Report on Commodity Climate Risk Premium

The World Federation of Exchanges (WFE) releases a report on commodity climate risk premium, aimed at analyzing the pricing of climate risk in commodity markets.

The World Federation of Exchanges believes that with the development of investors’ awareness and strategies for climate risk, research on climate risk premium has become an important topic for the financial industry to identify and address climate change.

Related Post: S&P Releases the First Climate Aware Index for Commodities

Background on Commodity Climate Risk Premium

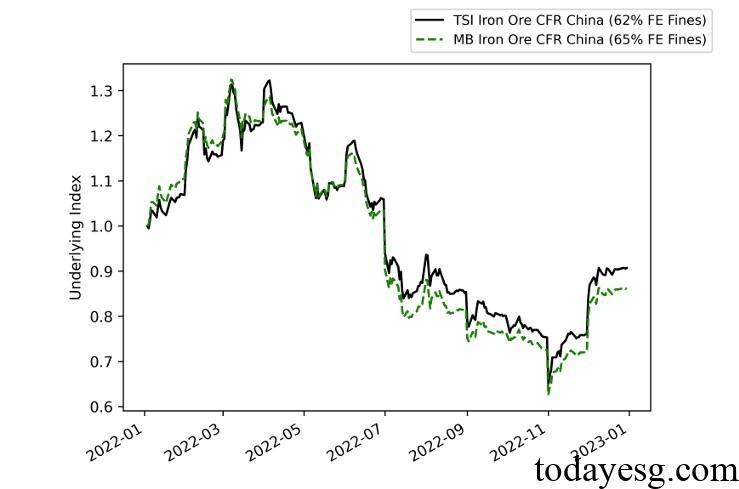

The World Federation of Exchanges uses two iron ore option contracts provided by the Singapore Exchange: SGX TSI Iron Ore CFR China (62% Fe Fines) and SGX MB Iron Ore CFR China (65% Fe Fines) as research objects. The iron percentage of these two types of iron ore option contracts is different. The first type has a lower iron percentage and requires more processing procedures, so the climate risk is higher. The second type has a higher iron percentage and lower climate risk.

The advantages of using iron ore option contracts as the research objects are as follows:

- Avoid endogeneity issues in climate risk premium research: Most financial assets can be classified into brown and green assets based on their climate risk in research, but this classification cannot avoid endogeneity issues. For example, when studying brown and green stocks, different companies have different characteristics that can affect research conclusions. Using iron ore option contracts as the research object can directly measure climate risk exposure without the need for additional control variables.

- Forward looking assessment of climate risk premium: Climate risk, as a forward-looking risk, has significant errors when using traditional econometric time series analysis methods. Option contracts incorporate market expectations of future price fluctuations and tail risks into pricing, allowing for more efficient estimation of climate risk premium.

- Objective measurement of climate risk premium using option data: The implied risk probability Q and actual risk probability P of option contracts can measure the overall risk premium of assets. By using a two-stage differential approach, researchers can continue to obtain premiums attributed to climate risk. This method can avoid subjective climate scoring systems and provide more objective climate risk measurement standards.

Results on Commodity Climate Risk Premium

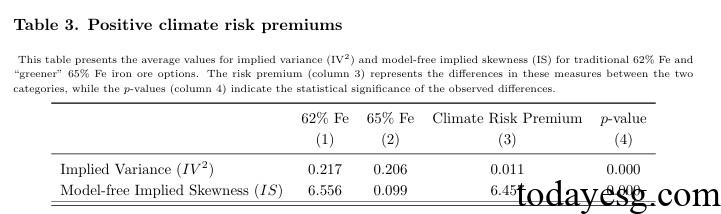

This study uses two key option variables: implied variance and implied skewness. Implied variance reflects the market’s judgment of future price fluctuations and measures overall price risk. Implied skewness reflects the market’s expectation of price decline relative to price rise, measuring tail risk.

Researchers first analyzed the pricing of climate risk in two options and compared the differences in their implied variance and implied skewness. The implied variance of the 62% iron option (0.217) is higher than that of the 65% iron option (0.206), indicating that the market expects the price volatility of brown iron option to be greater than that of green iron option.

The implied skewness of 62% iron option (6.556) is significantly higher than that of 65% iron option (0.099), indicating that the market expects a higher probability of downside risk in brown iron ore option. The difference between the two is considered as a climate risk premium, which is statistically significant (P-value less than 0.01).

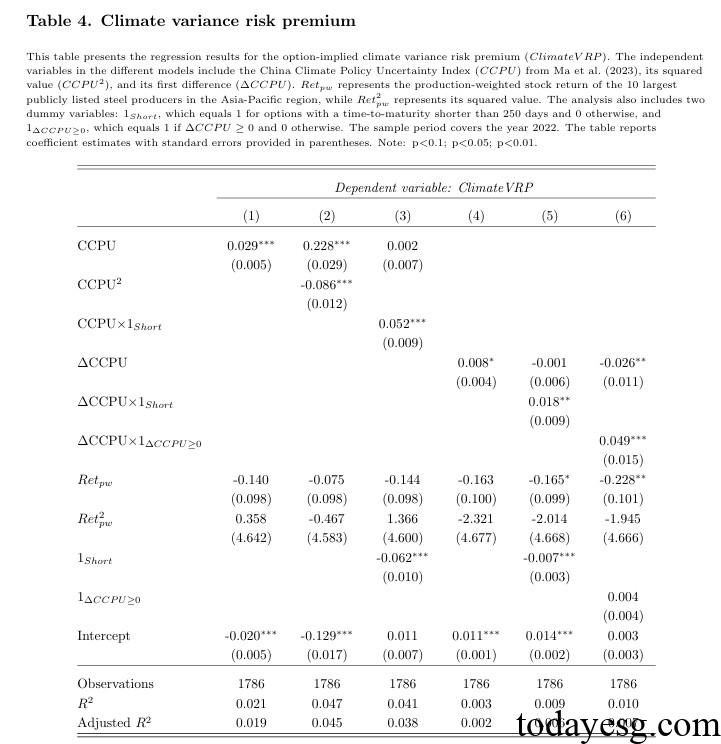

Researchers referred to previous literature and introduced two indicators, climate policy uncertainty and steel industry production performance, using regression analysis to study the key factors of climate risk premium. The research results show that the climate policy variable has statistical significance (0.228), and its square term also has statistical significance (-0.086). This indicates that an increase in policy uncertainty will first increase the climate risk premium, and after reaching a higher level of uncertainty, it will decrease the climate risk premium.

Researchers believe that the impact of climate policy uncertainty on climate risk premium is consistent with real options theory, where an increase in initial climate uncertainty increases market volatility and increases investors’ demand for protection against potential prices fluctuations. When uncertainty reaches a high level, investors tend to adopt a wait-and-see attitude and are unwilling to pay high costs for hedging risks.

Reference: