2025 Responsible Investment Trends Report

The Canadian Responsible Investment Association (RIA) releases 2025 Responsible Investment Trends report, aimed at summarizing the development of responsible investment in Canada.

The Canadian Responsible Investment Association surveys 83 asset owners and asset managers.

Related Post: Responsible Investment Association Releases 2023 Responsible Investment Trends Report

Canada’s Responsible Investment Development

By 2025, the scale of responsible investment assets in Canada increases by 15.9% compared to 2024, and market participants’ focus is shifting from market size to the application of responsible investment. The proportion of respondents adopting ESG integration has increased to 96%, and their asset management scale accounts for 87%. A quarter of the respondents indicate that the priority of responsible investment is higher than last year, with 76% of respondents collaborating with other market participants on responsible investment, which is higher than the global market (62%).

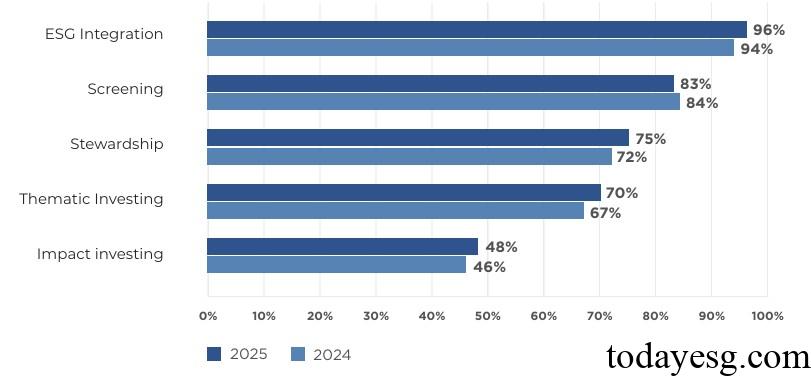

With the development of the responsible investment market, respondents’ expectations for future growth are decreasing. Since 2020, the proportion of people who believe that the market is growing rapidly has decreased from 54% to 3%. In terms of responsible investment methods, ESG integration (96%), screening (83%), stewardship (75%), thematic investment (70%), and impact investment (48%) account for a relatively high proportion. Compared to 2024, only the application proportion of screening methods has decreased from 84%, while the proportion of other methods has increased.

Investors’ confidence in the responsible investment industry is on the rise, with 68% of investors having confidence in ESG information disclosure, 91% having confidence in the disclosure of their own institutions, and an overall confidence rate of 65% (40% in 2024). Nevertheless, investors believe that the standardized disclosure of responsible investing, as well as the development of global ESG ratings and ESG regulatory policies, will continue to boost confidence.

Responsible Investment and ESG Factors

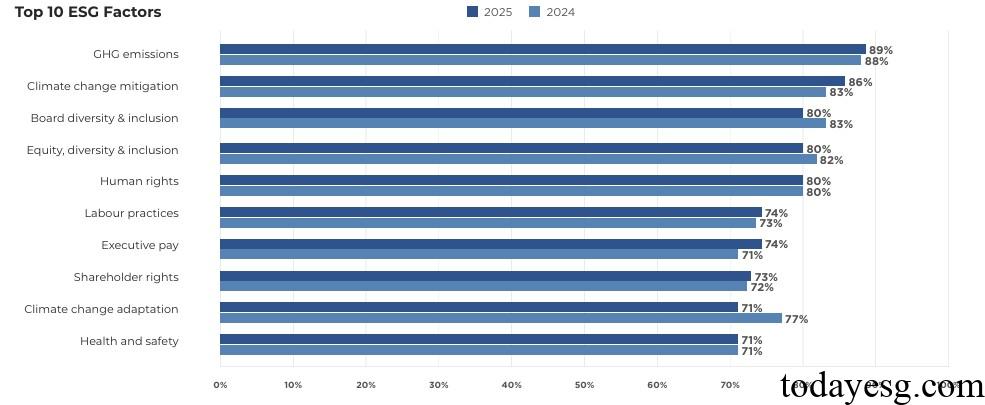

The reasons why respondents consider ESG factors include reducing risk (83%), increasing returns (56%), and fulfilling fiduciary obligations (48%). Among the top ten ESG factors considered by respondents, greenhouse gas emissions (89%), climate change mitigation (86%), and board diversity and inclusion (80%) account for a relatively high proportion. In terms of sources of ESG information, a relatively high proportion are from corporate sustainability reports (92%), internal research (89%), and direct provision by companies (88%).

In terms of environmental factors, greenhouse gas emissions (91%), climate change mitigation (88%), and climate change adaptation (74%) account for a relatively high proportion. In terms of social factors, fairness, diversity, and inclusiveness (82%), human rights (82%), and labor practices (76%) account for a relatively high proportion. In terms of governance factors, board diversity and inclusiveness (84%), executive compensation (78%), and shareholder rights (76%) account for a relatively high proportion.

In terms of stewardship, investors’ main concerns include climate change (92%), diversity and inclusion (82%), and greenhouse gas emissions reduction (82%). 68% of respondents reported proactive management results, an increase of 15 percentage points compared to last year.

In terms of ESG framework, respondents mainly use the Taskforce on Climate-related Financial Disclosures, the Sustainability Accounting Standards Board, and the United Nations Sustainable Development Goals. The proportion of using the Canadian Sustainability Disclosure Standards published by the Canadian Sustainability Standards Board is 48%, a decrease of 5 percentage points from last year, possibly due to regulatory agencies adopting it as a voluntary standard.

Reference:

2025 Canadian Responsible Investment Trends Report

ESG Advertisements Contact:todayesg@gmail.com