Emerging Market Green Bond Report

International Finance Corporation (IFC) of the World Bank Group and Amundi release a report on emerging market green bonds, aimed at summarizing the development of green bond market.

The International Finance Corporation is an important issuer of global green bonds and continues to provide technical support to other green bond issues. According to data from the Climate Bonds Initiative (CBI), the World Bank issued $54.3 billion in sustainable bonds in 2024, making it the world’s largest issuer of sustainable bonds.

Related Post: Climate Bond Initiative Releases 2024 Global Sustainable Bond Market Report

Emerging Market Green Bond Performance

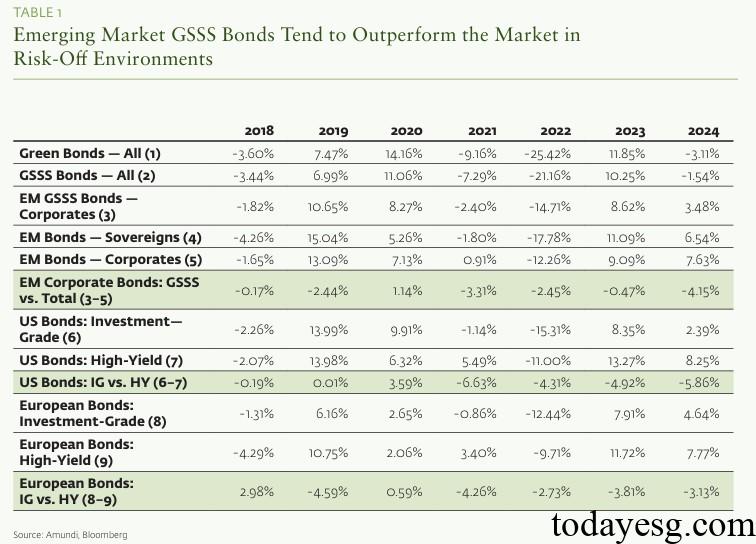

The return of the 2024 Emerging Markets Sustainable Bond Index is 3.48%, lower than the Emerging Markets Sovereign Bond Index (6.54%) and the Emerging Markets Corporate Bond Index (7.63%). Sustainable bonds perform relatively better in safe environments but perform average in normal market conditions. The global green bond return rate in 2024 is -3.11%, and the global sustainable bond return rate is -1.54%, both lower than the emerging market sustainable bond index return rate.

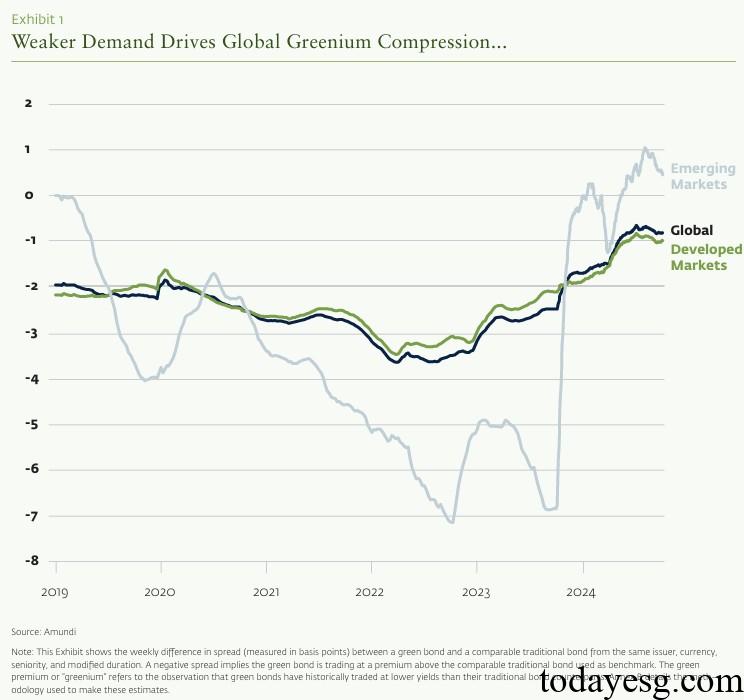

In terms of green premium, Amundi estimates that the green premium for emerging market green bonds in 2024 is 1.2 basis points, lower than in 2023 (1.5 basis points), which may be due to a decrease in market demand for green assets. This trend is consistent with developed markets, where the green premium for green bonds has decreased from 2.2 basis points in 2023 to 1.3 basis points in 2024. This indicates that in an environment of rising interest rates, investors are more concerned about bond yields than sustainable features of bonds. As the green bond market gradually matures, the green premium may continue to narrow in the future.

Emerging Market Green Bond Trends

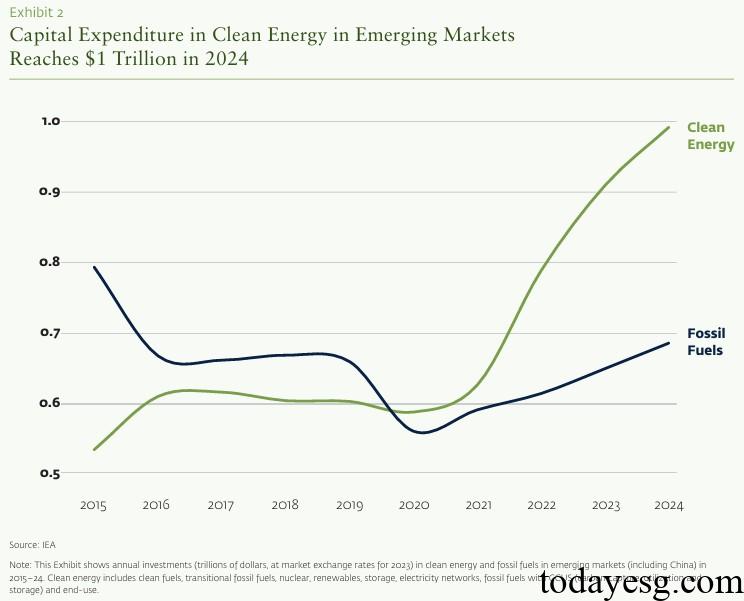

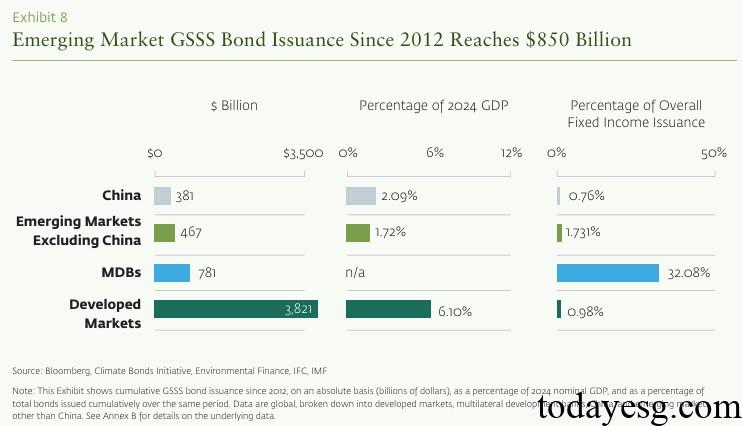

Since 2018, the global issuance of sustainable bonds has reached $5.1 trillion, with green bond issuance accounting for 60% of the total. The total size of green bonds in emerging markets is $800 billion, surpassing that of multilateral development banks ($730 billion). This growth comes from the increasing demand for energy transition and sustainable investment in emerging markets, as well as the improvement in transparency of confidence disclosure by emerging market issuers and investors. According to data from the International Energy Agency (IEA), the total investment in clean energy in emerging markets reached a historic high of $1 trillion in 2024.

The scale of sustainable bond issuance in emerging markets in 2024 is $180 billion, a year-on-year decrease of 14%. However, since 2018, the issuance of sustainable bonds in emerging markets has increased sixfold, with green bonds accounting for two-thirds. Emerging market issuers are gradually increasing the issuance scale of sustainable development bonds, as these bonds can support both environmental and social projects. In 2024, China’s proportion of sustainable bond issuances in emerging markets will be 41%, a decrease of 76% compared to 2018, but still in a dominant position. In 2024, China’s green bond issuance accounts for 60% of the total issuance in emerging markets, and its percentage in GDP is also higher.

Emerging Market Green Bond Outlook

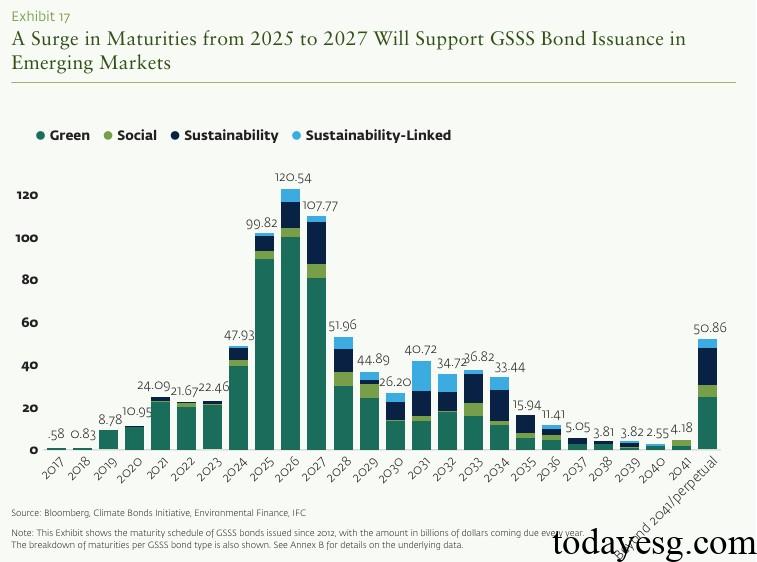

From 2025 to 2027, emerging markets will have $330 billion in sustainable bond maturities, making it the largest three-year period for sustainable bond maturities in the next two decades. Most of these bonds were issued in a low-interest rate environment, and the current high-interest rate levels may pose a challenge for issuers to refinancing. The uncertainty of economic growth, the focus of sustainable regulatory policies on greenwashing, and investors’ preferences for climate financing may all become important factors affecting the development of green bonds in emerging markets.

Reference: