Sustainability Disclosure Report for the Insurance Industry

KPMG releases a sustainability disclosure report for the insurance industry, aimed at analyzing the development of sustainable disclosure in the insurance industry.

KPMG analyzes the 2024 disclosure reports of 45 insurance companies worldwide, which adopt various sustainability disclosure frameworks such as the European Sustainability Reporting Standards (ESRS), the International Sustainability Standards Board (ISSB) Standards, and Recommendations from Taskforce on Climate-related Financial Disclosures (TCFD).

Related Post: International Association of Insurance Supervisors Releases Climate Risk Management Application Paper

Environmental Disclosure in the Insurance Industry

In terms of environmental sustainability disclosure, the insurance industry mainly focuses on two themes: climate change and biodiversity:

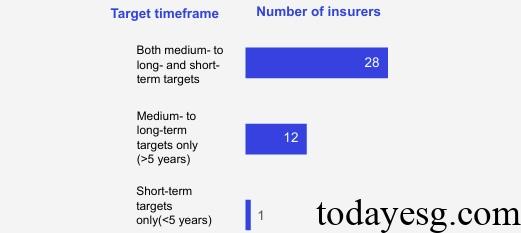

Climate change: 42% of insurance companies have released transition plans, an increase of 8 percentage points compared to last year. More than 90% of insurance companies have assessed the risks posed by extreme weather and are considering reducing this risk through product innovation and climate resilience. Almost all insurance companies have set carbon reduction targets, but one-third of them have not set short-term targets. 80% of insurance companies have disclosed their financing emissions data, an increase of 17 percentage points compared to last year.

Biodiversity: Insurance companies hold different attitudes towards the materiality of biodiversity, with 49% believing it to be material and adopting the Taskforce on Nature-related Financial Disclosures (TNFD) framework to disclose the risks and opportunities associated with nature. 31% of insurance companies have disclosed biodiversity indicators or targets, which focus on reducing deforestation and avoiding ecosystem damage. 40% of insurance companies incorporate nature and biodiversity into their strategies, focusing on solutions that protect nature in their investments.

Social Disclosure in the Insurance Industry

In terms of social sustainability disclosure, insurance companies mainly focus on consumers and end-users:

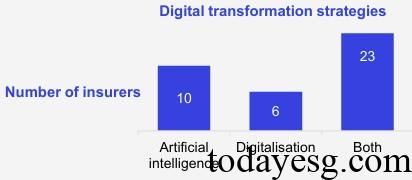

Consumers and end-users: Almost all insurance companies consider consumer disclosure to be material, with most disclosing contents on digital transformation, financial inclusion, etc. These disclosures focus on risks (26), impacts (17), and opportunities (12). Under the supervision of the Corporate Sustainability Reporting Directive (CSRD), European insurance companies provide more detailed disclosures of information. 82% of insurance companies have disclosed consumer-related performance indicators, but less than half have set relevant targets.

Governance Disclosure in the Insurance Industry

In terms of governance sustainability disclosure, insurance companies mainly focus on business conduct:

Business Conduct: Insurance companies mainly disclose risks (37 companies), impacts (17 companies), and opportunities (8 companies) in their business activities, including accountability mechanisms, governance structures, data protection, supplier management, etc. 84% of insurance companies have disclosed data and technology risks and plan to address them through network security monitoring, employee education, and other means. 29% of insurance companies have disclosed quantitative targets, with the most common targets including training (9 companies), board diversity (5 companies), and complaint rates (2 companies).

Reference: