Report on Sustainable Taxonomy

The Asia Securities Industry and Financial Markets Association (ASIFMA) releases a report on sustainable taxonomy, aimed at investigating the application of sustainable taxonomy in Asian jurisdictions.

The Asian Securities and Financial Markets Association surveyed banks, asset management companies, and sustainability index providers, focusing on common implementation themes and challenges of sustainable taxonomy.

Related Post: Global Reporting Initiative Releases Sustainability Taxonomy

Asian Sustainable Taxonomy Application

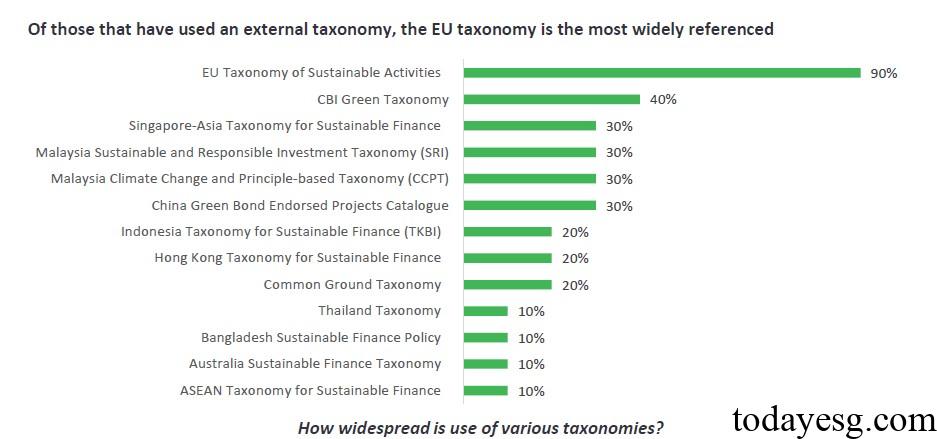

All respondents mentioned external classifications in the survey, with the EU Taxonomy and CBI Green Taxonomy being mentioned the most frequently, at 90% and 40% respectively. 80% of respondents mentioned internal taxonomy, which references external frameworks and are combined with taxonomy from other regions around the world. Respondents indicated that the departments with the widest application of sustainable taxonomy include sustainable finance, legal, and financial reporting, which provide support for classification application, decision-making, and training.

In the application aspect of sustainable taxonomy, information disclosure (35%), product labeling (22%), and ESG incentives (13%) account for a relatively high proportion. 70% of respondents believe that taxonomy has a role in reducing greenwashing and promoting transformational financing, and 90% of respondents suggest Do No Significant Harm or Minimum Social Standards in the taxonomy to ensure that economic activities make a positive contribution to the environment. 30% of respondents have implemented multiple taxonomy, and 90% of respondents believe that interoperability of taxonomy remains a significant challenge.

Asian Sustainable Taxonomy Challenges

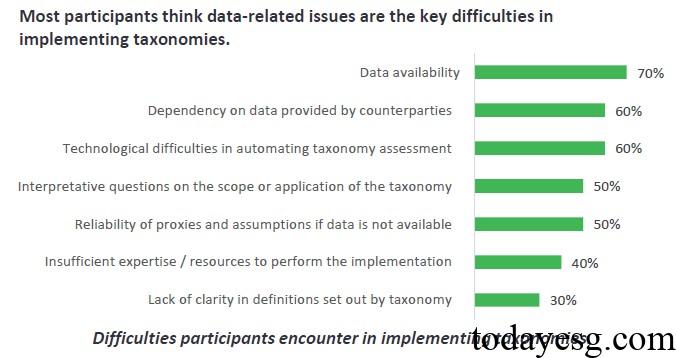

The respondents believe that the main challenges in the implementation process of sustainable taxonomy are data availability (70%), reliance on counterparties to provide data (60%), and automation technology difficulties in classification evaluation (60%). These issues reflect the limitations of sustainable data on the application of taxonomy, therefore respondents’ suggestions include improving data availability (80%), identifying data needs and sources (50%), and interpreting data in taxonomy (50%).

The respondents generally believe that taxonomy should not be mandatory, as mandatory use may create regulatory burdens and deviate from its original design purpose of promoting sustainable investment. Some respondents believe that if sustainable taxonomy is enforced, the focus should be on product labeling, information disclosure, and classification related financial instruments. 50% of respondents believe that taxonomy will become a mandatory requirement in the future, but interoperability, data quality, and compliance burden remain challenges in the mandatory application process.

The recommendations provided by the Asian Securities and Financial Markets Association include:

- Maintain the voluntariness of taxonomy: The EU has already relaxed the scope of application of taxonomy, and future taxonomy should be based on voluntary application.

- Improve interoperability of taxonomy in different regions: Jurisdictions can communicate with each other to achieve mutual recognition and equivalence of different taxonomies.

- Strengthen data availability and capacity building: Market participants can develop data solutions, improve data availability, and simplify classification processes to increase efficiency.

- Engage: Regulatory agencies should continue to collaborate with the industry to jointly design and apply taxonomy.

Reference: