2025 Asset Owner ESG Survey Report

Morningstar releases 2025 Asset Owner ESG Survey report, aimed at analyzing their attitudes towards ESG investment and attitude.

In this quantitative survey, Morningstar collects responses from over 500 global asset owners with total AUM of $19.1 trillion. Europe, Asia Pacific, and North America account for 40%, 40%, and 20% respectively.

Related Post: Morningstar Releases 2024 Asset Owner ESG Survey Report

Asset Owner ESG Investment

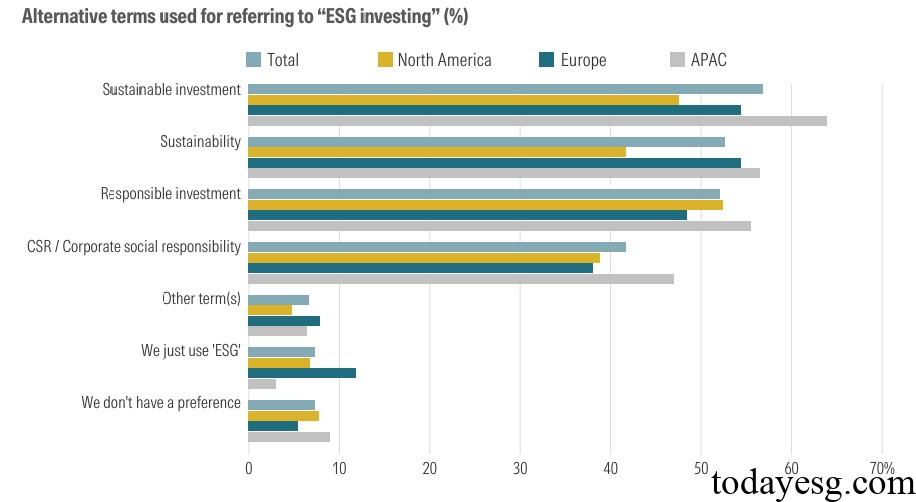

In terms of the application of ESG labels, some respondents believe that ESG labels help to quickly identify concepts, while others see ESG labels as marketing terms. 69% of respondents are still using ESG to maintain consistency. In terms of ESG terms, sustainable investment (57%), sustainability (53%), and responsible investment (52%) are more common.

Despite differing attitudes towards ESG terms, most asset owners have incorporated ESG factors into their investments. 20% of respondents have incorporated ESG factors into 75% of their asset management scale, and 10% of respondents have incorporated ESG factors into their entire investment portfolio. The average ESG asset management scale of the respondents is 44%, an increase of 2 percentage points compared to last year.

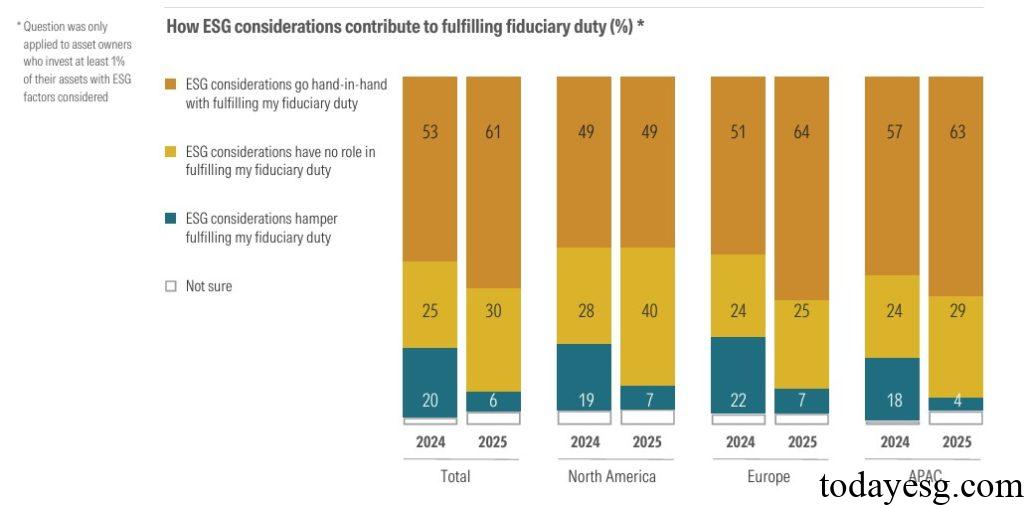

In terms of implementing ESG investments, stakeholder pressure, ethical principles, and fiduciary duty are the most significant factors, with fiduciary duty showing the most significant growth this year. 61% of respondents believe that fiduciary duty is closely related to ESG investment, while only 6% believe that there is a contradiction between ESG factors and fiduciary duty. The main challenges faced in implementing ESG investments are return impact, lack of standardized data, and disclosure difficulties.

Asset Owner ESG Survey

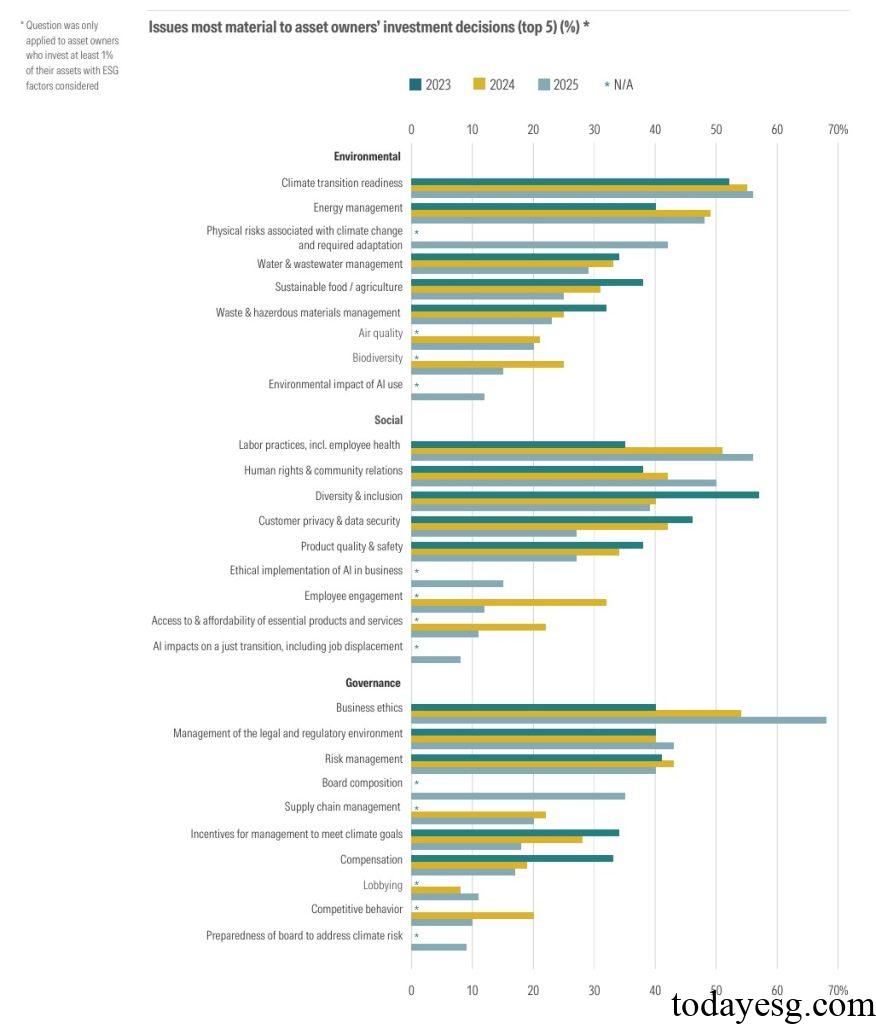

More than half of the respondents believe that ESG has been more material in the past five years, with 67%, 60%, and 38% in Asia Pacific, Europe, and North America, respectively. In terms of ESG materiality themes, the main choices of respondents are:

- Environment: Climate transition readiness, energy management, and physical risks associated with climate change and required adaptation.

- Social: Labor practices and employee health, human rights and community relations, and diversity and inclusion.

- Governance: Business ethics, management of the legal and regulatory environment, and risk management.

In terms of ESG regulatory policies, 55% of respondents believe that ESG regulatory policies have a positive impact, with China, Singapore, and the UK accounting for 81%, 70%, and 69%, respectively. ESG regulatory policies that are helpful include standardized frameworks, corporate and fund information disclosure, and greenwashing issues. When considering the negative effects of ESG regulatory policies, the main factors to consider are the heavy burden of information disclosure, lack of market standards, and complexity of taxonomy. 46% of respondents believe that the current relaxation of regulatory policies in the European Union and the United States is incorrect, while 27% believe it is correct.

Reference: