What is the Sustainable Finance Taxonomy

The International Capital Market Association (ICMA) believes that sustainable finance taxonomy is a classification system that can identify activities, assets, and projects related to achieving climate, environmental, social, or sustainable goals.

The Climate Bonds Taxonomy, released by the Climate Bonds Initiative in 2012, is the world’s first Sustainable Finance Taxonomy. With the development of sustainable finance, the complexity of classification methods continues to increase. In 2014, the International Capital Markets Association released the Green Bond Principles, providing a set of voluntary standards for the fundraising, issuance, and classification of green bonds. 2020 EU Taxonomy is considered the most comprehensive taxonomy, consisting of 6 environmental objectives and 170 economic activities.

Related Post: Introduction to the Climate Bonds Taxonomy Released by Climate Bond Initiative

Development of Sustainable Finance Taxonomy

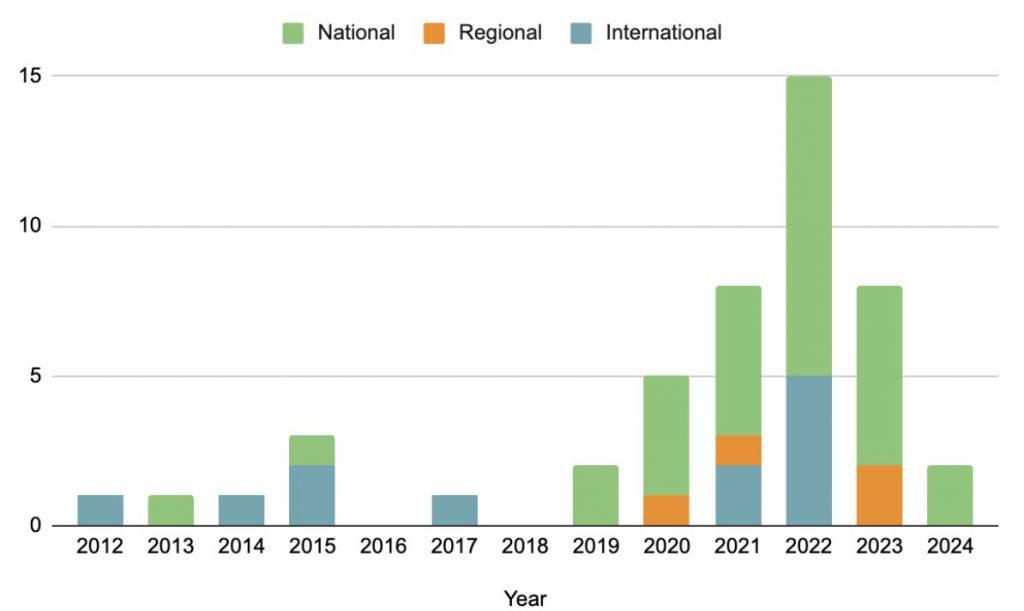

As of February 2024, a total of 47 sustainable finance taxonomies have been released globally, of which 31 classifications are issued by different jurisdictions, 27 classifications involve green goals, and the rest mainly focus on social goals, blue economy, and United Nations Sustainable Development Goals (UN SDGs). Taxonomy is often used as a voluntary tool to collaborate with other parts in sustainable financial ecosystem and provide assistance for sustainable development.

The sustainable finance taxonomies can be divided into the following three types:

- Principle-based Taxonomy: Taxonomy defines a set of core principles for the market, but does not specify thresholds or screening criteria for related activities, such as the Green Bond Principles released by the International Capital Markets Association.

- Whitelist-based Taxonomy: Taxonomy includes compliance projects and economic activities for some industries or sub industries, such as taxonomies released by some jurisdictions.

- Technical Screening Criteria-based Taxonomy: Taxonomy defines screening criteria and thresholds for economic activities, as well as how to evaluate these activities, such as the EU Taxonomy.

In practical operation, some taxonomies contain two of the above features, which provide specific technical standards for high priority industries based on a set of core principles, such as the ASEAN Taxonomy.

Themes of Sustainable Finance Taxonomy

At present, most sustainable finance taxonomies mainly focus on climate change and are covering some social or other environmental themes (such as biodiversity and blue economy). Common themes of sustainable finance taxonomies include:

- Climate Finance Taxonomies: focuses on activities that can align with the global warming goals of the Paris Agreement.

- Green Finance Taxonomies: focuses on environmental goals and broader green economy activities.

- Social Finance Taxonomies: focuses on activities aimed at social goals such as education and health.

- SDG Taxonomies: focuses on activities that meet the 17 United Nations Sustainable Development Goals.

- Transition Finance Taxonomies: focuses on activities that do not meet climate finance taxonomies but can provide assistance for transition.

- Taxonomies of Undesirable Activities: focuses on activities that are highly polluting, harmful, or exacerbate environmental and social risks.

Under the development of global sustainable finance taxonomy, most taxonomies are still in the early stages of development and implementation, and various jurisdictions are still designing sustainable finance taxonomy with different needs, goals, and application processes.

Reference: