Climate Disclosure Report for Listed Companies

The Singapore Exchange (SGX) releases a climate disclosure report for listed companies, aiming to summarize the climate information disclosure of listed companies on the Singapore Exchange.

The Singapore Exchange analyzes sustainability reports released by over 500 listed companies and evaluates climate disclosures based on the Taskforce on Climate-related Financial Disclosures.

Related Post: Singapore Exchange Releases Sustainable Disclosure Rules for Listed Companies

Climate Disclosure Performance for Listed Companies

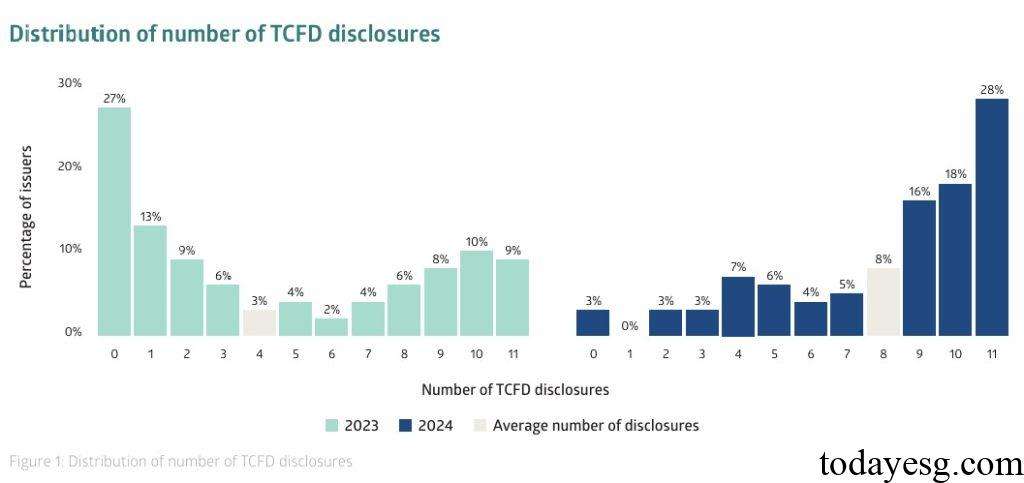

97% of listed companies provide climate disclosure in their sustainability reports, including at least one disclosure recommended by the working group. In 2023, each listed company discloses an average of four climate information items, and this indicator increases to eight items by 2024. Only 28% of companies have disclosed all 11 climate issues. Overall, the climate information disclosure performance of listed companies is better than the global average (82% disclose at least one item, and 3% provide all disclosures).

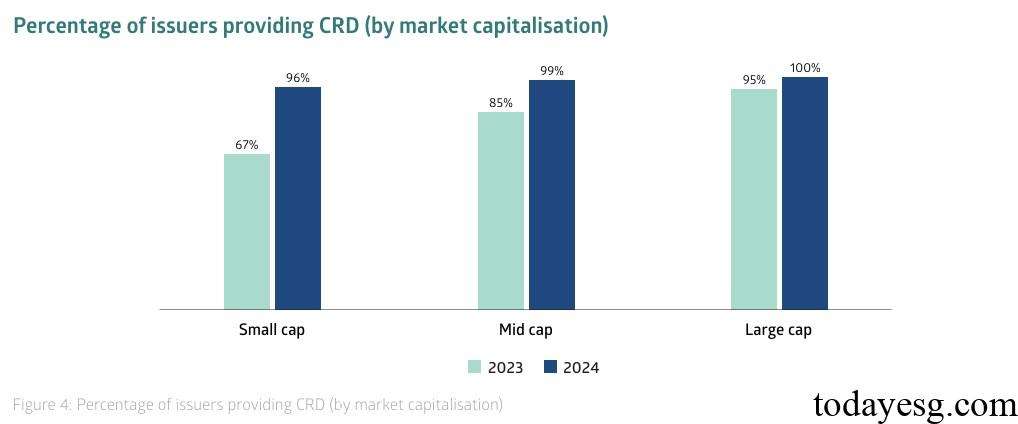

97% of companies listed on the main board in 2024 disclose climate information, an increase of 1 percentage point compared to 2023. The progress of companies listed on the Catalist is rapid, with 80% disclosing climate information in 2024, an increase of 21 percentage points compared to 2023. From the perspective of market value, the climate disclosure ratios of large cap stocks, mid cap stocks, and small cap companies in 2024 are 100%, 99%, and 96%, respectively, an increase of 5 percentage points, 14 percentage points, and 29 percentage points compared to 2023.

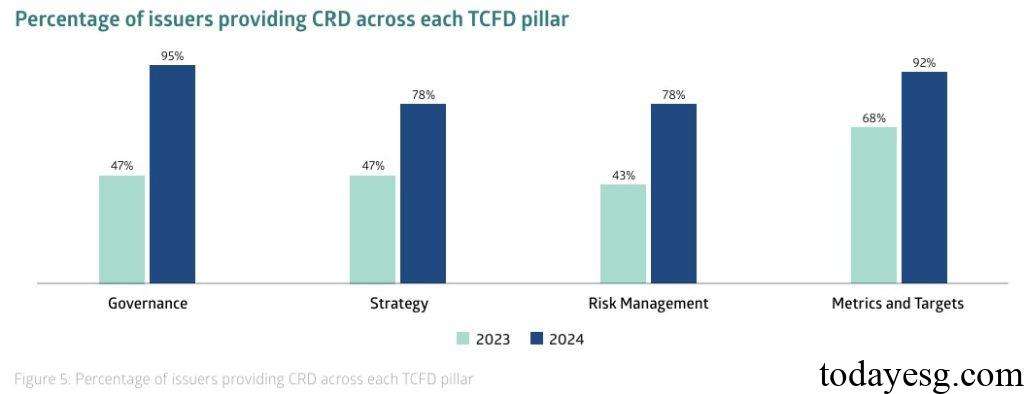

Climate Disclosure Performance Based on TCFD

The Singapore Exchange investigates the disclosure of information by listed companies regarding governance, strategy, risk management, and metrics and targets. The proportion of information disclosure for the four pillars in 2024 is 95%, 78%, 78%, and 92% respectively, all of which have made progress compared to 2023. Governance remains the most frequently disclosed content by listed companies, with 94% disclosing the board’s oversight of climate issues and 88% disclosing the role of management in assessing and managing climate issues.

In terms of strategy, 53% of listed companies disclose climate issues over different time frames, 77% disclose the impact of climate issues on business and finance, and 35% conduct climate scenario analysis. In terms of risk management, 69% of listed companies have disclosed processes for identifying and assessing climate related risks, 72% have disclosed climate risk management processes, and 48% have incorporated climate risks into their company’s risk management framework. In terms of metrics and targets, 91% of listed companies have disclosed climate indicators, of which 88% have disclosed greenhouse gas emission data. Scope 1, Scope 2, and Scope 3 account for 80%, 87%, and 29%, respectively.

Climate Disclosure Recommendations for Listed Companies

Based on the above data, the Singapore Exchange provides climate disclosure recommendations for listed companies based on TCFD four pillars:

- Governance: Increase disclosure of board climate responsibility, such as specifying the frequency of board climate related meetings. At the same time, listed companies can clarify the organizational structure of their management in climate matters and regularly evaluate, review, and update climate information on a timely basis.

- Strategy: Provide more detailed short-term, medium-term, and long-term time frames, and improve climate scenario analysis based on this to provide stakeholders with more information. Listed companies can also disclose how climate issues affect their strategy.

- Risk management: Provide more detailed information on identifying, assessing, and managing climate risks, adjust risk management processes based on risk characteristics, and incorporate climate risks into the overall risk management framework.

- Metrics and targets: Strengthen Scope 3 information disclosure, collect data on carbon prices, compensation indicators, etc., to develop more comprehensive climate related transition plans.

Reference: