2025 Environmental Disclosure Benefits Report

The Carbon Disclosure Project (CDP) releases 2025 Environmental Disclosure Benefits Report, which aims to analyze the returns obtained by companies from disclosing environmental risks, impacts, and opportunities, and encourage companies to disclose based on the CDP questionnaire.

CDP believes that environmental risk is a financial risk, and if companies ignore environmental risk, the economic losses generated by 2050 will reach $38 trillion, accounting for more than one-third of global GDP.

Related Post: CDP Releases Report on 2025 Corporate Climate and Nature Progress

Introduction to Environmental Disclosure Benefits

Environmental disclosure benefits refer to the returns that a company receives by disclosing its environmental risks, impacts, and opportunities and acting, which may be financial or strategic returns. Environmental disclosure benefits can help companies manage environmental risks, prepare for the rapidly changing regulatory environment, and help increase revenue sources. Currently, two-thirds of the global market value of enterprises have obtained environmental disclosure benefits by disclosing information based on CDP questionnaires.

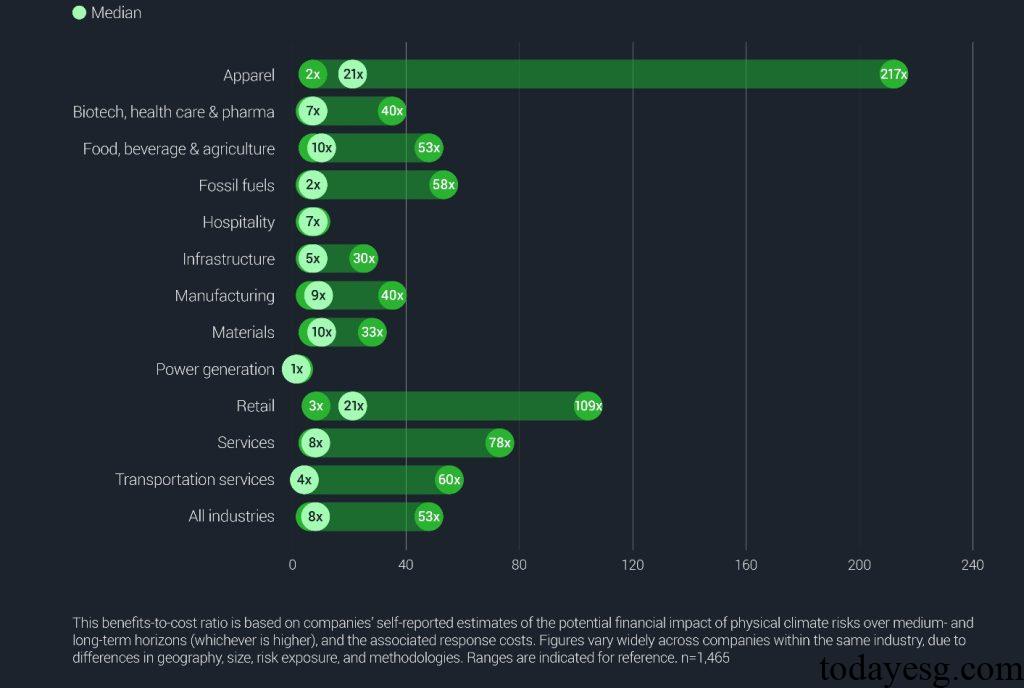

CDP research shows that investing $1 in climate risk can bring a maximum return of $21. All industries investing in climate risk will generate positive returns. The financial risk caused by environmental risks is 13 times the cost (average data). For large global corporations, the negative impact of environmental risks is approximately $6.5 trillion, and the cost of addressing these risks is $1.4 trillion. 67% of enterprises have recognized material environmental risks, with policy risks (28%) and physical risks (19%) accounting for a relatively high proportion.

Environmental Disclosure Benefits Development

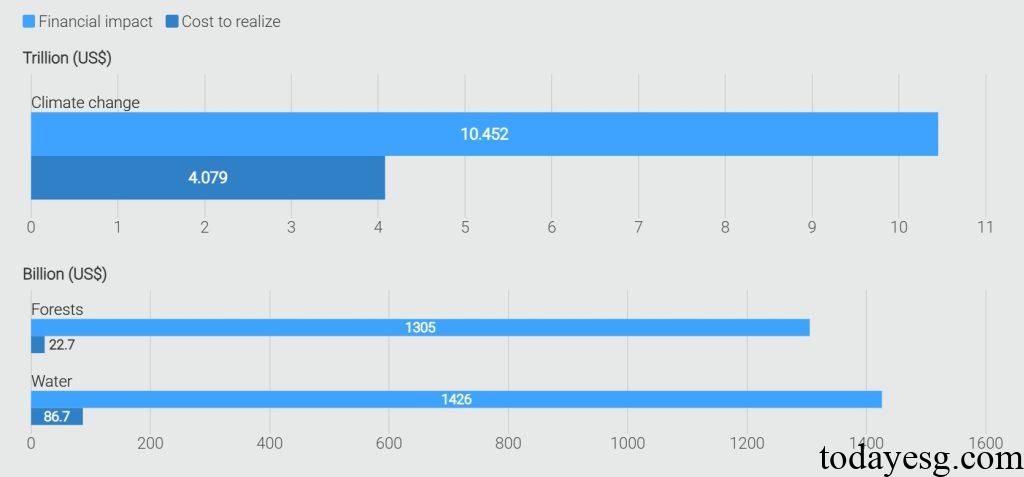

From the analysis of income consistency, the consistency ratios of climate change, forest and water resource disclosure, and corporate income are 15%, 13%, and 12%, respectively. In terms of the financial impact of environmental risks, the financial risks of climate change, forests, and water resources are $10.45 trillion, $1.31 trillion, and $1.43 trillion, respectively. The costs of addressing these risks are $408 trillion, $22.7 billion, and $8.7 billion, respectively. In contrast, the benefits generated by forest and water resource disclosure are more significant, but companies that exceed the average do not engage in environmentally friendly businesses in these two areas.

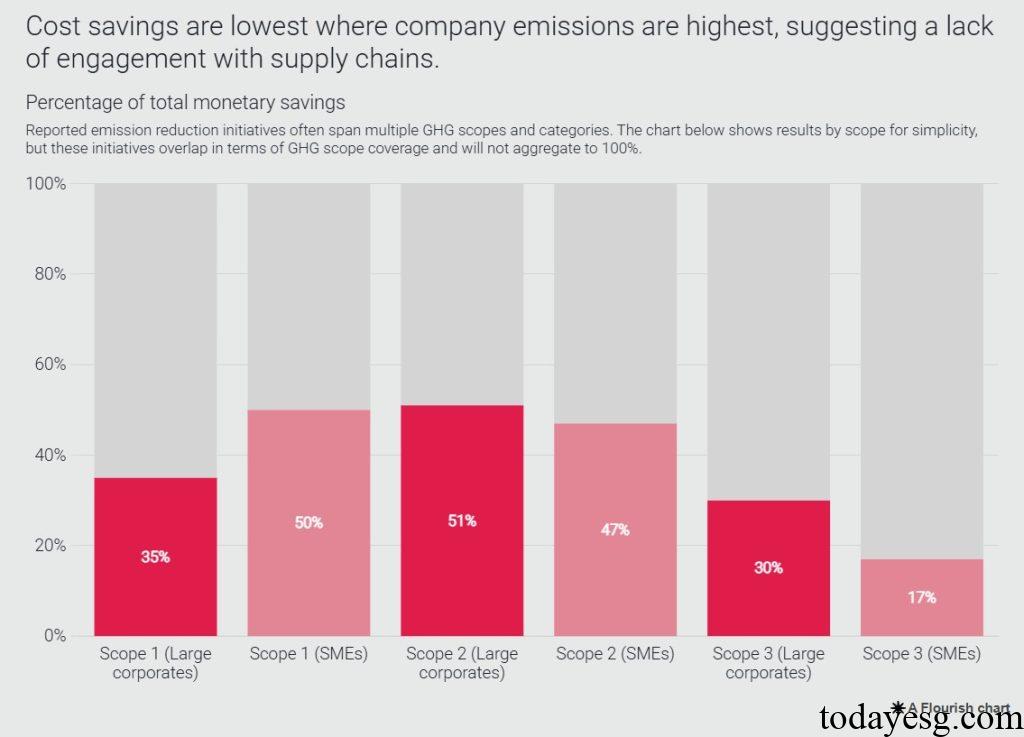

The environmental disclosure benefits of a company also depend on its supply chain. If a company has high carbon emissions, the benefits obtained through environmental disclosure will be even less. For Scope 3 carbon emissions, the profits obtained by large enterprises and small and medium-sized enterprises are 30% and 17% respectively, significantly lower than those of Scope 1 and Scope 2. This indicates that companies need to collaborate with upstream and downstream supply chain enterprises in Scope 3 to jointly reduce carbon emissions and achieve higher environmental disclosure benefits.

CDP believes that effective tools that companies can use in environmental disclosure include:

- Scenario analysis: 21% of companies have not conducted scenario analysis on environmental disclosures, and many companies have not disclosed key environmental assumptions in scenario analysis.

- Internal pricing: Only 19% of companies implement internal pricing for environmental external factors, primarily carbon pricing. There is a significant difference in carbon pricing levels among enterprises, with 50% of them adopting carbon prices between $9 and $124 per ton.

- Transition plan: 43% of large enterprises have formulated transition plans, 15% of small and medium-sized enterprises have formulated transition plans, of which only half of the plans meet the 1.5-degree Celsius warming target.

Reference: