Scope 3 Research Project

Bank for International Settlements (BIS) and the Hong Kong Monetary Authority (HKMA) launch the Scope 3 research project, aiming to demonstrate how artificial intelligence technology can reduce the information gap in climate transition and lower Scope 3 carbon emissions.

The Scope 3 research project is set against the backdrop of the Sustainable Finance Action Agenda published by the Hong Kong Monetary Authority, focusing on carbon emission reduction plans in the financial industry (Scope 3 accounts for over 95% of total emissions).

Related Post: Net-Zero Asset Owner Alliance Releases Discussion Paper on Scope 3

Background of Scope 3 Research Project

Scope 3 refers to indirect greenhouse gas emissions from upstream and downstream activities that occur within the enterprise’s value chain but are not owned or controlled by it. Originally proposed by the Greenhouse Gas Protocol, Scope 3 is now included in the standards of the International Sustainability Standards Board (ISSB) and will be applied in over half of the jurisdictions worldwide.

Scope 3 accounts for 75% of global corporate carbon emissions, and for the financial industry, the emission share reaches 95%, primarily concentrated in Category 15 financing emissions. Despite strict definitions of different categories in Scope 3, there is significant flexibility in calculation methods. There are significant differences in enterprise supply chain data systems, and the availability of raw data varies, posing challenges for Scope 3 in terms of input data and calculation methods. To reduce these differences, organizations including the Partnership for Carbon Accounting Financials (PCAF) have adopted a series of standards to assist enterprises.

Introduction to Scope 3 Research Project

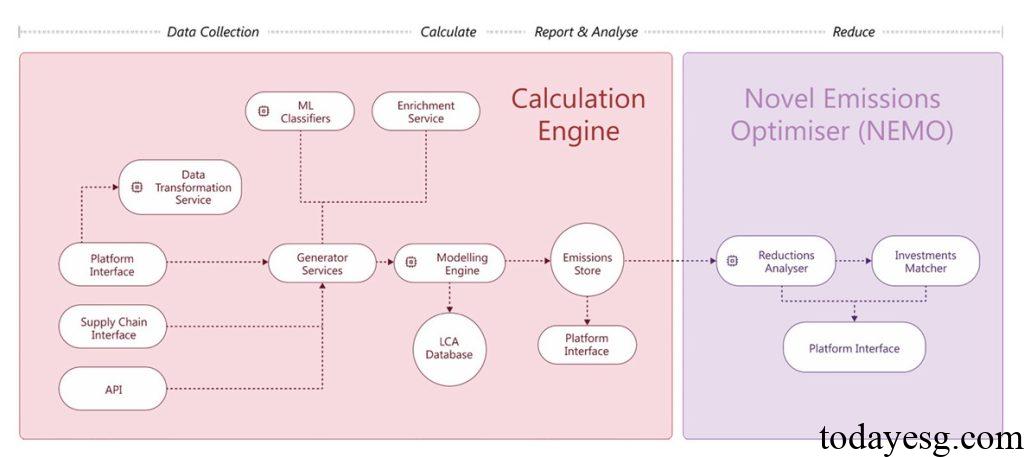

The Scope 3 research project, launched by the Bank for International Settlements and the Hong Kong Monetary Authority, focuses on how to utilize advanced data technology and artificial intelligence to accurately collect, interpret, and calculate Scope 3 and other supply chain data, as well as how to identify carbon reduction opportunities and achieve supply chain decarbonization. The Scope 3 research project includes:

- Reduce the burden of collecting data when calculating the carbon footprint of enterprises.

- Utilize more detailed emission factors to enhance calculation accuracy.

- Assist users in predicting and adjusting the effectiveness of carbon emission reduction measures.

- Improve the accuracy of Scope 3 calculations across the upstream and downstream of the supply chain.

The achievements of the Scope 3 research project include:

- Data collection: Adopt standardized methods to collect supply chain data from small and medium-sized enterprises, utilize application programming interfaces to automatically obtain data from enterprises, and automatically convert data formats used by different enterprises.

- Calculation and reporting: Explore methods for standardizing raw data, inputting data, extracting data, and generating models.

- Reduction analysis: Deploy artificial intelligence models to select from the emission reduction measures database or dynamically identify and evaluate emission reduction measures.

Reference:

Exploring AI for Scope 3 Accounting and Transition Finance

ESG Advertisements Contact:todayesg@gmail.com