Guidelines for Responsible Investment in Securitized Bonds

The United Nations Principles for Responsible Investment (UNPRI) releases guidelines for responsible investment in securitized bonds, aimed at introducing how to apply responsible investment to securitized bonds.

The United Nations Principles for Responsible Investment believes that the complexity of securitized bond assets has slowed down the application of responsible investment methods, but investors have made progress in this area in recent years.

Related Post: Morningstar Launches First Structured Product Impact Index

Introduction to Securitized Bonds

Securitized products refer to the binding of different types of debt (such as mortgages, consumer loans, or corporate loans) together, converting them into tradable securities supported by these debts, and secured by the claims of these specific assets. Common securitized bonds include Residential mortgage-backed securities (RMBS), Commercial mortgage-backed securities (CMBS), Asset backed securities (ABS), and Collateralized loan obligations (CLO).

Due to the diversity of types and structures of securitized bonds, as well as the difficulty of data availability, the progress of these assets in responsible investment has been slow. The United Nations Principles for Responsible Investment believes that the following factors are promoting the application of responsible investment in this asset:

- Customer demand: Investors’ attention to sustainable investment methods such as responsible investment has increased.

- Materiality: The application of sustainable market standards helps investors evaluate the materiality of sustainable factors.

- Regulatory policies: Some jurisdictions have introduced regulatory policies to promote the development of securitized assets.

- Sustainable outcomes: The sustainable outcomes of securitized bonds are consistent with the environmental and social standards of sustainable funds.

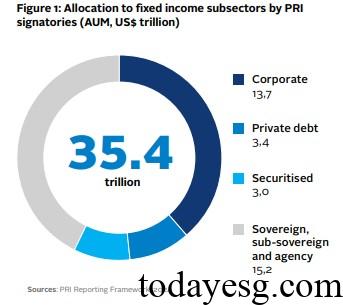

The total size of securitized bonds worldwide is approximately $14 trillion, and most of them are classified as fixed income assets. For example, in the Bloomberg Global Aggregate Index, securitized bonds account for 12% and corporate bonds account for 18%. The 2024 report released by the United Nations Principles for Responsible Investment shows that 9% of the fixed income assets of signatory institutions are securitized bonds, with a total size of $3.04 trillion, accounting for 3% of the total asset size of signatory institutions. Some regulatory policies, such as the European Green Bond Standard, also specifically introduce green securitization.

Introduction to Responsible Investment in Securitized Bonds

Compared with stocks and bonds, the development of securitized bond liability investment poses challenges. The securitized bond can have multiple small assets, and it is difficult to assess the sustainability factors of these assets. The United Nations Principles for Responsible Investment believes that securitization bond responsible investment will develop in three directions:

- Investment Analysis and Decision Making: Due to insufficient data transparency and structural complexity, the integration of sustainability factors in securitized bonds is relatively low. In other fixed income assets, investors can use negative screening methods to identify sustainable risks and opportunities, but it is difficult to implement in securitized bonds. Currently, investors are considering how to incorporate sustainability factors into their investment decisions for securitized assets, such as analyzing based on collateral and trading instruments, and applying emission calculation methods for securitized investment portfolio financing.

- Development of Theme-Focused Strategies: Some asset management companies are developing sustainable securitized bonds to allocate financing towards environmental and social themed projects. Investors are also providing sustainability assurance for securitized bonds through external evaluations and second party opinions. Some collateral assets of securitized bonds have also been subjected to negative screening and other methods to exclude unsustainable financing.

- Engagement and Collaboration: Stakeholders are involved in securitized bond liability investments, such as the Structured Finance Association (SFA) and Partnerships for Carbon Accounting Financials (PCAF), which invite industry practitioners to develop sustainable standards for securitized assets.

Reference:

Responsible Investment in Securitized Debt a Technical Guide