TNFD 2025 Status Report

The Task Force on Nature-related Financial Disclosures (TNFD) releases 2025 status report, aiming to summarize nature-related markets practices and information disclosure.

As of July 2025, over 1800 companies have joined the TNFD Forum, and over 600 companies have voluntarily committed to disclosing information based on the TNFD recommendations, with a total market value of $7 trillion.

Related Post: TNFD Launches Free Learning Platform

Nature-related Financial Disclosures Development

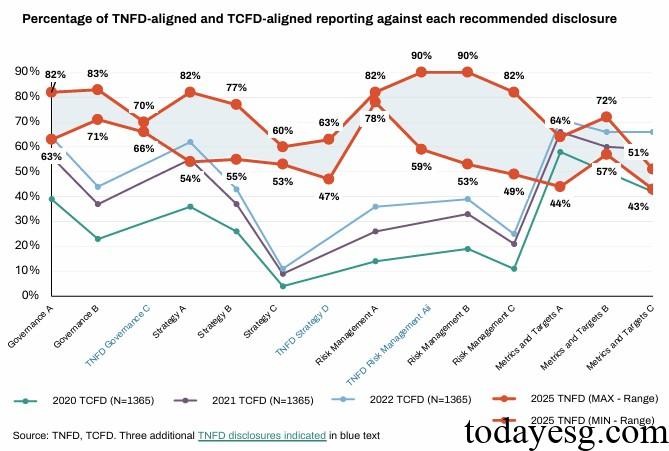

In September 2023, the TNFD released the TNFD recommendation, providing information disclosure standards for enterprises. The respondents of this survey mainly include enterprises (49%), financial institutions (28%), and market service providers (23%). 63% of respondents believe that the natural risks and opportunities they face are more important than climate risks and opportunities, and 78% of respondents have combined natural information disclosure with climate information disclosure. Among the 14 items recommended for disclosure by TNFD, the average disclosure by companies is 8.7, and 36% of respondents have already disclosed all items.

Compared to early climate-related financial disclosures, the disclosure ratio recommended by TNFD is higher, as TNFD recommendations have stronger consistency with existing natural disclosure indicators. 77% of respondents hope that the International Sustainability Standards Board (ISSB) will introduce disclosure standards for nature, biodiversity, and ecosystem services. 91% of respondents believe that these standards should be consistent with TNFD recommendations, and 76% of respondents believe that mandatory disclosure of natural information has a positive effect on identifying and assessing natural risks.

The TNFD believes that the driving factors for corporate natural related financial disclosure include:

Regulatory attention: In March 2022, the Network for Greening the Financial System (NGFS) believed that natural related risks would have a significant impact on the macro economy. In September 2023, it encouraged regulatory agencies to assess the economic and financial risks caused by natural losses. In July 2024, it released a framework for natural related financial risks. 70% of the respondents stated that they have been required by regulatory policies, mainly including listed companies (51%) and non-listed companies (18%).

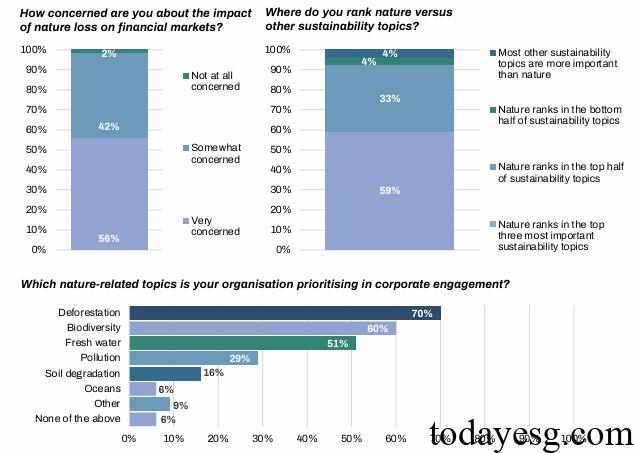

Investor attention: Investors are paying attention to the natural risks of their investment portfolios and requesting that the invested parties identify, evaluate, and manage these natural risks. The members of Nature Action 100 include 230 institutional investors with a total asset management scale exceeding $30 trillion. 59% of investors listed nature as one of the three major substantive sustainable themes, with deforestation (70%), biodiversity (60%), and water resources (51%) being key directions.

Nature-related Financial Disclosures Challenges

The TNFD believes that the challenges of nature-related financial disclosure for enterprises include:

- Data availability and quality: Excluding water resources and waste, respondents are not familiar with natural quantitative disclosure, and natural data has regional characteristics, so they need to understand the natural data in that region. The working group plans to collaborate with nature-related data partners to support more natural indicators and establish natural data public facilities to help small and medium-sized enterprises.

- Knowledge and skills building: Respondents believe that in addition to TNFD recommendations and LEAP methods, the TNFD needs to provide more natural disclosure of knowledge and skills. The working group plans to release industry guidelines and natural related transition planning documents and provide more natural disclosure cases.

Reference: