Carbon Market and Sustainable Finance Report

The International Capital Market Association (ICMA) releases a report on carbon market and sustainable finance, aiming to summarize the role of carbon markets in the field of sustainable finance.

The International Capital Market Association believes that compliance and voluntary carbon markets have great potential in reducing global carbon emissions, and these carbon markets, along with carbon taxes and carbon offset mechanisms, also have a positive impact in the field of sustainable finance.

Related Post: CFA Institute Releases Global Carbon Market Report

Introduction to Carbon Market

The carbon market comprises compliance and voluntary carbon markets. The compliance carbon market is a regulated trading system where enterprises in specific industries (typically with high carbon emissions) are obligated to participate. It adopts a total quantity control and trading framework, allocating carbon emission allowances through both free allocation and auction, thereby providing economic incentives for enterprises.

In 2024, the total trading value of the global compliance carbon market amounted to $947 billion, accounting for 25% of global greenhouse gas emissions. Common compliance carbon markets include the European Union Emissions Trading System, the California Carbon Emissions Trading Program, and the China Emissions Trading Scheme.

The voluntary carbon market is smaller in scale compared to the compliance carbon market, with a total transaction value of USD 535 million in 2024. Carbon credits in the voluntary carbon market originate from carbon offset projects. Companies can purchase carbon credits to offset their greenhouse gas emissions, prepare for potential regulatory requirements, and enhance their corporate reputation. The voluntary carbon market is typically not restricted by jurisdictions, and multiple carbon exchanges have been established globally, playing a role in market pricing and information disclosure.

The International Capital Market Association believes that the following factors have influenced the development of the carbon market:

- Article 6 of the Paris Agreement: Establish two important frameworks to introduce carbon offsets into the carbon market. Currently, these frameworks are voluntary in nature, and their development depends on international cooperation and application.

- The EU Carbon Border Adjustment Mechanism (CBAM): Aims to ensure that imported goods and EU-produced goods are subject to the same carbon tax. This mechanism provides economic incentives for non-EU countries to establish their own carbon markets.

- Carbon offset recognition: Carbon offset is crucial in the development of the voluntary carbon market. Currently, the Science Based Targets initiative (SBTi) has developed carbon offset cases to supplement the decarbonization of the value chain.

Relationship between Carbon Market and Sustainable Finance

The relationship between the carbon market and sustainable finance encompasses:

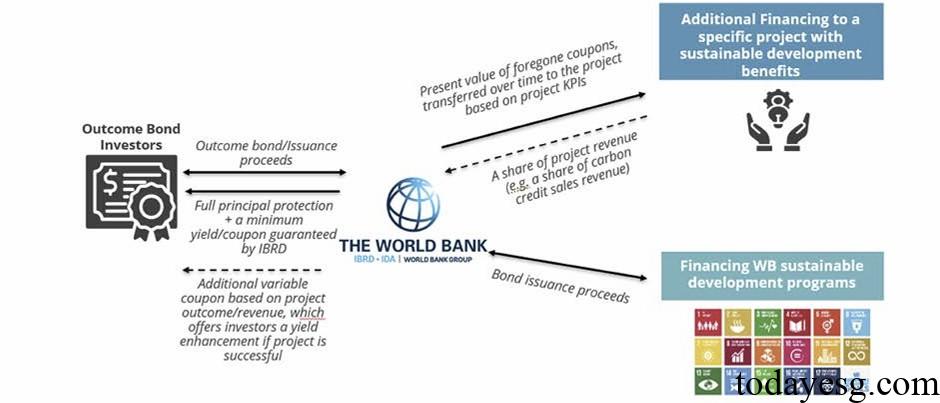

- Innovation in Sustainable Bonds: Despite the limited role of the carbon market in the current design of sustainable bonds, some sustainable bonds have raised funds that have been used for projects capable of generating carbon offsets, and the proceeds generated by these projects will be returned to investors. For example, the World Bank has issued forest restoration-linked bonds, plastic reduction-linked bonds, and carbon emission reduction-linked bonds, which incorporate carbon offset mechanisms in a similar manner.

- Risk management and trading in the carbon market: Carbon market trading is primarily conducted through futures and options, which are important sustainable financial instruments. In 2023, the market trading volume of the EU Emissions Trading System reached EUR 648 billion, of which 99% was futures trading, and EUR 72.5 billion was traded over the counter. 73% of these transactions came from financial institutions and investment companies. It is expected that the trading volume of the voluntary carbon market will also grow to USD 35 billion by 2030.

Reference:

Understanding the Opportunity from Carbon Markets for Sustainable Finance and the Wider Market

ESG Advertisements Contact:todayesg@gmail.com