Private Sector Climate Finance Report

The World Economic Forum (WEF) releases a report on private sector climate finance, aiming to propose solutions to promote private sector climate finance.

The World Economic Forum believes that the private sector plays an important role in global climate finance, with emerging market economies needing to raise $2.4 trillion annually by 2030, with over half of the funding coming from the private sector.

Related Post: Climate Policy Initiative Releases 2025 Global Climate Finance Report

Current Situation of Private Sector Climate Finance

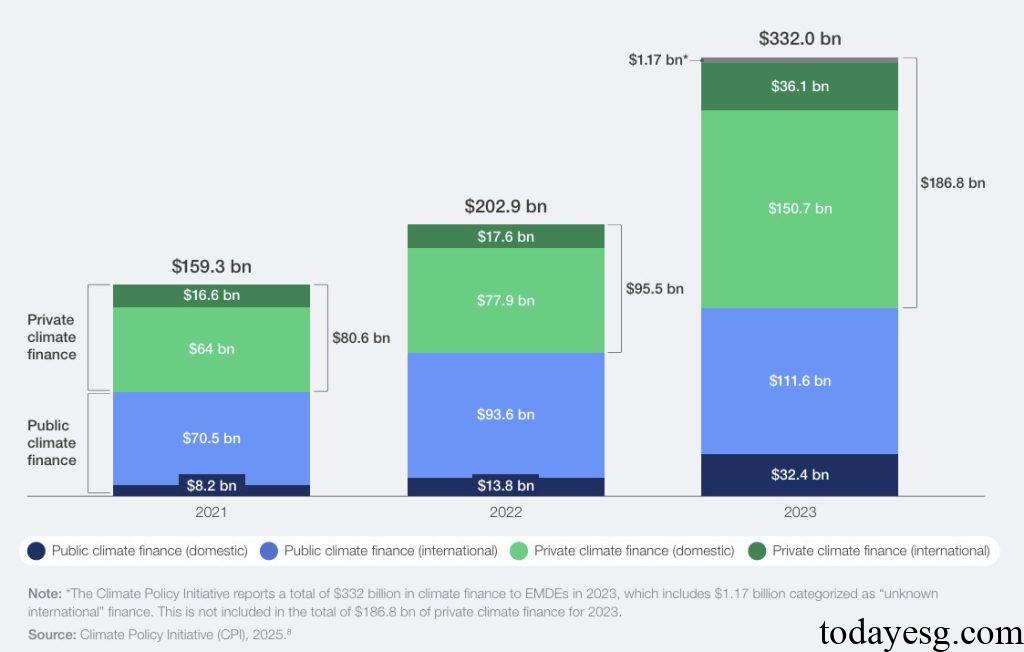

By 2023, the global climate finance scale reaches $1.9 trillion, of which $332 billion is invested in emerging market economies. To achieve the Paris Agreement, private financing needs to reach $1.3 trillion by 2030. The New Collective Quantitative Goal can raise $300 billion annually, but there is still a funding gap of $700 billion per year. Public finance cannot meet these investment scales, and the private sector needs to become a participant in climate action.

Private sector climate finance is divided into two parts: domestic and international. From 2021 to 2023, the scale of private sector domestic climate finance increases from $64 billion to $150.7 billion, and the scale of international climate finance increases from $16.6 billion to $36.1 billion. To fill the climate finance gap by 2030, private sector climate finance needs to increase by 20 times. 96% of the funds are invested in climate change mitigation, with the energy industry accounting for 75%. According to data from the Climate Policy Initiative (CPI), commercial banks and enterprises account for a relatively high proportion of private sector climate finance, reaching 40% and 35% respectively.

Roadmap for Private Sector Climate Finance

To accelerate private sector climate finance, the World Economic Forum has released a roadmap for climate finance solutions, proposing recommendations from short-term, medium-term, and long-term:

- Enhance project channel accessibility: Develop small-scale climate solutions in the short term, increase investment in climate infrastructure in the medium term, and jointly create a climate finance value chain with investors and multilateral development banks in the long term.

- Increase data transparency: Establish a climate investment data platform in the short term and develop standardized climate digital tools in the medium term.

- Support local funding: Reduce climate risks for investors in the short term and increase financing channels such as green loans in the medium term.

- Simplify risk sharing mechanisms: Provide climate risk mitigation tools in the short term and expand climate insurance solutions in the value chain in the long term.

- Enhance regulatory policy certainty: Transform national independent contributions into actionable investment roadmaps in the medium term, establish investment policy platforms in the long term, and incorporate them into climate regulatory policies.

- Expand the equity investment structure: Deploy more equity investments from development banks in the short term, attract investors through sustainable infrastructure in the medium term, and develop equity investment tools that are suitable for institutional investors in the long term.

Reference:

Unlocking Private Capital for Climate and Growth

ESG Advertisements Contact:todayesg@gmail.com