2025 European Sustainability Reporting Standards Report

The European Financial Reporting Advisory Group (EFRAG) releases the European Sustainability Reporting Standards (ESRS) report, aimed at analyzing the 2024 European corporate sustainability disclosure reports.

2025 is the first mandatory reporting period under the Corporate Sustainability Reporting Directive (CSRD) in Europe, requiring companies to disclose sustainability information for 2024. The European Financial Reporting Advisory Group (EFRAG) collects 656 sustainability reports released by companies before April 20, 2025.

Related Post: Introduction to European ESG Regulation: Corporate Sustainability Reporting Directive

2024 Corporate Sustainability Report Status

The average page of a corporate sustainability report is 115 pages, with a median of 100 pages. The shortest report is 25 pages, and the longest report is 440 pages. The report length of financial institutions (140 pages) generally exceeds that of non-financial institutions (110 pages). Correlation analysis shows that the number of pages in sustainability reports is not related to the size of the enterprise or the number of disclosed topics but may be related to the jurisdiction where the enterprise is located and the level of detail of the information disclosed.

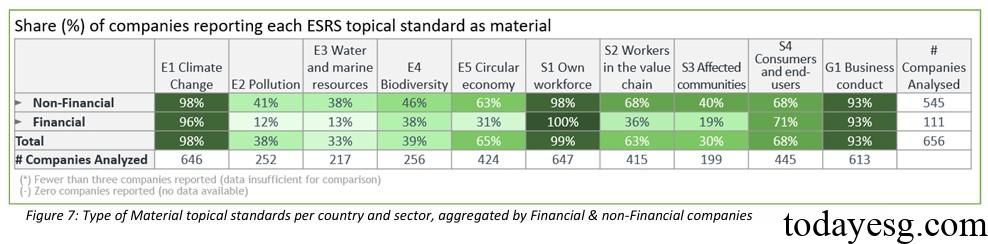

In terms of environment, social, and governance, the topics with the highest proportion of disclosure are E1 Climate Change (98%), S1 Own Workforce (99%), and G1 Business Conduct (93%). Other common themes include E5 circular economy (65%), S2 workers in the value chain (63%), and S4 consumers and end-users (68%). In terms of material topics within the disclosure theme, climate change mitigation, energy, working conditions of own workforce, equal treatment and opportunities for all own workforce, and corporate culture account for a relatively high proportion.

European Sustainability Reporting Standards: Environmental Disclosure

The key issues for corporate environmental disclosure include:

- Transition plan: 55% of enterprises have already developed transition plans to mitigate climate change, but the details and standardization of current transition plans are not enough. 70% of companies have disclosed Scope 1 and Scope 2 short-term goals that meet the 1.5-degree Celsius warming target, of which 60% have already passed third-party certification.

- Carbon pricing and biodiversity indicators: 20% of enterprises have applied internal carbon pricing, with mining industry (60%), power industry (50%), and transportation industry (30%) accounting for a relatively high proportion. 30% of enterprises have applied biodiversity indicators, and industries that have a direct impact on ecosystems, such as the real estate industry, power industry, and construction industry, disclose more biodiversity indicators.

- The financial impact of climate related risks: Most companies disclose climate risks in a narrative manner, and some companies have begun to quantify their financial impact, including asset level risk exposure and revenue impact.

European Sustainability Reporting Standards: Social Disclosure

The key issues of corporate social disclosure include:

- ESRS S2 Workers in the value chain: Most companies have disclosed their labor policies, and some have implemented these policies through supplier actions and appeal mechanisms and have achieved continuous monitoring.

- ESRS S3 Affected communities: Many companies are starting to use affected communities as material disclosure topics, and in addition to minimum disclosure requirements, they are setting indicators based on their own business models. These indicators typically include financial inclusion, education, and economic development plans.

- ESRS S4 Consumers and End Users: Digitization is key for businesses to measure and disclose consumer experience and impact, and responsible consumption is a key area of disclosure for businesses, reflecting a high level of focus on reputation.

Reference: