2025 Progress Report

The Sustainable Banking and Finance Network (SBFN) releases 2025 progress report, aiming to summarize the sustainable financial development of emerging market economies.

This report focuses on the progress of members in ESG integration, climate and nature risk management, and sustainable financing. As of October 2025, the Sustainable Banking and Finance Network has 101 members with assets of approximately $80 trillion.

Related Post: Principles for Responsible Banking Releases 2025 Progress Report

Progress in ESG Integration

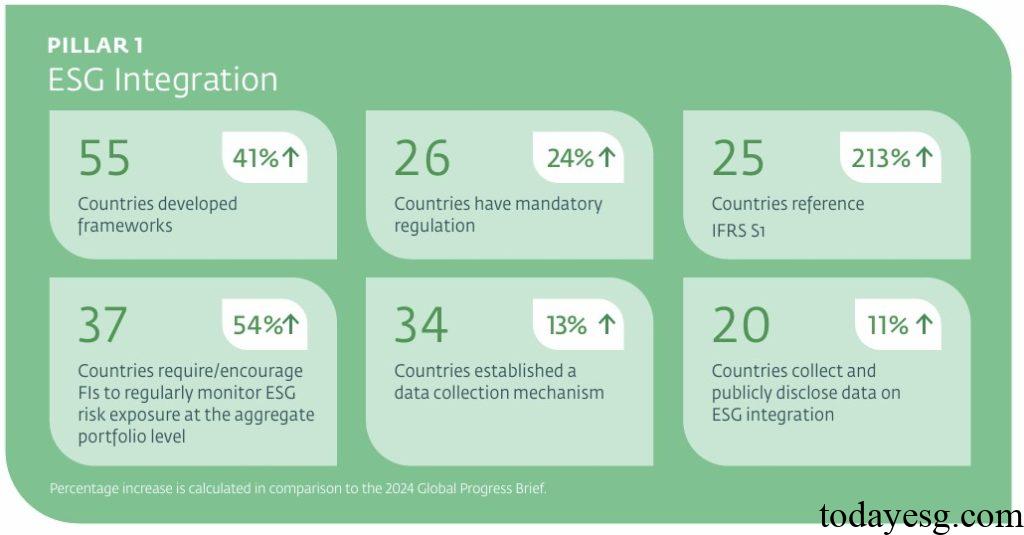

As the foundation of sustainable financial policies, 76% of members have developed ESG integration frameworks, of which 37 members have introduced frameworks that include both banking and non-banking sectors, incorporating environmental and social risks into the financial ecosystem. Banking institutions are developing comprehensive environmental and social risk management strategies based on these frameworks, which will be supervised and implemented by the board of directors. Among these ESG integration frameworks, 26 jurisdictions require mandatory integration, and 25 reference the requirements of IFRS S1.

ESG integration can help the financial industry strengthen sustainable data quality, with 80% of members encouraging financial institutions to establish environmental and social management systems and incorporate due diligence into decision-making. These ESG regulations are transitioning from voluntary practices to regulatory requirements, and ensuring consistency and effectiveness of ESG integration in the future is a key issue that members need to address.

Progress in Climate and Nature Risk Management

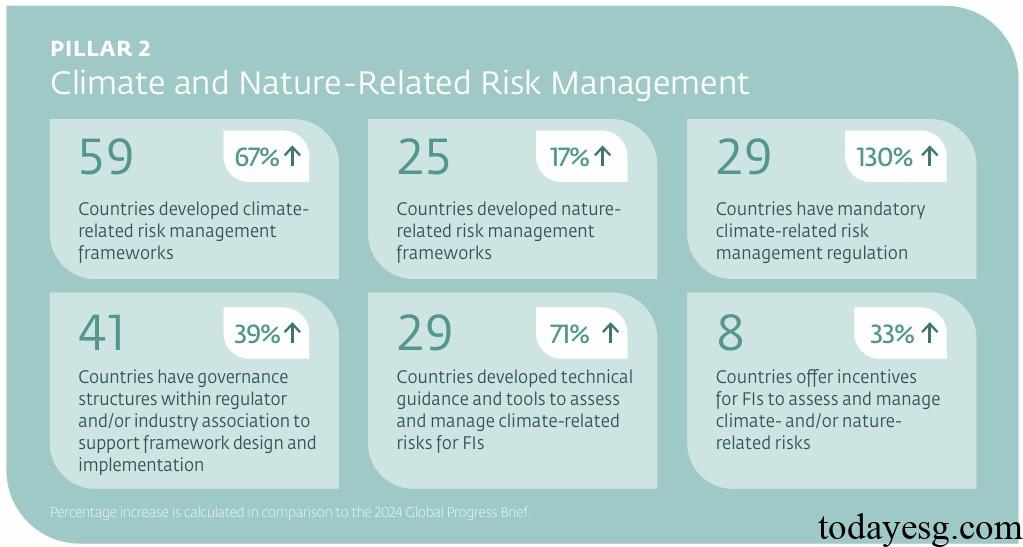

Climate and nature risk management focuses on the medium to long-term financial risks arising from climate change and natural risks in the financial industry. 82% of members have developed climate risk management frameworks, with half of them implementing mandatory regulatory policies, indicating that climate risk is being seen as a core requirement for sustainable financial regulation. The Paris Agreement and the Taskforce on Climate-related Financial Disclosures (TCFD), adopted by 43 and 39 members respectively, are the most popular international standards for climate risk management.

Compared to climate risk management, progress in nature risk management is slower, and members are taking initial measures to incorporate natural factors into regulatory actions. 8% of members have developed frameworks to analyze the interaction between natural risks and the financial industry, 6% have released guidelines for assessing and managing natural related risks, and 14% have established a natural risk data infrastructure. Considering the complex relationship between climate risks and nature risks, future jurisdictions will continue to integrate natural risks and form relevant frameworks and policy actions.

Progress in Sustainable Financing

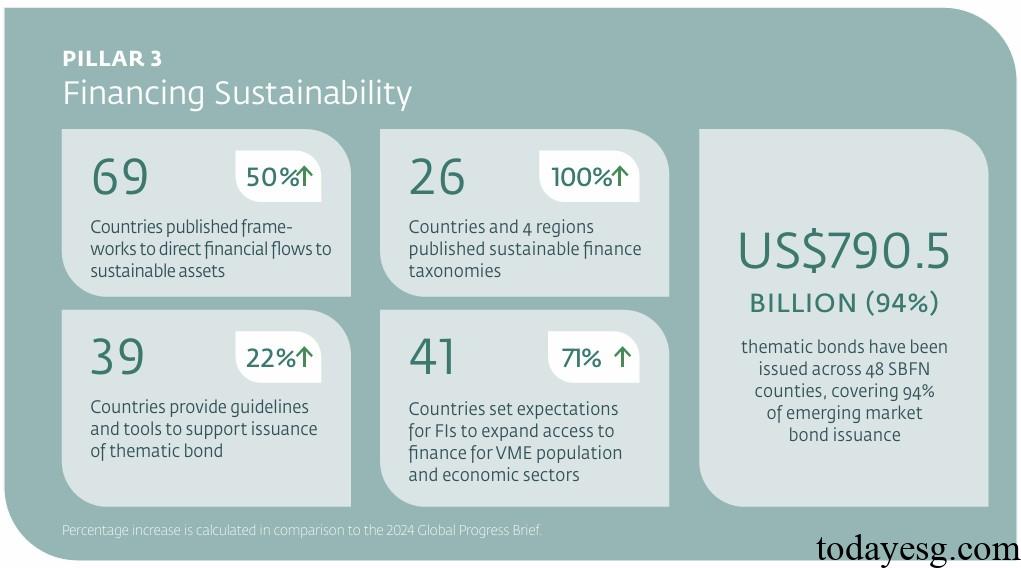

Sustainable financing is an indicator that measures the flow of funds towards climate, society, green economy, and sustainable development goals. 96% of members have developed sustainable financing frameworks, including bond guidelines, taxonomies, and sustainable finance roadmap. 68% focus on green assets, followed by sustainable assets (49%) and social assets (42%). The proportion of blue assets and biodiversity assets is relatively low, and currently only 10% of members are included in the sustainable financing framework.

The Sustainable Banking and Finance Network believes that members need to improve the interoperability of sustainable financing frameworks, strengthen data disclosure, and develop incentives for market participants to promote the application of sustainable financing tools.

Reference:

Sustainable Banking and Finance Network 2025 Global Progress Report

ESG Advertisements Contact:todayesg@gmail.com