2025 Q2 Global Sustainable Fund Report

Morningstar releases 2025 Q2 Global Sustainable Fund Report, aimed at summarizing the development of global sustainable funds.

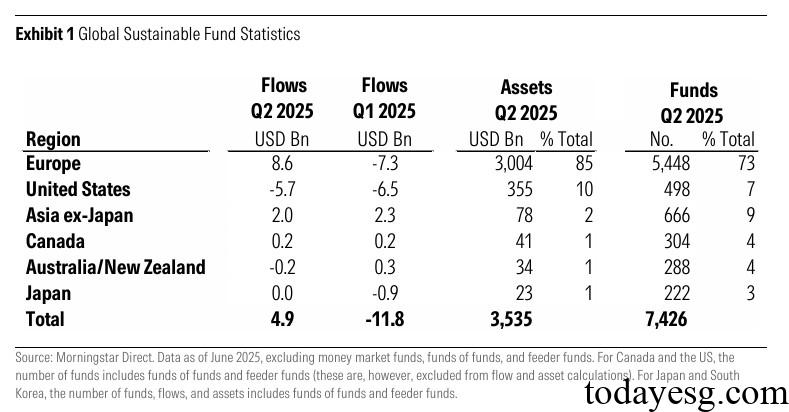

In the second quarter of 2025, the Global Sustainable Fund recorded a net inflow of $4.9 billion, reversing the trend of $11.8 billion outflow in the previous quarter.

Related Post: Morningstar Releases 2025 Q1 Global Sustainable Fund Report

Global Sustainable Fund Development

The total size of global sustainable funds in the second quarter of 2025 is $3.54 trillion, an increase of nearly 10% compared to the first quarter ($3.2 trillion). The reason for the growth is the rise in the stock and bond markets, such as the Morningstar Global Market Index growing by 11.5% and the Morningstar Global Core Bond Index growing by 4.3%. Europe accounts for 85% of the total size of the global sustainability fund, while the United States accounts for 10%.

In the second quarter of 2025, the global sustainable fund had a net inflow of 4.9 billion US dollars, including a net inflow of 8.6 billion US dollars in the European market, a net outflow of 5.7 billion US dollars in the US market, and a net inflow of 2 billion US dollars in the Asian market. In the second quarter, a total of 72 sustainable funds were issued globally, with over 40 issued in the Asian region.

European Sustainable Fund Development

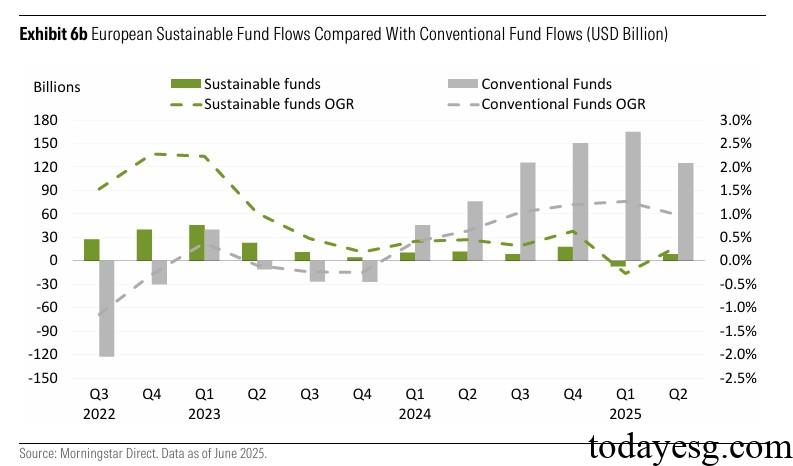

The net inflow of the European Sustainable Fund in the second quarter of 2025 was $8.6 billion, compared to a net outflow of $7.3 billion in the previous quarter. The net inflow of actively managed funds was $4.1 billion, while the net inflow of passive strategy funds was $4.5 billion. The net inflow of non-sustainable funds in Europe was $125 billion, lower than the previous quarter’s $165 billion. From the perspective of sustainable fund categories, fixed income funds recorded a net inflow of $10.1 billion, significantly higher than other categories. The stock fund recorded the highest net outflow ($2.4 billion).

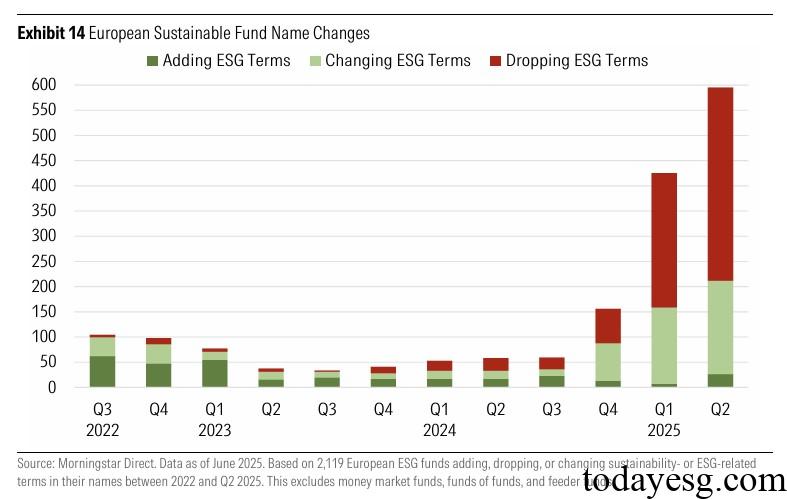

The total size of the European Sustainable Fund has reached $3 trillion, an increase of 10% compared to the first quarter ($2.7 trillion). Stock funds and fixed income funds account for 63% and 24% of the total scale, respectively. This quarter, a total of 25 sustainable funds were issued, the lowest number since 2022, and 100 funds were closed, possibly due to regulatory tightening of naming rules for sustainable funds. This quarter, 600 sustainable funds changed their names, with over half abandoning ESG terminology, setting a record in these years.

United States Sustainable Fund Development

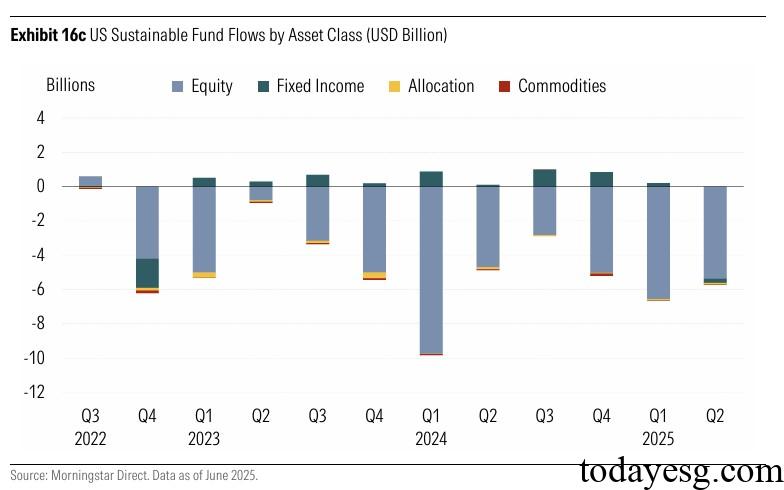

In the second quarter of 2025, the net outflow of sustainable funds in the United States was $5.7 billion, marking the eleventh consecutive quarter of fund outflow. The net outflow in the previous quarter was $6.5 billion. The net outflow of actively managed funds was $5.3 billion, and the net outflow of passive strategy funds was $400 million, both of which decreased compared to the previous quarter. The net outflow of sustainable fixed income funds was $200 million, marking the first recorded outflow in nearly two years, while the net outflow of sustainable stock funds was $5.4 billion.

Despite the outflow of funds, the total assets of sustainable funds in the United States increased to $355 billion this quarter, due to growth in the stock and bond markets. Stock funds and fixed income funds account for 82% and 16% of the total scale, respectively. This quarter, a total of 5 sustainable funds were issued in the United States, and 19 sustainable funds were closed.

Reference: