2025 Corporate Sustainability Survey Report

Morgan Stanley Institute for Sustainable Investing releases its 2025 Corporate Sustainability Survey, aimed at measuring companies’ attitudes towards sustainability strategies.

Morgan Stanley surveys sustainability decision-makers from over 300 listed companies and private companies worldwide, each with an annual revenue exceeding $100 million.

Related Post: Morgan Stanley Releases 2025 Individual Investor Sustainable Investment Report

Corporate Sustainability Strategy

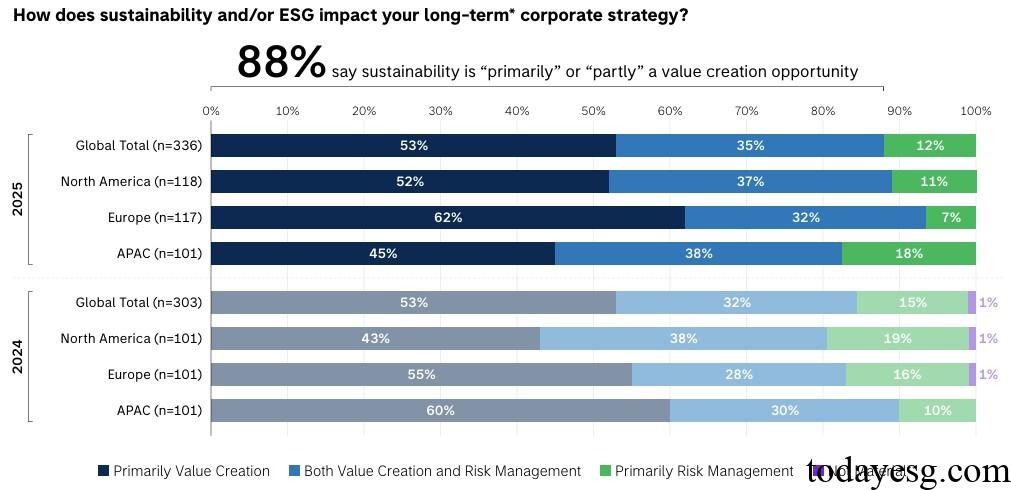

88% of companies view sustainable development as an opportunity for value creation, an increase of 3 percentage points compared to 2024. North American and European companies increased by 9 and 10 percentage points respectively, while Asian companies decreased by 8 percentage points. Currently, 18% of companies in Asia consider sustainable development as risk management, an increase of 10 percentage points compared to last year. Different industries have different attitudes towards sustainable development. Public utilities (78% in 2025, 58% in 2024), consumer industries (68% in 2025, 59% in 2024), and real estate industries (59% in 2025, 45% in 2024) view sustainable development as an opportunity for value creation.

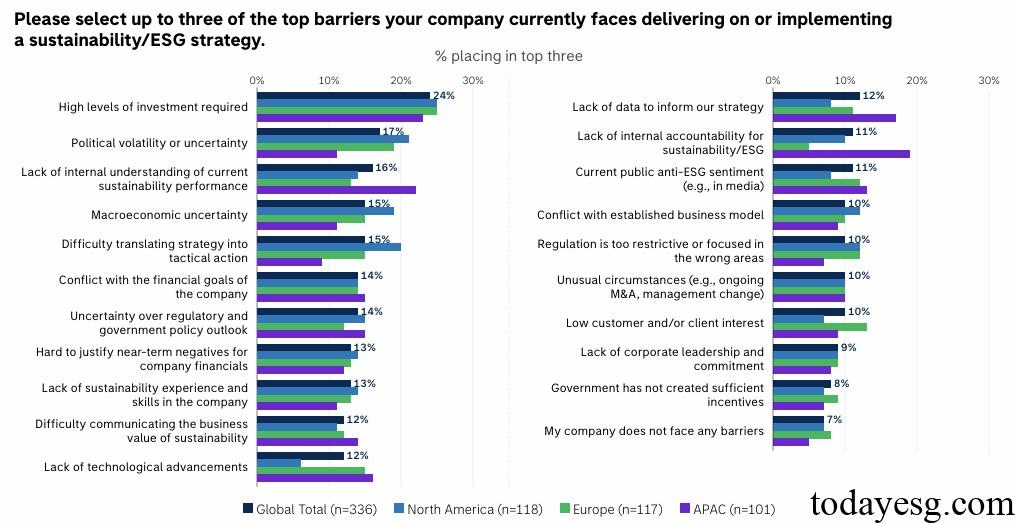

In terms of sustainable strategic progress, 65% of companies believe they have reached or exceeded expected levels, up from 59% in 2024. The proportions of North America, Europe, and Asia Pacific regions are 65%, 69%, and 60%, respectively. On the biggest challenges faced in implementing sustainable strategies, investment, uncertainty, and sustainable performance accounts for 24%, 17%, and 16%, respectively. 83% of companies believe that the return on sustainable investment can be measured in a similar way to non-sustainable projects.

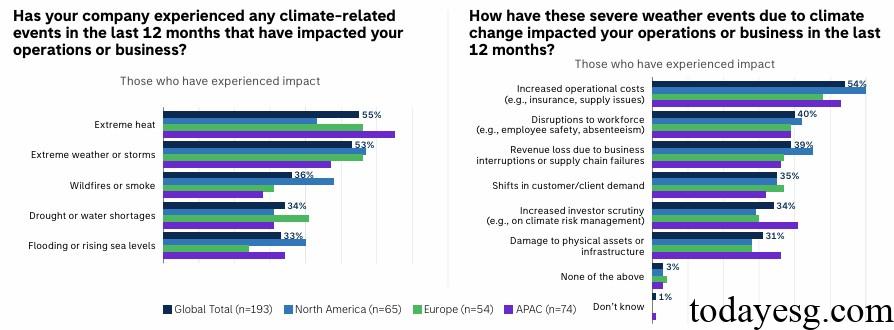

57% of companies have been affected by climate events in the past year, with high proportions of extreme heat (55%), extreme weather (53%), and wildfires (36%). The main causes of these impacts include increasing operating costs (54%), interrupting business (40%), and revenue loss (39%). More than 75% of companies believe that climate risks will continue to increase operating costs and require more climate related investments in the next five years, and one-third of companies say they are prepared for climate risk events.

Corporate Sustainability Future Development

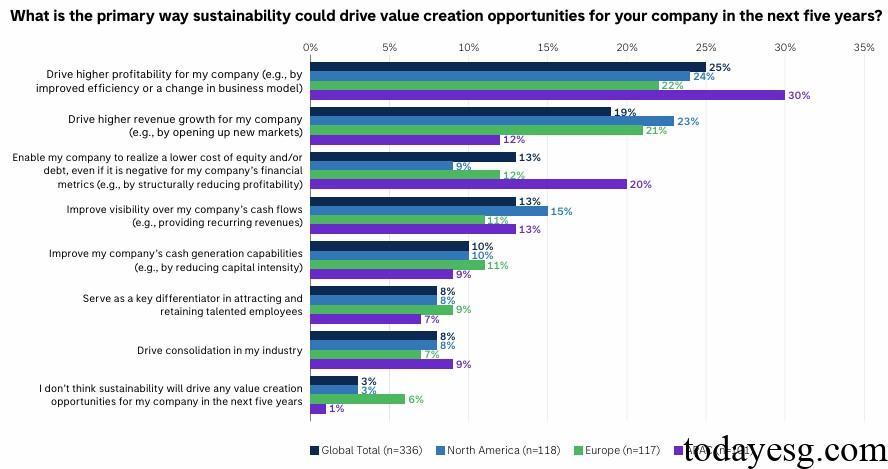

In the next five years, the companies surveyed believe that sustainable development will improve profitability (25%), increase business revenue (19%), and reduce financing costs (13%). Meanwhile, the challenges brought by sustainable development include changing existing processes (19%), increasing regulatory risks (15%), and rebuilding supply chains (13%). In terms of industry, the consumer industry, real estate industry, and industry believe that sustainability will bring more opportunities, while the communication industry and information technology industry believe that it will bring more costs.

In terms of key factors for sustainable development in the future, technological progress, economic environment, and market demand account for a relatively high proportion, reaching 33%, 32%, and 28% respectively.

Reference:

Sustainable Signals: Corporates 2025

ESG Advertisements Contact:todayesg@gmail.com