bill

The Australian Senate passes a mandatory climate-related financial disclosure scheme, aimed at formally requiring eligible enterprises and asset owners to disclose climate-related financial information.

The mandatory climate-related financial disclosure scheme is the fourth part of the Treasury Laws Amendment, which refers to the climate-related financial disclosure framework consultation document previously released by the Australian Treasury, as well as the International Sustainability Standards Board Standards (ISSB Standards).

Related Post: Australia Plans to Establish Climate Related Financial Disclosure Framework

Background of Climate-related Financial Disclosures

Climate-related financial disclosures aim to report on how climate change affects a company’s financial performance. As public awareness of climate change increases, investors are demanding that enterprises disclose climate-related risks and opportunities. Considering the potential financial risks associated with the impact of climate change on corporate financial performance, regulatory agencies are also developing climate disclosure policies.

At present, Australia already has some voluntary climate-related financial disclosure policies, such as the Australian Securities Exchange issuing guidance that large listed enterprises need to write sustainability and climate change reports in accordance with the Task Force on Climate-related Financial Disclosures (TCFD) framework. However, the existing climate-related financial disclosures lack sufficient information quantity and standardization, which may affect investor decision-making and increase greenwashing risks.

Introduction to Mandatory Climate-related Financial Disclosures

Last October, the Australian Accounting Standards Board (AASB) released a draft of the Australian Sustainability Reporting Standards (ASRS), which is based on the International Sustainability Standards Board standards and aligned with major climate-related financial disclosure frameworks worldwide.

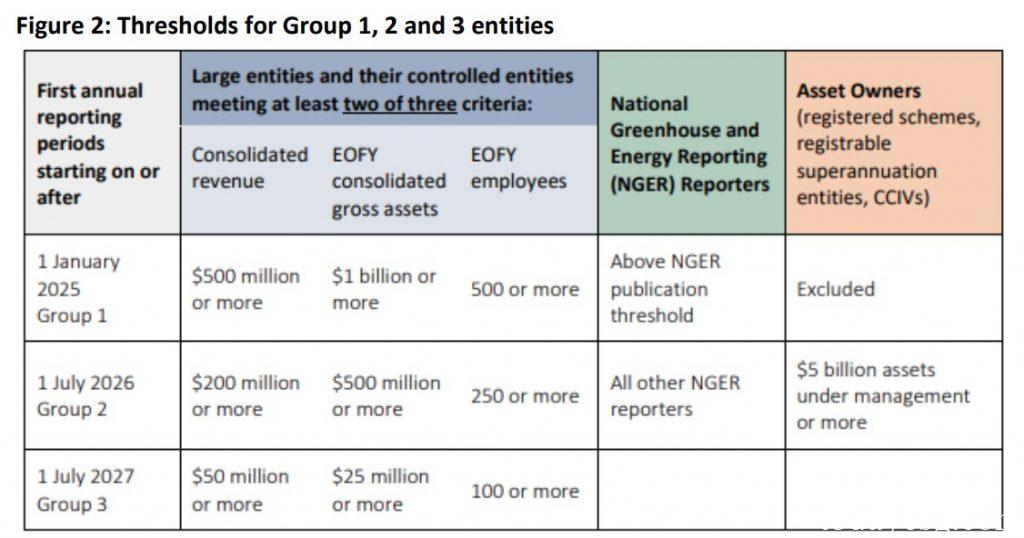

The mandatory climate-related financial disclosure bill will require enterprises to disclose in stages, and enterprises need to meet specific thresholds or comply with the disclosure requirements of the National Greenhouse and Energy Reporting Scheme. The new information disclosure will be completed in the sustainability report and included as part of the company’s annual report, while hiring a third party to audit the sustainability report.

The Australian Treasury believes that at least 1800 large corporations and asset owners are required to disclose climate information. These enterprises and asset owners will be divided into different groups:

- The first group, starting from January 2025, requires enterprises to meet at least two of the following three conditions: revenue exceeding 500 million or total assets exceeding 1 billion or number of employees exceeding 500.

- The second group, starting from July 2026, requires enterprises to meet at least two of the following three conditions: revenue exceeding 200 million, total assets exceeding 500 million, or a workforce exceeding 250. Asset owners need to meet the requirement of AUM greater than 5 billion.

- The third group, starting from July 2027, requires enterprises to meet at least two of the following three conditions: revenue exceeding 50 million or total assets exceeding 25 million or number of employees exceeding 100.

The Australian Treasury expects that the three groups will involve 729, 755, and 278 enterprises or asset owners respectively, with some enterprises in the first group already disclosing information in accordance with the requirements of the Australian Securities Exchange. Although the AUM of asset owners may reach the threshold of the first group, information disclosure is still required under the second group. For the third group of enterprises, if they can prove that there are no material climate-related risks and opportunities, they are exempt from information disclosure.

According to the Australian Sustainability Reporting Standards, a company’s climate-related financial disclosure must include the following:

- The material climate risks and opportunities faced by enterprises.

- Corporate governance, strategy, and risk management plans.

- Climate-related indicators and targets, including Scope 1, Scope 2, and Scope 3 carbon emission indicators.

Corporate directors are required to declare in the sustainability report that the report complies with the sustainability reporting standards in the Act, but according to the three-year transition period of the Act, directors only need to declare that the company has taken reasonable measures to ensure compliance with the sustainability reporting standards set forth in the Act. In addition, mandatory audit requirements for sustainable development reports are still being developed, but according to the consultation document of the Auditing and Assurance Standards Board, the latest deadline for auditing reports for all groups is July 2030.

Reference:

Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill 2024

Contact:todayesg@gmail.com