Global Sustainable Bond Market Report

World Bank releases 2025 Q3 Global Sustainable Bond Market Report, which aims to summarize the development of the global sustainable bond market, with a focus on the development of sovereign sustainable bonds.

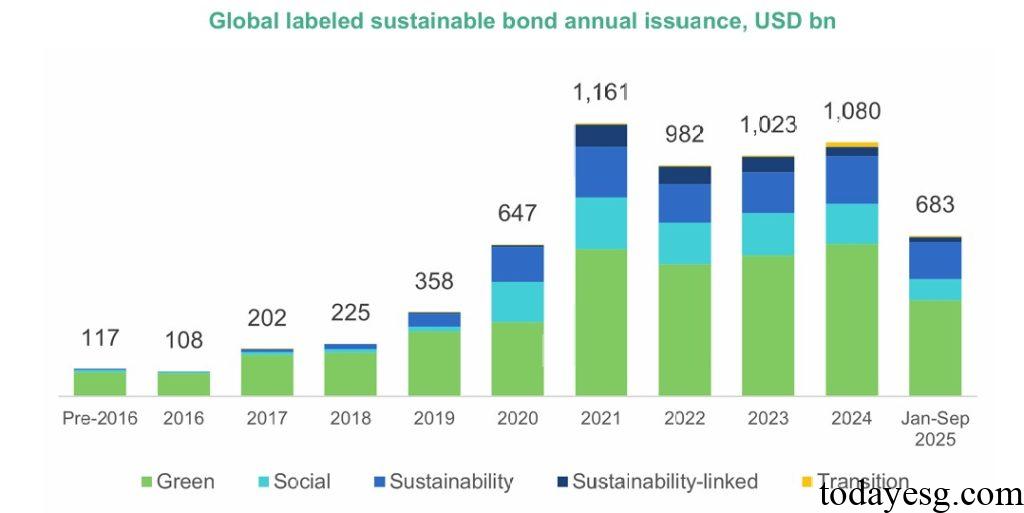

As of September 2025, the cumulative issuance amount of global green bonds, social bonds, sustainable development bonds, sustainability-linked bonds, and transition bonds has reached 6.59 trillion US dollars.

Related Post: World Bank Releases 2025 Q2 Global Sustainable Bond Market Report

Global Sustainable Bond Market Development

The global issuance scale of sustainable bonds in the third quarter of 2025 is $192 billion, the lowest since the first quarter of 2023, a decrease of nearly 30% compared to the third quarter of 2024. From January to September 2025, the total global issuance of sustainable bonds was 683.4 billion US dollars. Based on the current issuance rate, the scale of sustainable bond issuance for the whole year of 2025 will be lower than the previous four years. The issuance of green bonds, social bonds, sustainable development bonds, sustainability-linked bonds, and transition bonds in the third quarter decreased by 24.5%, 68.2%, 6.1%, 72.1%, and 10.6% respectively compared to the third quarter of last year.

The issuance of sustainable bonds in emerging and developed markets decreased by 31.9% and 44.7% year-on-year in the third quarter of 2025. Emerging markets account for 14% of the global sustainable bond market issuance. Green bonds dominate emerging and developed markets, accounting for 67% and 66% of the total issuance scale, respectively. The public sector accounts for 27% of issuance in emerging markets and 42% in developed markets.

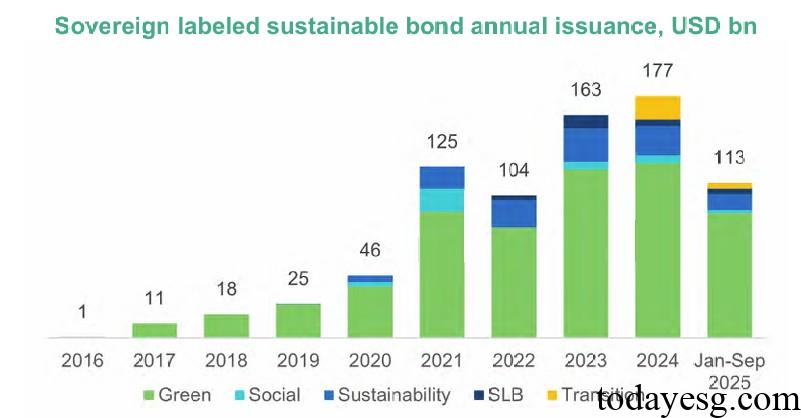

The scale of sustainable bond issuance in the public sector accounts for 34% of the total issuance, with green bonds being the preferred tool for issuers, accounting for 59% of the total issuance. Among public sector issuers, the government has the largest proportion (45% overall, 22% in Q3), while the proportion of sovereign issuers is increasing (35% overall, 54% in Q3).

Global Sovereign Sustainable Bond Development

In the third quarter of 2025, 21 countries worldwide issued sovereign sustainable bonds. As of September 2025, 61 countries have issued sovereign sustainable bonds, with a cumulative issuance scale of 782.2 billion US dollars. The issuance scale of sovereign sustainable bonds in the third quarter was 3.4 billion US dollars, a year-on-year increase of 0.4% and a month on month decrease of 17.8%. Green bonds are the main tool in emerging markets, with an issuance scale of $556 billion, accounting for 94.3% of sovereign sustainable bonds. Sustainable development bonds are the main tool in developed markets, with an issuance scale of 88.5 billion US dollars, accounting for 46% of sovereign sustainable bonds.

Since 2016, 29 emerging market countries have issued $193.3 billion in sustainable bonds, accounting for 2.9% of the total global issuance of sustainable bonds. Green bonds dominated in the second quarter of 2025 (57.5%), while sustainable development bonds dominated in the third quarter (57.7%). The top three emerging market countries in terms of sustainable bond issuance are Chile ($55 billion), Mexico ($28 billion), and Thailand ($22 billion).

Reference:

World Bank Global Sustainable Bond Market

ESG Advertisements Contact:todayesg@gmail.com