2025 Multilateral Development Bank Climate Finance Report

European Investment Bank (EIB) releases 2025 Multilateral Development Bank Climate Finance report, aiming to outline the global climate finance actions of multilateral development banks.

This report shows that multilateral development banks have exceeded their 2025 climate finance targets and are steadily achieving their 2030 climate finance targets.

Related Post: European Investment Bank Releases 2023 Multilateral Development Bank Climate Finance Report

Introduction to Climate Finance by Multilateral Development Banks

Climate finance is at the core of multilateral development banks’ support for the Paris Agreement and sustainable development. Climate finance can help jurisdictions establish climate adaptive low-carbon economies and provide a foundation for the United Nations Sustainable Development Goals. The European Investment Bank has released its first multilateral development bank climate finance report since 2012, providing stakeholders with data and details on climate finance. The European Investment Bank plans to launch a digital project at the COP30 conference to establish an interactive network platform that facilitates user access to this data.

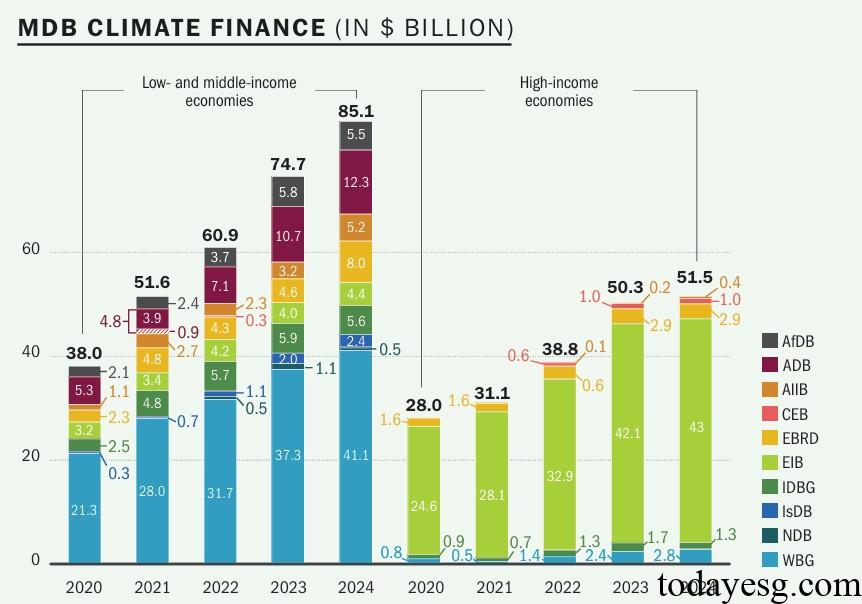

In the past year, the global multilateral development banks’ climate finance scale has increased by 10%, and the climate finance scale of low – and middle-income economies has increased by 14%. Private finance mobilized by multilateral development banks worldwide has increased by 33%. These data indicate that multilateral development banks have played an important role in climate finance. In 2024, all multilateral development banks worldwide provided $51.5 billion in climate finance to high-income economies and $85.1 billion to low – and middle-income economies. The climate finance scale of the World Bank, European Investment Bank, and Asian Development Bank is relatively high.

Climate Finance Data by Multilateral Development Banks

Multilateral development banks’ climate finance can be divided into climate mitigation finance and climate adaptation finance. The finance scale for climate mitigation in high-income economies is $46.8 billion, while in low – and middle-income economies it is $58.8 billion. The finance scale for climate adaptation in high-income economies is $5 billion, while in low – and middle-income economies it is $26.3 billion. The main investment aspects for climate mitigation finance are energy ($41 billion), construction ($18 billion), and transportation ($15.7 billion). The main investment aspects for climate adaptation finance are energy (9.8 billion US dollars), cross sector (6.5 billion US dollars), and water resources (5.9 billion US dollars).

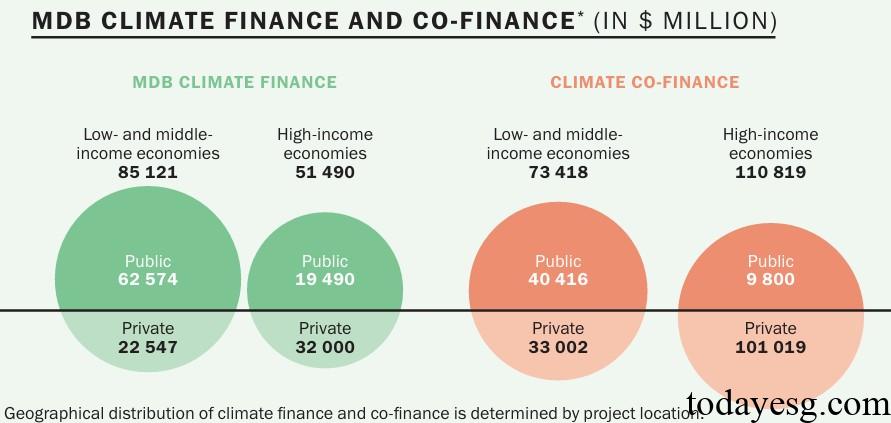

The climate finance tools of multilateral development banks mainly include credit (93.5 billion US dollars), policy-based lending (13.1 billion US dollars), and guarantees (11.1 billion US dollars). The main regions for climate finance are Europe (58.2 billion US dollars) and Asia (31 billion US dollars). In terms of climate co-finance, the private finance scale of high-income economies is $101 billion, and the public finance scale is $9.8 billion. The private finance scale of low – and middle-income economies is 33 billion US dollars, and the public finance scale is 40.4 billion US dollars. High income economies have a stronger ability to mobilize private climate finance.

Reference:

Multilateral Development Banks Hit Record $137 Billion in Climate Finance