Net Zero Carbon Market Regulatory Roadmap

Oxford Net Zero releases a roadmap for regulating the net zero carbon market, aimed at summarizing the development trends and gaps with the net zero carbon market, and providing regulatory recommendations.

The carbon market is an important tool for net zero transition and can provide funding for climate actions. The roadmap for carbon market regulation can promote the design and implementation of regulatory frameworks for carbon markets in jurisdictions.

Related Post: CFA Institute Releases Global Carbon Market Report

Global Carbon Market Regulation Development

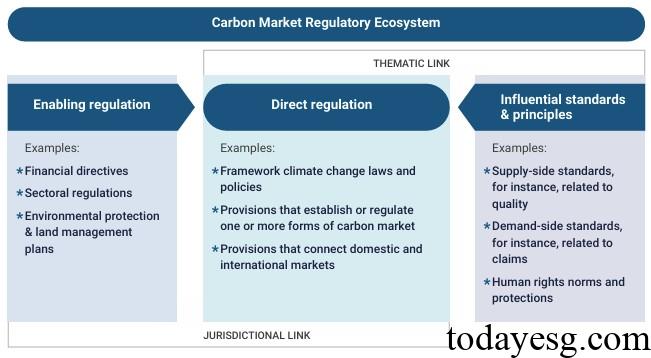

Carbon market regulation refers to laws, policies, or guidance documents related to the carbon market, which are divided into three types:

- Enabling regulation: Financial directives, industry regulatory measures, and environmental protection and land management plans.

- Direct regulation: Legal and policy frameworks for climate change, rules for establishing carbon markets.

- Influential standards and principles: Carbon market supply and demand standards.

The Oxford Net Zero believes that as stakeholders’ understanding of carbon market risks and opportunities deepens, existing carbon market regulatory policies have the following shortcomings:

- Net zero alignment: Existing policies typically do not distinguish between carbon reduction and carbon removal quantities, nor do they differentiate between the financing channels required for different emission reduction activities.

- Robust social and environmental safeguards: Existing policies lack provisions for social and environmental safeguards, such as local benefit sharing and appeal mechanisms.

- Clarity and flexibility in standards: Most regulations lack interoperability, resulting in inconsistent standards for measuring and calculating different types of carbon projects, posing challenges for tracking carbon credit usage.

- Domestic misalignment: There may be inconsistencies between carbon market policies and other policies due to the mutual influence of policies formulated by different regulatory agencies.

- Conflict of distinct financing pathways and obligations: Carbon markets often do not differentiate between financing types, resulting in a mismatch between climate financing and carbon financing.

Introduction to Net Zero Carbon Market Regulatory Roadmap

To address the challenges, the roadmap has established six development directions:

- Efficient and Effective Financing: Consider the impact of carbon market transaction costs and financing efficiency on promoting market size.

- End State of Net Zero: Jurisdictions need to adopt internationally recognized principles and standards, appropriately distinguishing between carbon reduction and carbon removal.

- Ecosystem Integrity: Establish a comprehensive measurement and disclosure mechanism to ensure that carbon projects achieve true emission reduction benefits and do not harm local communities and the environment.

- Equitable Responsibilities and Outcomes: Regulations need to consult with various stakeholders, provide them with appeal mechanisms, and clarify their rights to the benefits of emission reduction activities.

- Enforcement and Oversight: Establish necessary infrastructure to ensure transparency in carbon trading and apply high integrity supervision and information disclosure mechanisms in the supply chain.

- Easy of Use: Design low-cost carbon market methods, develop user-friendly carbon market systems, and assist market participants in project design, monitoring, reporting, verification, and registration processes.

Reference:

Roadmap to Net-Zero Aligned Carbon Market Regulation

ESG Advertisements Contact:todayesg@gmail.com