ESG Integration and Long-Term Investment Strategy Report

The CFA Institute Research & Policy Center releases a report on ESG integration and long-term investment strategy, aimed at summarizing the role of ESG integration in long-term investment strategy.

The CFA Institute believes that the United Nations Principles for Responsible Investment (UNPRI) and the Institutional Investors Group on Climate Change (IIGCC) have released investment frameworks that incorporate ESG risks and opportunities into long-term investment strategy.

Related Post: Early Development and Long-term Value of ESG Investment

ESG Integration and Long-Term Investment Strategy Analysis

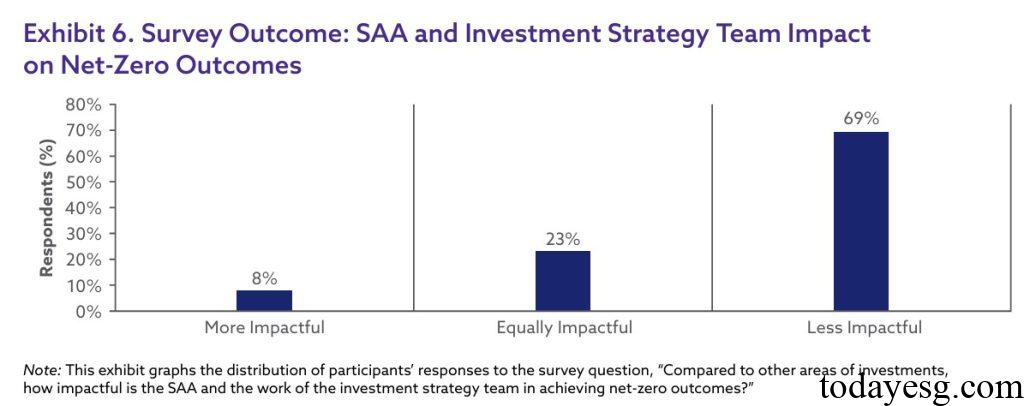

The CFA Institute investigates the relationship between asset owners’ ESG integration and long-term investment strategy. Asset owners generally believe that ESG integration mainly occurs at the asset class level, rather than top-down strategic allocation. The reason for this phenomenon is that asset owners usually have multiple investment objectives, and ESG integration does not have a central position among these objectives.

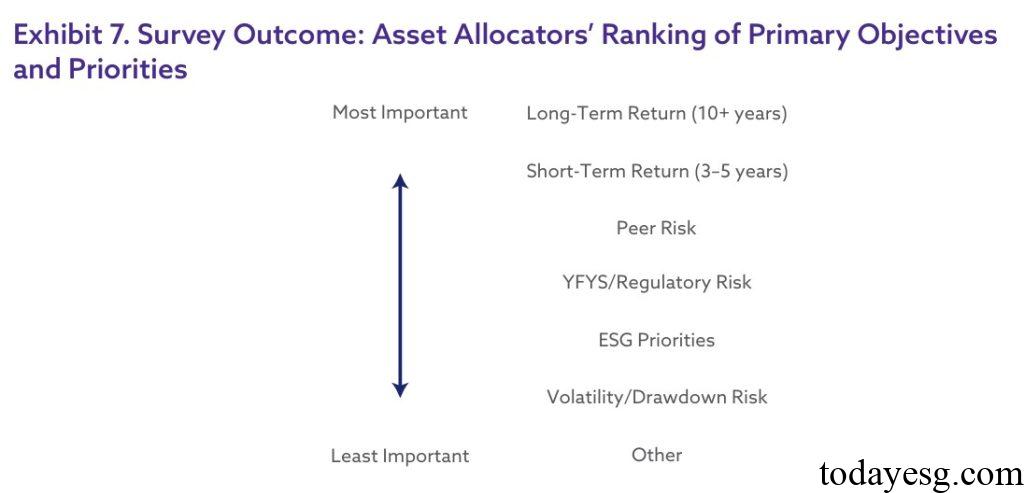

The investment objectives that asset owners need to consider include returns, risks, liquidity, regulation, etc. The traditional measurement method (mean variance optimization) provides a foundation for quantitative goals, but qualitative goals such as sustainability are difficult to measure. Most respondents consider long-term and short-term returns to be the most important factors to consider, with ESG factors ranking only above downside risk.

ESG integration at the strategic allocation level typically involves incorporating climate factors into capital market assumptions, internal scenarios, and stress testing. Due to the complexity of climate scenarios and the difficulty in estimating their impact on different assets, this approach has significant uncertainty. For example, some asset owners optimize their long-term investment strategy using 80% of traditional capital market assumptions and 20% of climate related capital market assumptions.

When asset owners consider ESG factors, they typically use them as risk management tools rather than investment return tools. In the process of asset allocation, ESG factors are mainly used to reduce downside risks rather than upside potential. Most respondents believe that ESG factors play a greater role in private assets than in public assets, because private investors can accept larger tracking errors, and assets with positive environmental and social impacts require longer investment periods. In the next three to five years, asset owners plan to continue strengthening ESG methods in areas such as climate scenario analysis, net zero targets, and impact investing.

Reference:

Integrating ESG Information into Long-Term Investment Strategy