2025 Green Bond Report

Hong Kong releases 2025 Green Bond Report, aiming to summarize the issuance and application of green bonds in Hong Kong.

As of August 2025, Hong Kong has issued HKD 240 billion in green bonds under the Government Sustainable Bond Program.

Related Post: Introduction to Hong Kong Green Bond Program

Hong Kong Green Bond History

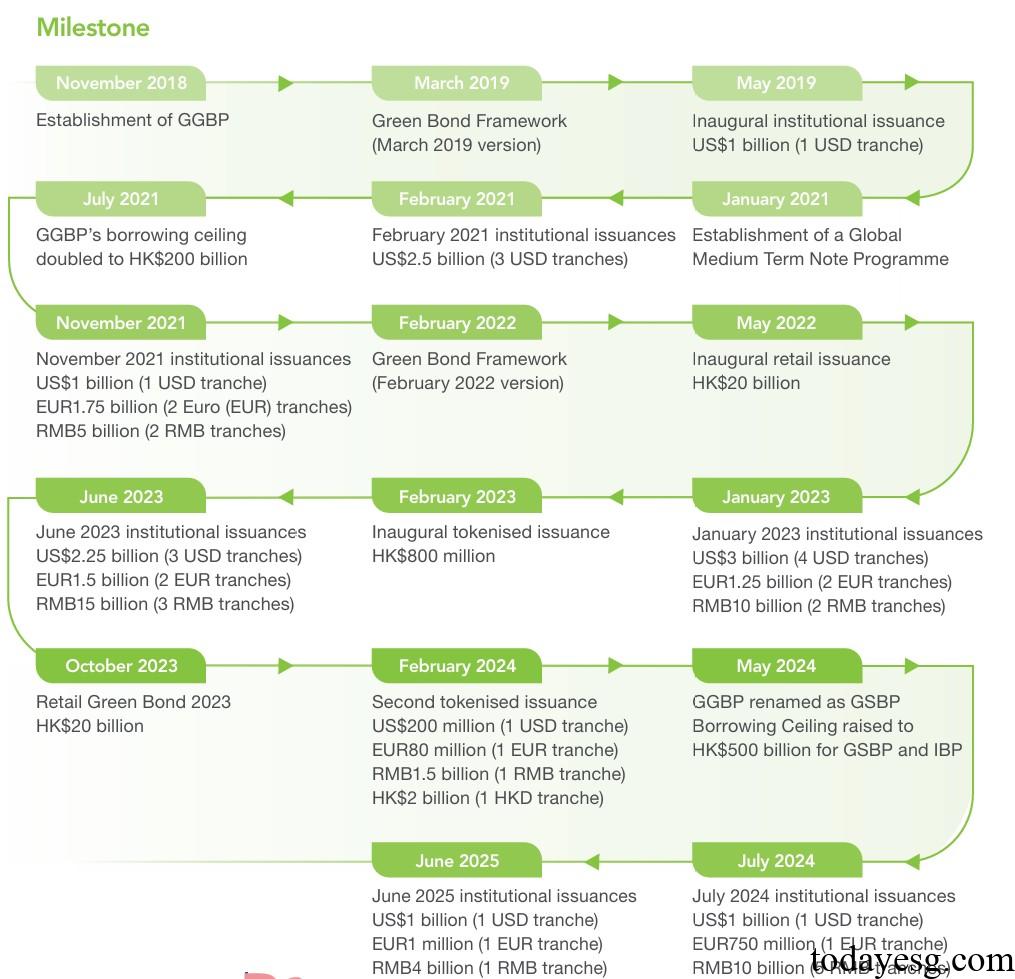

In March 2019, Hong Kong released the Green Bond Framework, which outlines how issuing green bonds can support low-carbon economic development, and plans to release an annual report on the allocation of funds and expected environmental impact of green bonds. In February 2022, Hong Kong updated its green bond framework, and the funds raised from the bonds will only be used for financing or refinancing green projects, which must meet one or more of the following eligible economic activities:

- Renewable energy.

- Energy efficiency and conservation.

- Pollution prevention and control.

- Waste management and resource recycling.

- Water and wastewater management.

- Nature conservation and biodiversity.

- Clean transportation.

- Green building.

- Climate change adaptation.

In May 2019, Hong Kong issued its first batch of institutional green bonds, totaling $1 billion. In May 2022, Hong Kong issued its first batch of retail green bonds, totaling HKD 20 billion. In February 2023, Hong Kong issued its first batch of tokenized bonds, totaling HKD 800 million. In May 2024, the government’s green bond program was renamed as the Government Sustainable Bond Program, with the fundraising limit increased to HKD 500 billion.

As of August 2025, Hong Kong has issued eleven batches of green bonds with a total issuance size of approximately HKD 240 billion. The scale of institutional green bonds is about HKD 200 billion, and the scale of retail green bonds is about HKD 40 billion. As of August 2025, Hong Kong has approved 116 green projects involving six eligible economic activities.

Hong Kong Green Bond Proceeds Allocations

As of August 2025, ten out of eleven batches of green bonds have classified or reserved the raised funds for green projects, with only the HKD 21 billion green bond funds issued in June 2025 yet to be distributed. These fund allocations are usually allocated to different types of projects in different years. For example, the green retail bond issued in Hong Kong in 2023, which raised HKD 20 billion, has been fully allocated to 36 green projects, with financing funds accounting for 97.4% and refinancing funds accounting for 2.6%. These funds are invested in green buildings (65%), water and wastewater management (25%), etc. Based on the analysis of the allocation of funds for other published green bonds, the two eligible economic activities mentioned above are the main directions for allocation.

The information on the allocation of green bond funds provided in this report has been subject to third-party review by the Hong Kong Quality Assurance Agency. All issued green bonds have also obtained the Green and Sustainable Finance Certificate issued by the Hong Kong Quality Assurance Authority.

Reference:

Hong Kong Green Bond Report 2025

ESG Advertisements Contact:todayesg@gmail.com