Australian Sustainable Finance Taxonomy

The Australian Sustainable Finance Institute (ASFI) releases its first sustainable finance taxonomy, aimed at promoting sustainable finance development in Australia.

The Australian Sustainable Finance Institute believes that the Australian Sustainable finance taxonomy provides classification criteria for green and transition financing related economic activities, which can help achieve net zero transition.

Related Post: Introduction to Global Sustainable Finance Taxonomy

Background of Australian Sustainable Finance Taxonomy

Sustainable finance taxonomy is a classification and definition tool that can scientifically and consistently evaluate whether an economic activity meets sustainability standards. The sustainable finance taxonomy can reduce the evaluation costs of financial institutions, improve information transparency, and help verify and validate the green and transition actions of enterprises. The sustainable finance taxonomy can also enhance investor information, reduce greenwashing risks, and help different jurisdictions compare investment products and sustainable disclosures.

47 jurisdictions worldwide have developed national or regional sustainable finance taxonomies, with the EU Taxonomy widely regarded as an important benchmark. However, the EU Taxonomy does not include important industries such as mining and agriculture in Australia. Therefore, the Australian Sustainable Finance Taxonomy has been modified based on the EU Taxonomy and is available for voluntary use by market participants.

Introduction to Australian Sustainable Finance Taxonomy

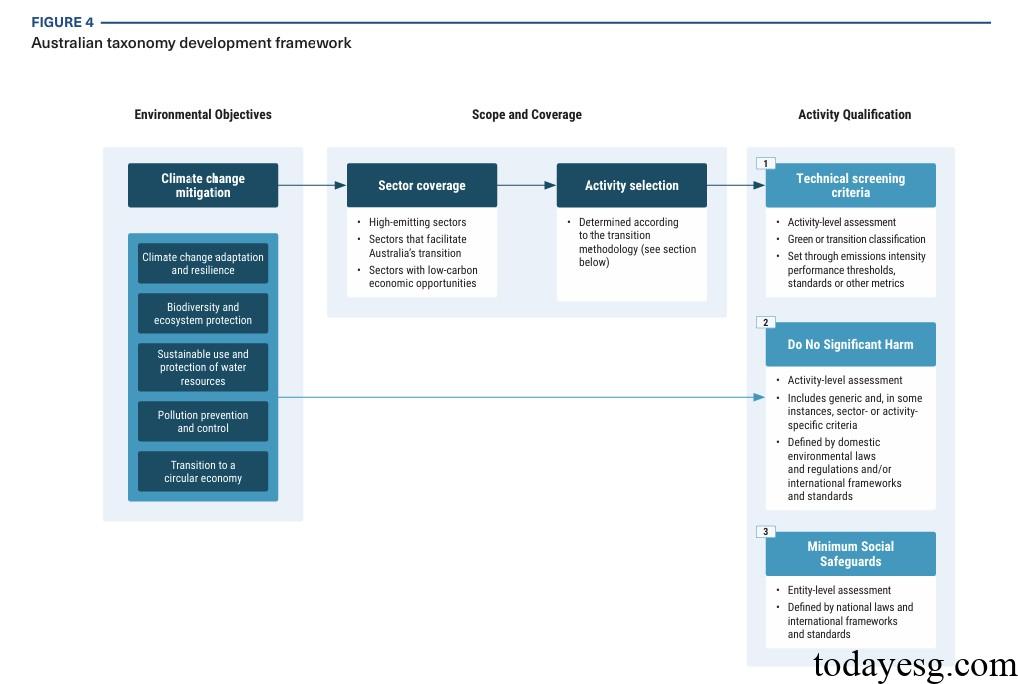

The Australian Sustainable Finance Taxonomy first identifies and describes environmental and social goals, as well as the coverage of the classification, and develops technical screening criteria for these sectors and activities. In addition, taxonomy also includes minimum social requirements and does not cause significant harm to environmental objectives.

The environmental objectives involved in the Australian sustainable finance taxonomy include:

- Climate change mitigation.

