Climate Transition Plan Report

The Association for Financial Markets in Europe (AFME) releases a report on climate transition plans, aimed at summarizing the development of climate transition plans and exploring the application of them in financial industry.

The Association for Financial Markets in Europe believes that the climate transition plan provides important information for the financial industry, helping them understand decarbonization trajectories and provide transition financing. The implementation of the climate transition plan requires not only the cooperation of the financial industry, but also various stakeholders including non-financial sectors and regulatory agencies.

Related Post: Introduction to the Transition Assessment Guidelines of Climate Bond Initiative

Introduction to Climate Transition Plan

At present, there is no unified definition for climate transition plans globally, but with the increasing attention to interoperability in various jurisdictions, progress is being made in developing a widely applicable transition plan. The International Organization for Standardization has proposed global standards for climate transition plans of financial institutions. The Financial Stability Board analyzed the role of climate transition plans in understanding and managing climate related financial risks and established a Transition Plans Working Group to carry out its work.

Although there is still a lack of a consistent global standard for climate transition plans, most current transition plans are based on the core pillars established by the Taskforce for Climate-related Financial Disclosures, namely governance, strategy, risk management, and metrics and targets. Meanwhile, most transition plans establish transition goals and timelines from short-term, medium-term, and long-term time perspectives, including implementation strategies and engagement strategies.

From the development of climate transition plans, mandatory transition plans are constantly replacing voluntary ones. For example, the EU Corporate Sustainability Due Diligence requires all companies that meet regulatory requirements to develop climate transition plans to ensure that their business activities are aligned with sustainable economic transition.

Stakeholders and Climate Transition Plan

In addition to the development of regulatory policies, the attention of various stakeholders to climate transition plans is also increasing. Some shareholder proposals of listed companies may require the investee to submit a climate transition plan. Some proxy advisors, such as Institutional Shareholder Services and Glass Lewis, have also begun evaluating transition plans in voting activities.

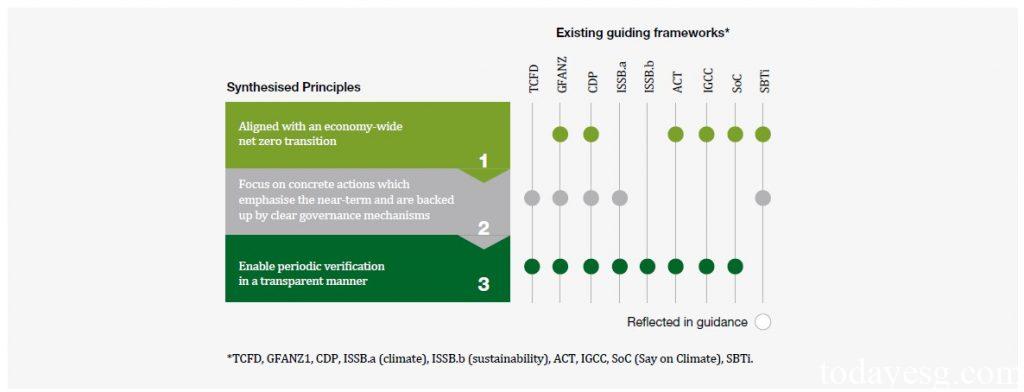

Various investor groups and organizations are also developing frameworks for climate transition plans, such as the Carbon Disclosure Project, which has established the contents that corporate transition plans should include and methods for evaluating them. Members of Climate Action 100+ suggest that companies disclose their transition plans and evaluate them. The evaluation results show that there has been significant progress in the disclosure of climate transition plans.

Application of Climate Transition Plan in Financial Industry

The transition plan outlines the net zero strategy and communicates how to integrate it into business activities. Financial institutions can use climate transition plans as part of due diligence to understand their clients’ business development and provide assistance for transition financing and the design of sustainable financial products. Asset managers can calculate the carbon emissions data of their investment portfolio based on the transition plan in order to carry out asset allocation. For long-term asset owners such as insurance companies, transition plans are an important element in measuring long-term investment value and managing climate related financial risks.

The climate transition plan has also been used by financial regulatory agencies for micro prudential assessments and macro financial stability analysis. For example, the draft ESG risk management guidelines released by the European Banking Authority mention the use of transition plans to manage ESG related risks. The Financial Stability Board considers the correlation between transition plans and financial risks from a macro perspective. The Association for Financial Markets in Europe believes that climate transition plans will play an important role in risk assessment and policy-making by regulatory agencies.

Reference: