Transition Fund Trends Report

The European Securities and Markets Authority (ESMA) releases a report on transition fund trends, aiming to understand the target strategies, investment portfolios, and other disclosures of transition funds.

The transition fund primarily invests in enterprises that support climate transition through three methods: positive screening, negative screening, and engagement.

Related Post: ESMA Releases Report on Sustainable Development Goals Funds

Transition Fund Trends Report Analysis

The European Securities and Markets Authority (ESMA) selected funds with terms related to transition or climate transition in their names as research samples, resulting in 220 transition funds, of which 121 were actively managed funds (the primary focus of the report). As of December 2024, the total asset size of these actively managed funds amounted to 30 billion EUR. Since the first quarter of 2022, the number of transition funds has nearly doubled, and the asset management scale has nearly quadrupled.

To delve deeper into the characteristics of transition funds, the European Securities and Markets Authority selected the largest 42 funds out of 121, accounting for over 90% of the total assets. The characteristics of these transition funds include:

- Transition Objectives: Transition funds primarily aim to achieve regular transition objectives through portfolio exposures or to promote economic development. However, external factors such as climate policies, consumer preferences, and technological updates may exceed the scope of fund objectives, necessitating consideration of the asset management company’s transition knowledge and data analysis capabilities. 62% of funds set dynamic objectives, with their financing emissions, transition activity revenue exposures, etc., changing over time. 67% of funds translate these objectives into measurable goals.

- Screening criteria: Transition funds employ various criteria to screen enterprises, including those based on scientific objectives (36%), transition plans (29%), capital expenditure (10%), and taxonomy consistency in income (2%). Some transition funds also utilize internal ESG ratings (81%) and external ESG ratings (48%) as screening criteria. A minority of funds employ potential escalation as a screening criterion, but most fail to provide clear methodologies and underlying data.

- Monitoring indicators: The indicators used by the transition fund to measure the progress of transition include portfolio emission indicators (76%), activity exposure indicators (55%), and score-based indicators (29%). These indicators can measure performance in terms of the investment portfolio, but the impact of the invested enterprises’ own development still needs to be considered. Some forward-looking data and ESG ratings can be used to identify leaders among transition enterprises and leaders in climate change solutions.

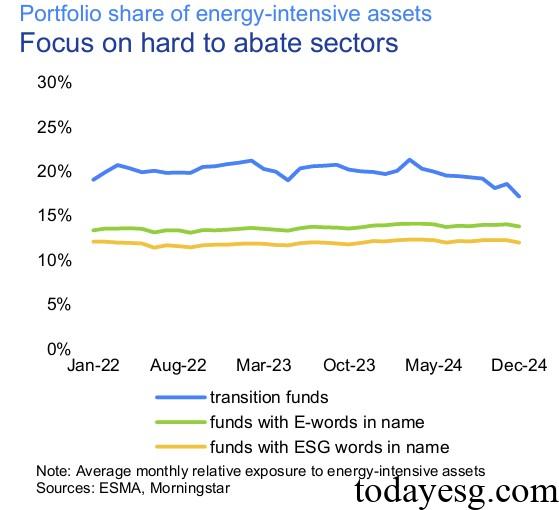

- Investment Portfolio: Transition funds, environmental funds, and ESG funds exhibit distinct characteristics. Transition funds typically exhibit a 10 percentage points higher proportion of energy-intensive industries compared to other funds. The proportion of transition funds invested in climate solution companies is 5 percentage points higher than that of other funds, and the proportion of transition funds invested in companies with sustainable development goals is 3 percentage points higher. Sixty percent of investments in transition funds are in stocks, compared to 50 percent for environmental and ESG funds.

Reference:

Emerging Trends in Transition Fund Strategies

ESG Advertisements Contact:todayesg@gmail.com