- Climate change adaptation and resilience.

- Biodiversity and ecosystem protection.

- Sustainable use and protection of water resources.

- Pollution prevention and control.

- Transition to a circular economy.

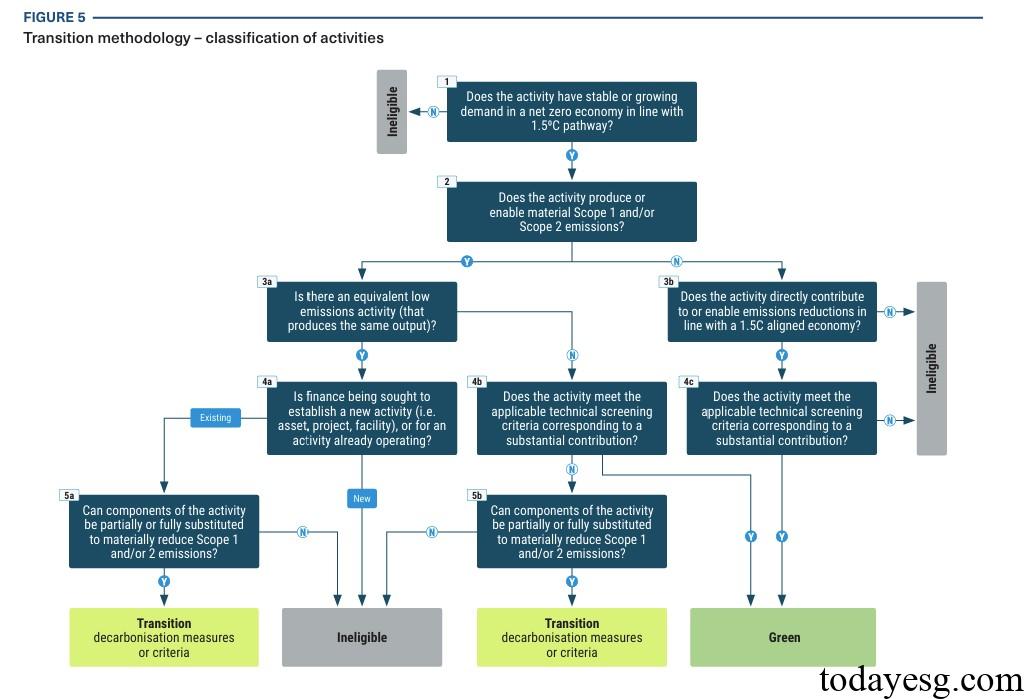

The Australian Sustainable finance taxonomy involves green economic activities and transition economic activities, where one economic activity can be classified as green economic activity, transition economic activity, or ineligible economic activity based on different screening criteria. These filtering criteria include:

- Does economic activity follow the 1.5-degree Celsius warming path and is it consistent with the 1.5-degree Celsius warming path?

- Does economic activity generate substantial Scope 1 and Scope 2 carbon emissions, and will it reduce material carbon emissions?

- Are there alternative activities with lower carbon emissions in economic activities, and will these alternative activities reduce material carbon emissions?

- Does the economic activity meet the technical screening criteria and make material contributions to environmental goals?

Application of Australian Sustainable Finance Taxonomy

The Australian Sustainable finance taxonomy can be used for sustainable financial products, investments, incentives, information disclosure, and transition plans. The Australian Sustainable Finance Institute provides two use cases:

- Activity-level Uses: Taxonomy can be used to screen eligible activities, assets, or projects and incorporate them into green bond frameworks, asset allocation frameworks, policy support frameworks, and investment portfolio strategies, which have an impact on the issuance of green financial instruments, sustainable investments, and green subsidies.

- Entity-level Uses: Taxonomy can help businesses demonstrate consistency between their business models and environmental goals, and incorporate green and transition benchmark performance, which can have an impact on climate-related information disclosure and transition plans. This information can enhance the transparency of sustainable financial markets.

Reference: