European Sustainability Reporting Standards Report

KPMG releases the 2025 European Sustainability Reporting Standards report, aimed at analyzing the sustainability information disclosure situation of European companies.

KPMG analyzes the 2025 sustainability reports released by 270 listed companies, and the results of the reports are generally consistent with the research findings of the European Financial Reporting Advisory Group (EFRAG).

Related Post: EFRAG Releases Implementation Guidance for European Sustainability Reporting Standards

Analysis of Sustainable Development Report

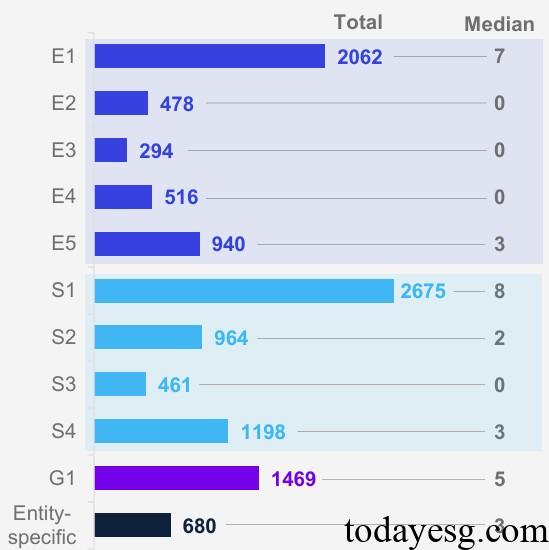

The European Sustainability Reporting Standard ESRS 1 requires companies to disclose material topics such as environment, society, and governance. The most frequently disclosed topics by companies include ESRS E1 Climate Change, ESRS S1 Own Workforce, ESRS G1 Governance, and ESRS S4 Consumers and end-users.

In terms of impacts, risks, and opportunities related to sustainable development, the average number of disclosures by companies is 43, with a median of 38. These disclosures are impact (60%), risk (26%), and opportunity (14%), respectively. Two thirds of the disclosures may have a negative impact on the sustainability of the company. These disclosures mainly include governance (48%), social (42%), and environmental (10%). Although disclosure usually meets regulatory policy requirements, it has low relevance to the overall strategy of the company and contains duplicate contents. In terms of short-term, medium-term, and long-term classification of sustainable development impacts, risks, and opportunities, companies disclose less. In terms of actual and potential impacts, companies disclose relatively little.

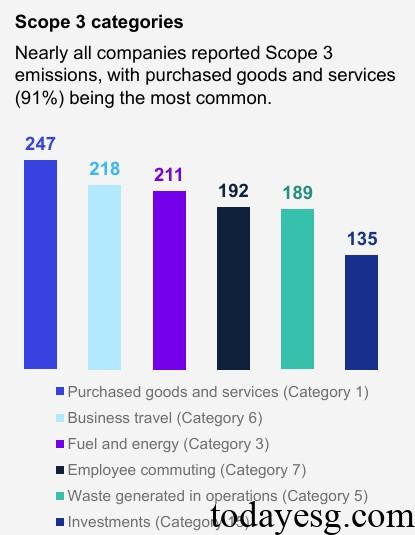

The most common sustainability disclosure for companies is carbon emissions, with almost all companies disclosing Scope 3 carbon emissions data, with a high proportion of purchases of goods and services (247), business travel (218), and fuel and energy (211). Nearly half of the companies use the boundary concept in the European Sustainability Reporting Standards to calculate their carbon emission ranges. In terms of the connectivity between sustainable development reports and financial reports, nearly half of the companies have not disclosed their financial impact, and the disclosed financial impact is mainly qualitative.

The main task of stakeholders in the preparation of sustainability reports is to identify potential sustainability issues (54%) and determine substantive sustainability issues (45%). Enterprises also refer to risk management processes, industry reports, peer reports, and other sustainability reporting standards, such as those of the Global Reporting Initiative (GRI), when writing reports. In terms of data, 45% of enterprises used estimates, mainly focused on Scope 3 greenhouse gas emissions data (36%), value chain data (25%), and energy data (21%). KPMG believes that estimation will not reduce the practicality of sustainable information, and estimation is necessary in the absence of historical data or precise measurement methods.

Reference: