IFRS Voluntary Application Guide for Enterprises

IFRS releases voluntary application guide of ISSB standards for companies, aimed at helping them communicate sustainability related financial information with stakeholders when applying IFRS S1 and IFRS S2.

IFRS encourages companies to apply IFRS S1 and IFRS S2 to disclose sustainability related risks and opportunities in order to meet the requirements of investors, financial institutions, and regulators. The voluntary application guide is not part of the IFRS standards, nor will it add or modify the contents of IFRS S1 and IFRS S2. Its legal effect is also lower than the regulations by jurisdictions.

Related Post: ISSB Releases IFRS Sustainability Disclosure Taxonomy

Reporting that Complies with ISSB Standards

IFRS considers that a company can only declare compliance with ISSB standards if it meets all the requirements of IFRS S1 and IFRS S2. There are differences in information disclosure data and processes among different enterprises, so it may be necessary to meet ISSB standards in stages. Enterprises can explain the extent to which they apply ISSB standards in sustainable information disclosure in order to improve transparency in reporting.

The ISSB standard provides some transition reliefs to reduce the reporting. These reliefs include:

- Climate first reporting: IFRS S1 requires companies to disclose climate related risks and opportunities only in the first annual reporting period.

- Timing of reporting: IFRS S1 allows companies to disclose sustainability related financial statements after the release of financial statements in the first annual reporting period, and subsequently requires simultaneous disclosure.

- Comparative disclosures: Companies may not be required to disclose comparative information during the first annual reporting period of applying IFRS S1 and IFRS S2.

- Greenhouse Gas Protocol: IFRS S2 allows companies to use Greenhouse Gas Protocol systems for measuring carbon emissions in the first annual reporting period.

- Scope 3 GHG emissions: Companies are not required to disclose Scope 3 carbon emissions data in the first annual reporting period.

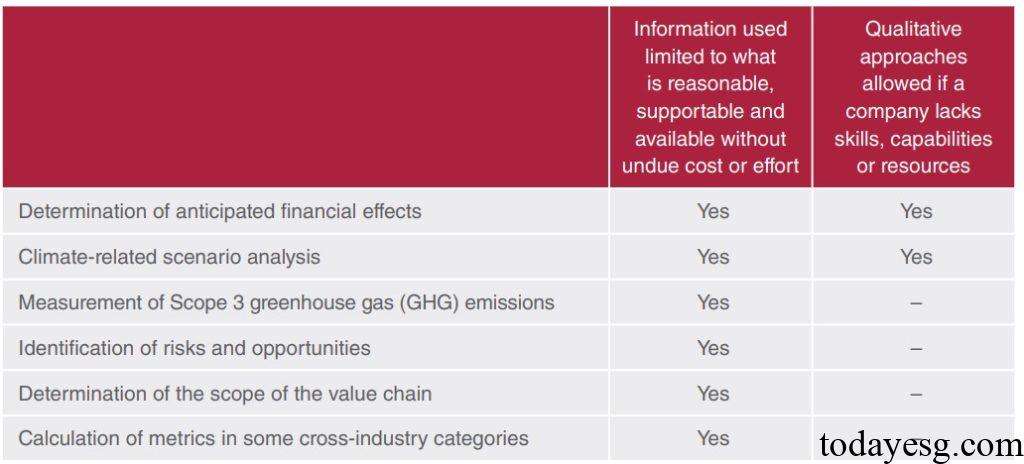

In addition to the transition reliefs, ISSB has also introduced a proportional mechanism, which allows companies to use qualitative methods instead of quantitative methods in some disclosures. This mechanism is always available to assist companies that are subject to skill, ability, and voluntary limitations. Enterprises can still demonstrate compliance with ISSB guidelines when applying the proportional mechanism. However, the proportional mechanism is only applicable to information disclosure in certain scenarios and may not be applicable for all indicators.

Differences between ISSB Standards and Sustainable Disclosure Framework

Prior to the release of the ISSB standards, some companies already use sustainable disclosure frameworks to disclose information. These sustainable disclosure frameworks include TCFD recommendations, SASB standards, and CDSB frameworks. If the enterprise already adopts these frameworks, it has made some progress in complying with ISSB standards, but it still needs to evaluate the differences between ISSB standards and sustainable disclosure frameworks.

IFRS S1 requires companies to use SASB standards as a source of guidance when identifying sustainability related risks and opportunities beyond climate related risks and opportunities. IFRS S2 also refers to climate related themes and indicators in SASB standards. Enterprises that conduct information disclosure based on SASB may already be prepared to disclose based on ISSB standards. In addition, IFRS S2 fully adopts the TCFD recommendations, and companies can provide additional disclosures in the TCFD report to explain the progress of IFRS S2.

In addition to SASB standards, companies can also consider some thematic disclosure frameworks, such as CDSB water resources disclosure framework and biodiversity disclosure framework. These CDSB frameworks provide environmental and social information disclosure, laying the foundation for companies to comply with IFRS S1 and IFRS S2. The ISSB standards also incorporate the concept of the IRF, and sustainability related risks and opportunities disclosed based on IFRS S1 and IFRS S2 can be included in the comprehensive report under IRF.

Reference: