Report on Carbon Border Adjustment Mechanism

The World Economic Forum (WEF) releases a report on carbon border adjustment mechanism, aiming to introduce the impact of carbon border adjustment mechanism on enterprises and provide recommendations.

The World Economic Forum believes that the carbon border adjustment mechanism can not only encourage countries to increase their emission reduction targets and support the Paris Agreement but also pose challenges to corporate competitiveness and economic growth.

Related Post: EU and UK Plan to Connect Carbon Emissions Trading Systems

What is Carbon Border Adjustment Mechanism

The carbon border adjustment mechanism refers to the mechanism of levying implicit emission prices on imported goods, where the levied price is equal to the price that the goods need to pay when produced under the policies of the importing country. The carbon border adjustment mechanism can adopt different structures, such as taxes linked to carbon taxes or certificate systems linked to carbon emission trading systems. The EU Carbon Board Adjustment Mechanism (CBAM) is the world’s first carbon border adjustment mechanism. It adopts a certificate system, requiring imported products to purchase certificates that are priced in line with the EU Emissions Trading System (ETS), thereby ensuring that the carbon cost of imported goods is like that of EU products.

The carbon border adjustment mechanism is different from traditional carbon pricing mechanism in that it does not establish new carbon prices through taxation or trading but rather avoids carbon leakage based on existing carbon prices. A study by the Organization for Economic Cooperation and Development (OECD) shows that when carbon prices rise by $1 per ton, carbon emissions from cement and steel plants decrease by 1.3%, but carbon leakage based on international trade offsets 13% reduction effect. After implementing the carbon border adjustment mechanism, the average carbon leakage rate can be reduced from 12% to 8%. Overall, the carbon border adjustment mechanism can coordinate carbon costs, reduce trade distortions, and promote export countries to implement stricter carbon reduction plans.

Impact of Carbon Border Adjustment Mechanism on Enterprises

The application of carbon border adjustment mechanism will lead to an increase in compliance costs for enterprises, a decrease in profit margins, and affect the competitiveness of export products. For enterprises, these impacts can be classified into the following categories:

- Compliance requirements: There are differences in regulatory policies, definitions, and standards in different jurisdictions, such as the scope, reporting cycles, and cost calculations of carbon offset mechanism in the European Union and the United Kingdom. Companies need to meet multiple compliance requirements.

- Technical limitations: The commercialization time of mature decarbonization technologies for products cannot be determined, and their application costs may require companies to bear additional carbon emission expenses in the short term.

- Financial obstacles: Decarbonization is a capital-intensive industry that requires long-term capital expenditure, which puts pressure on short-term business operations of enterprises.

At present, the carbon border adjustment mechanism of various countries is still in the transitional reporting stage, for example, the European Union plans to include more industries in regulatory policies before 2030. Enterprises that are prepared in advance can obtain market access opportunities earlier, establish more resilient supply chains, enhance investor confidence, gain the trust of regulatory agencies, and enhance competitive advantages.

How can Enterprises Cope with Carbon Border Adjustment Mechanism

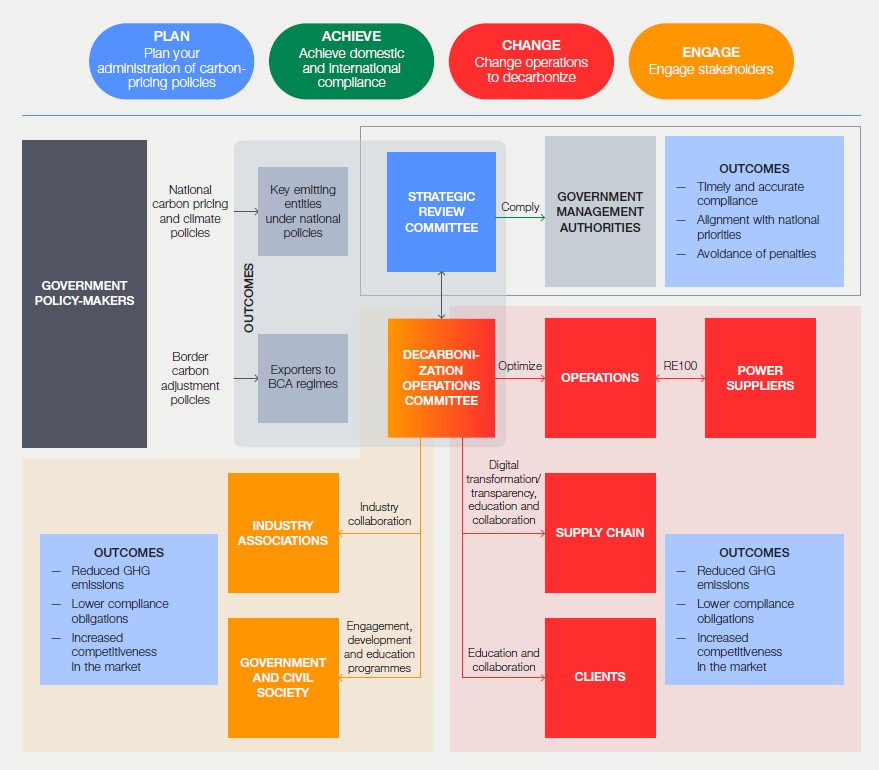

The World Economic Forum recommends that companies adopt the PACE framework to address carbon border adjustment mechanism. The PACE framework refers to:

- Plan: Establish internal governance mechanism, such as carbon emission monitoring and reporting systems, to reduce the risks associated with carbon pricing.

- Achieve: Take measures to meet the requirements of domestic and international carbon pricing systems and retain records and support documents.

- Change: Improve procurement, production, and delivery activities, reduce greenhouse gas emissions, and minimize risks from the root.

- Engage: Collaborate with stakeholders such as employees, suppliers, and regulatory agencies to jointly promote decarbonization actions.

Reference:

Climate and Competitiveness: Border Carbon Adjustments in Action