Global Climate Investment Report

Moody’s releases a global climate investment report aimed at encouraging governments to collaborate with the private sector to address the funding gap for climate investment and allocate the costs and benefits of climate investment in a reasonable manner.

Moody’s refers to clean energy data released by the International Energy Agency to assess the funding gap for global climate investments. The International Energy Agency’s scenario forecast is achieving net zero by 2045 for developed economies, achieving net zero by 2045 for China, and achieving net zero after 2050 for other developing economies.

Related Post: International Energy Agency Releases Emerging Market Clean Energy Report

Global Climate Investment Funding Gap

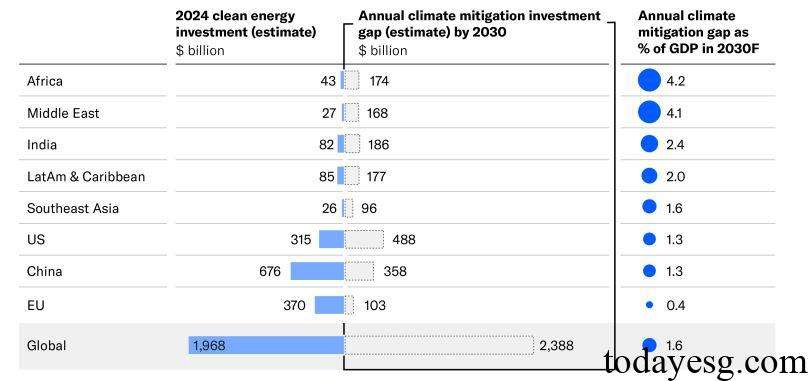

To achieve net zero, countries need to invest a significant amount of funds in climate mitigation and adaptation measures. The Climate Policy Initiative expects global climate investment to reach $8 trillion to $9 trillion annually by 2030, equivalent to 7.5% to 8.5% of global GDP in 2023. Moody’s estimates, based on data from the International Energy Agency, that $2.39 trillion in climate mitigation investment is needed globally by 2030. However, it is expected that global climate mitigation investment will be around $1.96 trillion by 2024. Emerging market economies have a significant funding gap and need to increase their investment by four times by 2030.

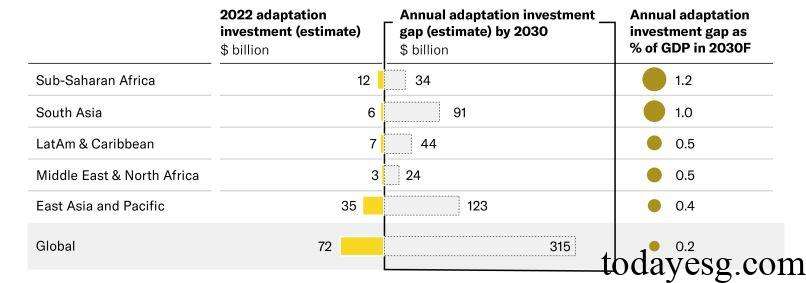

There is also a funding gap for global climate adaptation investment, with an annual requirement of $315 billion for climate adaptation investment by 2030, and approximately $72 billion for global climate adaptation investment by 2022. The funding gap for climate adaptation investment is lower than that for climate mitigation financing. Assuming that all climate mitigation and adaptation investments are managed by government, global government debt will account for 1.8% of GDP by 2030.

Private Sector Climate Investment Forecast

Although the funding gap for climate investment will create a debt burden for governments, half of climate investment comes from the private sector, so global government climate investment spending will account for approximately 0.9% of GDP by 2030. Emerging market governments need to bear a larger share of climate investment due to their relatively weaker financial systems compared to developed economies. The International Energy Agency predicts that private climate investment in emerging markets will reach $1.6 trillion by 2030 to achieve net zero by 2050.

The climate investment gap of China and the United States is relatively small, accounting for about 1.7% of GDP. The scale of China’s climate investment from 2021 to 2022 has exceeded the sum of other countries in the world, accounting for 51% of global climate investment. China’s unique economic structure has enabled state-owned enterprises to provide significant investments in climate mitigation. Moody’s research has found that while climate investments increase debt burdens, the economic and social impacts of not acting are greater.

Climate Policy and Climate Investment Tools

The International Monetary Fund and the World Bank believe that carbon pricing is the most effective tool for reducing emissions. It can encourage the private sector to use low-carbon technologies, increase government revenue through carbon taxes or carbon emissions trading systems, and use these funds for climate investment. At present, carbon pricing has been implemented in many countries, with an average carbon price of $20 per ton, covering 25% of global carbon emissions.

Blended financing is also an important financial tool for climate investment, which can attract private capital to participate in climate investment actions. From 2014 to 2022, the global blended financing scale is approximately $8 billion per year. Multilateral development banks are important participants in mixed financing, and they can formulate policies to promote development. Moody’s finds that adopting multiple climate policies can reduce the climate debt ratio by two-thirds by 2050, and early implementation of these investments can reduce climate change related losses by half.

Reference:

Sharing Climate Investment Cost with Private Sector can Ease Credit Impact