Global Transition Finance Report

The MSCI Sustainability Institute releases 2025 Q1 Global Transition Finance Report, which aims to analyze progress in areas such as global carbon emissions, climate goals, low-carbon funding flows, and net zero transition.

MSCI has changed the report name from Net Zero Tracker to Transition Finance Tracker to expand the research scope and focus on low-carbon economy development.

Related Post: MSCI Releases Global Net Zero Tracker Report

Global Carbon Emissions and Climate Targets

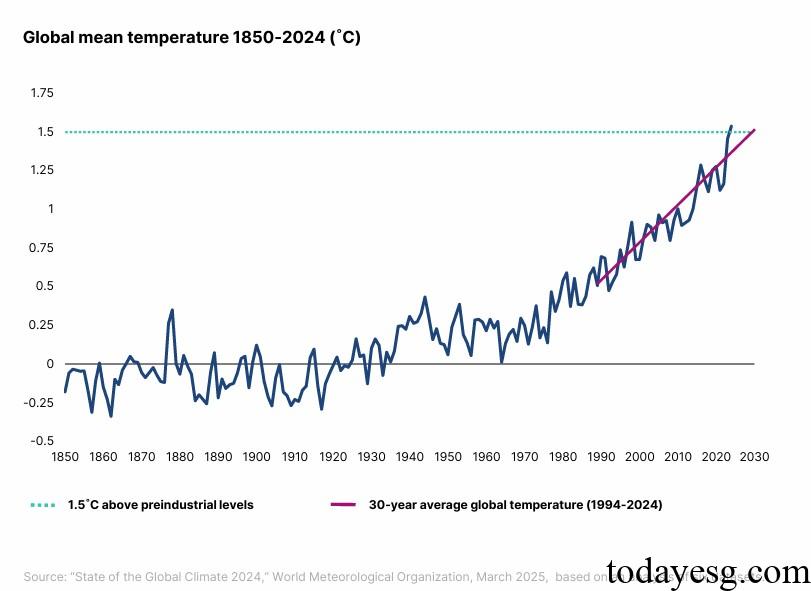

2024 is the hottest year in the world, and if we follow the warming rate of the past thirty years, global warming will reach 1.5 degrees Celsius by the year 2030 (based on the preindustrial period in 1850). Greenhouse gas emissions are a significant cause of global warming, and MSCI finds that listed companies and their subsidiaries contribute one-third of global greenhouse gas emissions. In 2024, global listed companies’ Scope 1 carbon emissions decreased by 2% to 11.1 billion tons, while non-listed companies’ Scope 1 carbon emissions were 7.3 billion tons.

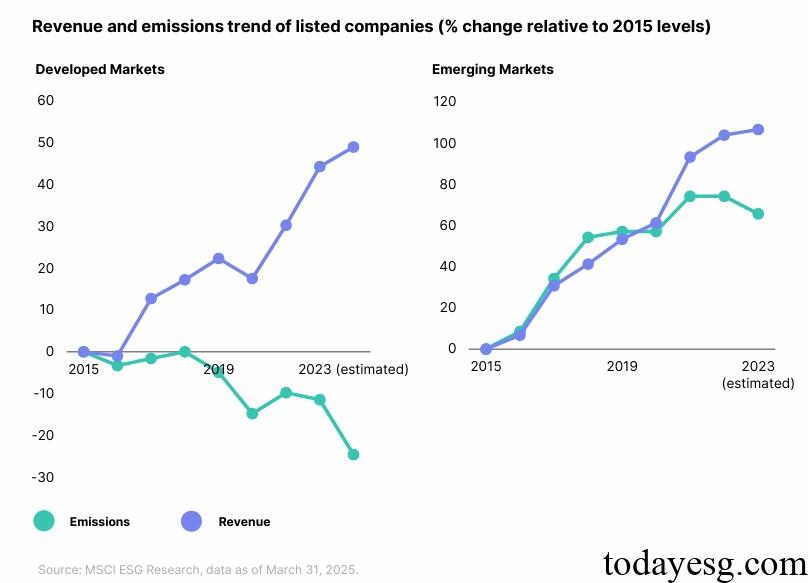

For a long time, there has been a correlation between greenhouse gas emissions and economic growth, but with the development of sustainable business practices, this correlation has weakened. According to data from the International Energy Agency (IEA), the global economy grew by 3% in 2024, but carbon emissions only increased by 0.8%. Developed economies have performed better in decarbonization, with revenue growth of nearly 50% for listed companies in developed economies since 2015, but carbon emissions have decreased by 25%.

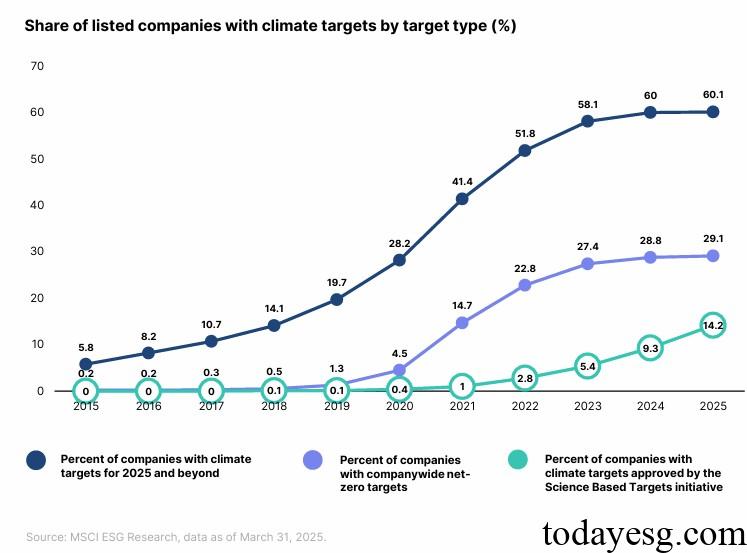

The setting of corporate climate targets has driven the reduction of carbon emissions. As of March 2025, 14.2% of listed companies have set science-based climate targets, 29.1% have set net zero targets, and 60.1% have set climate targets for 2025 and beyond. Industry (21.5%), consumer industry (15.5%), and information technology industry (13.9%) have a relatively high proportion of climate targets.

Global Transition Disclosure and Capital Flows

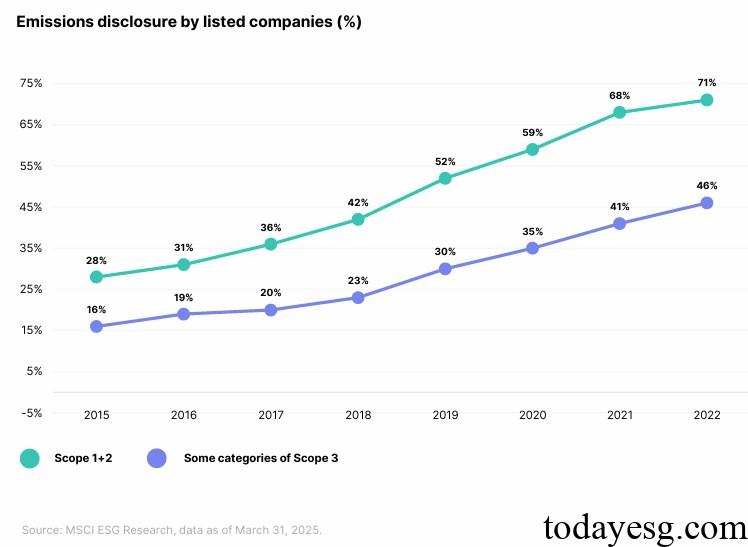

Since 2015, the proportion of listed companies disclosing Scope 1 and Scope 2 carbon emission data has increased from 28% to 71%, and the proportion disclosing Scope 3 carbon emission data has increased from 16% to 46%. Among non-listed enterprises, public utilities, real estate, and energy companies have the highest proportion of carbon emissions disclosure, and these companies usually have higher carbon emissions. Overall, the disclosure ratio of non-listed companies is significantly lower than that of listed companies, which may be due to differences in regulatory requirements for them.

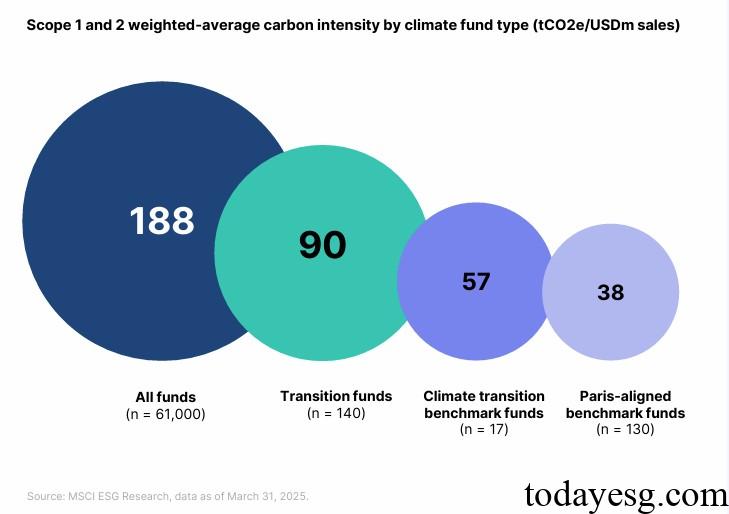

In recent years, global climate investment and transition investment have developed rapidly. From 2018 to 2024, the assets of publicly managed climate funds have reached 560 billion US dollars, an increase of nearly 20 times, and the assets of private climate funds are also close to 120 billion US dollars. The main investment directions of the climate fund are public utilities, industry, and information technology industries. From the perspective of portfolio carbon intensity classification, climate funds can be divided into Transition Funds, Climate Transition Benchmark Funds, and Paris-aligned Benchmark Funds.

As of March 2025, the carbon emissions, climate targets, and transition plans of global listed companies show a median expected global warming of 2.7 degrees Celsius, with energy, materials, and consumer industries expecting warming greater than 3 degrees Celsius. Investors can seek more opportunities in decarbonization actions in these industries.

Reference: