Global Sustainable Bond Report

The Climate Bond Initiative (CBI) releases 2025 H1 Global Sustainable Bond Report, aimed at summarizing the development of the sustainable bond market.

This report analyzes the global markets for green bonds, social bonds, sustainable development bonds, and sustainability-linked bonds.

Related Post: Climate Bond Initiative Releases 2024 Global Sustainable Bond Market Report

Global Sustainable Bond Market

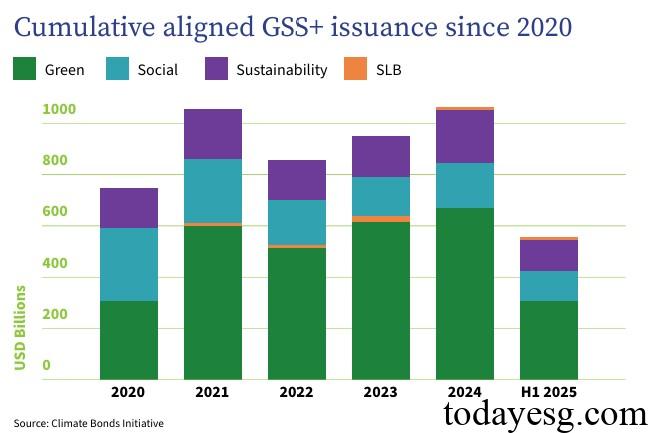

As of the first half of 2025, the total scale of global sustainable bond issuance is 6.2 trillion US dollars, of which supranational institutions (926.1 billion US dollars), the United States (859.8 billion US dollars), France (628.6 billion US dollars), and China (611.4 billion US dollars) are the main sources. Green bonds, social bonds, and sustainable development bonds account for a relatively high proportion, at 62%, 19%, and 18% respectively. The issuance scale of sustainable development linked bonds is the smallest, only 69.4 billion US dollars, accounting for 1% of the market.

The global issuance scale of sustainable bonds in the first half of 2025 is $555.8 billion, a year-on-year decrease of 4%. Green bonds, social bonds, and sustainable development bonds issuance are $341.3 billion, $98.4 billion, and $106.4 billion, respectively.

Global Green Bond Market

As of the first half of 2025, the total scale of global green bond issuance is 3.8 trillion US dollars. The main valuation currencies for green bonds in the first half of 2025 are Euro (51%), US Dollar (17%), and Chinese Yuan (13%). China is the largest issuer of green bonds, with an issuance volume of 48.3 billion US dollars and involving 161 transactions. The European Investment Bank is the largest issuer of green bonds, with an issuance scale of $19 billion and involving 10 transactions.

Global Social Bond Market

As of the first half of 2025, the total scale of global social bond issuance was 1.2 trillion US dollars, and 98.4 billion US dollars were issued in the first half of 2025, reaching a new high since 2021. Social bonds come from 25 currencies in 27 countries, with the highest amount denominated in US dollars, reaching 40.9 billion US dollars. The largest issuance scale comes from the United States, reaching $29.4 billion. The main issuers are government agencies (66%), development banks (13%), and financial institutions (12%).

Global Sustainable and Sustainability-linked Bond Market

As of the first half of 2025, the total scale of global sustainable development bond issuance is 106.4 billion US dollars, with 106.4 billion US dollars issued in the first half of 2025, exceeding 1 trillion US dollars for three consecutive times. Development banks are the main issuers of sustainable development bonds, with the World Bank issuing $45.1 billion through the International Bank for Reconstruction and Development and the International Development Association, involving 150 transactions.

As of the first half of 2025, the total issuance scale of global sustainable development linked bonds is 69.4 billion US dollars, and 9.7 billion US dollars will be issued in the first half of 2025. Non-financial institutions are the largest issuers of sustainable development linked bonds, with an issuance amount of $6.9 billion.

Reference:

Sustainable Debt Global State of the Market H1 2025

ESG Advertisements Contact:todayesg@gmail.com