2025 Global Carbon Credit Price Report

World Bank releases 2025 Global Carbon Credit Price Report, aimed at analyzing changes in global carbon credit prices.

World Bank believes that the global carbon credit price is related to the supply and demand relationship in the carbon credit market, as well as the standardization level of carbon credit projects, carbon quality, and types of contracts.

Related Post: World Bank Releases 2025 Global Carbon Credit Market Report

Global Carbon Credit Price Analysis

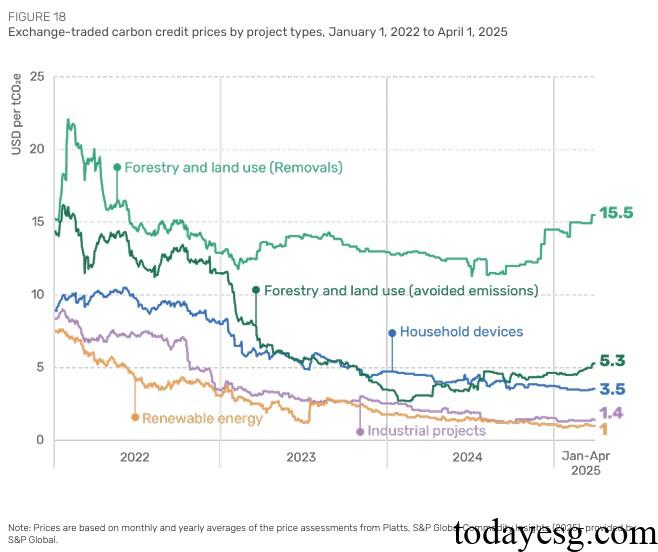

In 2024, the prices of most carbon credit projects decrease, with only natural based carbon credit projects experiencing price increases. The price increase of carbon credits related to forests and land use reflects the market’s emphasis on such projects. The prices of traditional renewable energy and carbon credits related to industrial projects have decreased, maintaining a long-term trend. At present, the carbon price of renewable energy projects has dropped to around $1 per ton of carbon dioxide, the lowest among all categories, while the carbon price of forest and land projects has reached 15 times.

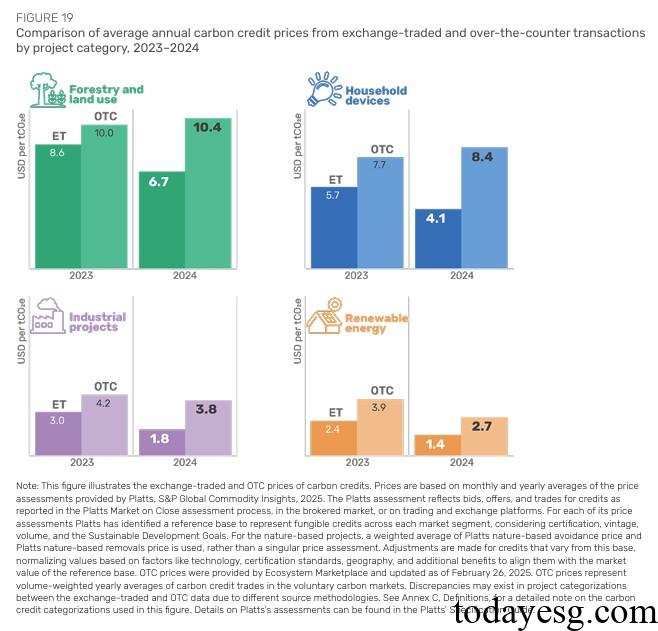

The carbon credit prices in OTC markets are generally higher, with carbon prices for forest and land projects, household equipment projects increasing compared to last year, and carbon prices for industrial projects and renewable energy projects decreasing compared to last year. In addition, the forward price of carbon projects based on nature has reached $20 per ton of carbon dioxide, nearly double the current price, indicating that the market is more optimistic about such carbon credits.

The correlation between carbon credit prices and carbon credit quality is constantly increasing, meaning that higher quality carbon credits are more likely to be traded at a premium, and buyers are willing to pay higher prices for high rated carbon credits. According to data from carbon credit rating agencies, for every additional level of credit rating for natural carbon emissions removal, the premium can reach up to $5 per ton. For higher ratings, the premium can reach up to 40%.

In addition, the price of carbon credits available for Nationally Determined Contributions (NDC) is higher than that of carbon credits in voluntary carbon markets. The carbon credit price that complies with Article 6 of the Paris Agreement can reach $20 per ton of carbon dioxide. For example, the average price of carbon credits delivered by Switzerland that comply with the Paris Agreement is 29 Swiss francs per ton of carbon dioxide, which translates to a price of over 30 US dollars. These premiums reflect that in some jurisdictions suppliers of carbon credit projects need to bear additional costs to produce carbon credits that meet higher quality requirements.

Besides jurisdictions, this pattern is also reflected in the international compliance carbon market. For example, the carbon prices for the two procurement activities of the Carbon Offsetting and Reduction Scheme for International Aviation in 2025 were $21.70 and $22.25, respectively, while last year’s procurement prices were mostly between $11 and $20.

Reference: