Report on Nature Finance Solutions

The World Economic Forum (WEF) releases a report on nature finance solutions, aimed at summarizing global nature finance solutions and their applications.

The World Economic Forum believes that the Global Biodiversity Framework has promoted the development of natural finance but still faces financial and technological challenges compared to climate finance.

Related Post: World Economic Forum Releases Nature Finance Report

Background of Nature Finance Solutions

The natural value is underestimated in the global economy. World Bank believes that from 1995 to 2020, global per capita productive capital increased by 47%, while per capita renewable natural capital decreased by 20%. Despite the pricing and trading of commodities in global markets, ecosystem services such as carbon and water cycles are still considered free and face the risk of natural losses. The global natural investment amount in 2022 is 200 billion US dollars, and the amount of negative activities that affect nature is 7 trillion US dollars.

The natural financing solution is a new tool for addressing the above issues, which converts natural resources into commodities that need to be restored, maintained, and enhanced to include nature in national and corporate balance sheets, and to incorporate natural contributions into cost-benefit and investment analysis. The scale of private financing related to nature has increased 11 times from 2020 to 2024, reaching 102 billion US dollars. It is expected that the commercial value of a nature friendly economy will reach 10.1 trillion US dollars by 2030.

Introduction to Nature Finance Solutions

The World Bank believes that global nature finance solutions can be divided into four categories:

- Financial instruments.

- Funds and facilities.

- Enabling mechanisms.

- Fiscal and regulatory measures.

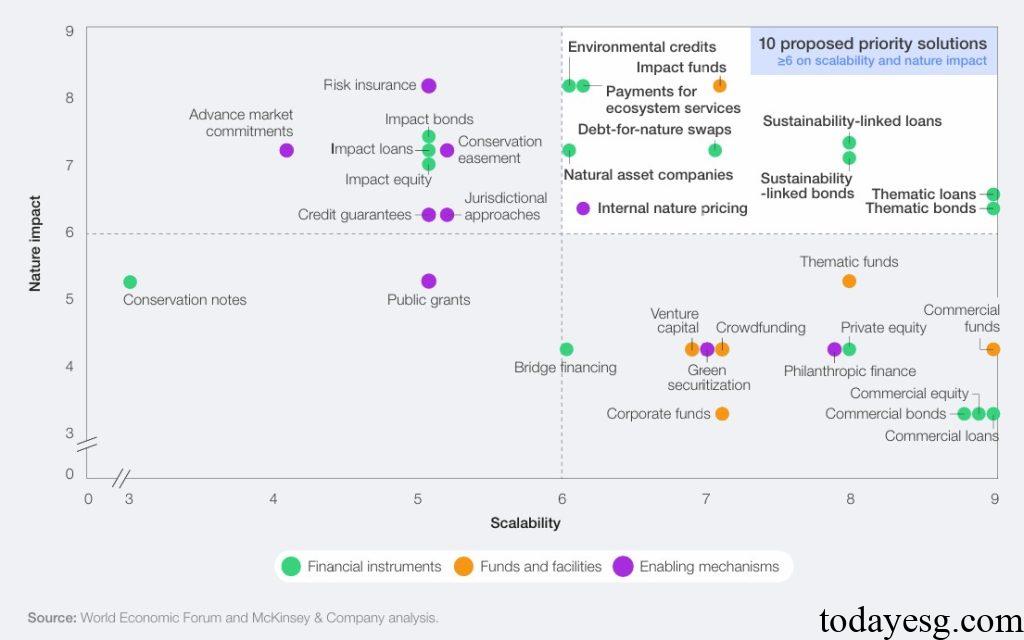

There are 37 nature finance solutions in the four categories mentioned above, although they have different values, not all solutions have the conditions to be deployed on a commercial scale. Based on indicators such as size, functionality, valuation, structure, and historical information, the World Bank believes that the following 10 nature finance solutions are worth prioritizing:

- Sustainability-linked bonds: Outcome-based tradable fixed income instruments whose coupon rates are linked to the company’s overall environmental or social performance indicators. Failure to meet the target will result in an increase in the coupon rate.

- Thematic bonds: Tradable fixed income instruments that raise funds for specific environmental and social projects. Thematic bonds and sustainability-linked bonds can indirectly give financial value to natural outcomes.

- Sustainability-linked loan: Outcome-based commercial debt instruments whose interest rates are linked to the borrower’s environmental or social key performance indicators. Failure to meet the target will lead to an increase in interest rates.

- Thematic loans: Commercial debt instruments whose funds are used for specific environmental and social projects. The role of thematic loans and sustainability-linked loans is like that of bonds.

- Natural asset companies: A new type of public or private company dedicated to converting the value of natural assets into financial assets, with revenues including carbon credits, biodiversity credits, ecotourism, sustainable logging, etc.

- Environmental credits: Verified positive environmental achievement units, including carbon credits, biodiversity credits, water resources credits, etc. Environmental credit can be traded for compliance or voluntary purposes, with the aim of monetizing a series of natural benefits and relying on third-party verification.

- Debt-for-nature swaps: A financial mechanism that allows countries to restructure their debt in exchange for local commitments to protect and restore nature, involving instruments such as bonds, loans, guarantees, credit enhancement, and parametric insurance. Most swaps occur in developing countries and emerging market economies.

- Payments for ecosystem services: Signing agreements with natural resource managers to provide economic incentives for them to protect or enhance ecosystem services. Payment is based on verified results, and graded rewards are provided for exceeding the completion limit.

- Impact funds: Funds aimed at achieving environmental or social outcomes, typically taking on higher risks or pursuing returns below market averages. These funds typically adopt private equity or venture capital structures and use blended finance methods to increase private capital investment.

- Internal nature pricing: A tool voluntarily used by enterprises and institutional investors to measure the impact of nature on a company or investment portfolio, like internal carbon pricing.

Reference:

Finance Solutions for Nature: Pathways to Returns and Outcomes