Sustainable Finance Taxonomy Phase 2A

The Hong Kong Monetary Authority (HKMA) releases sustainable finance taxonomy phase 2A, aiming to expand the coverage of the original taxonomy and support the sustainable finance development in Hong Kong.

In May 2024, the Hong Kong Monetary Authority released the first phase of the Sustainable finance taxonomy, defining economic activities that contribute to green and sustainable development. In September 2025, the Hong Kong Monetary Authority released a consultation document to include more economic activities.

Related Post: Hong Kong Monetary Authority Launches Hong Kong Taxonomy for Sustainable Finance

Background of Sustainable Finance Taxonomy

Hong Kong released the Climate Action Plan 2050 in 2021, setting the goal of achieving carbon neutrality by 2050 and planning to allocate HKD 240 billion over the next 15 to 20 years for climate change mitigation and adaptation actions. The Hong Kong sustainable finance taxonomy was developed in 2022 with the aim of providing a universal standard to accelerate the flow of funds towards activities that are conducive to low-carbon transition. The taxonomy aims to:

- Guide market participants in making green and sustainable product decisions.

- Accelerate the flow of funds towards green and sustainable assets, projects, and investments.

- Enhance market confidence in sustainable statements and reduce greenwashing risks.

- Improve comparability between investment portfolios.

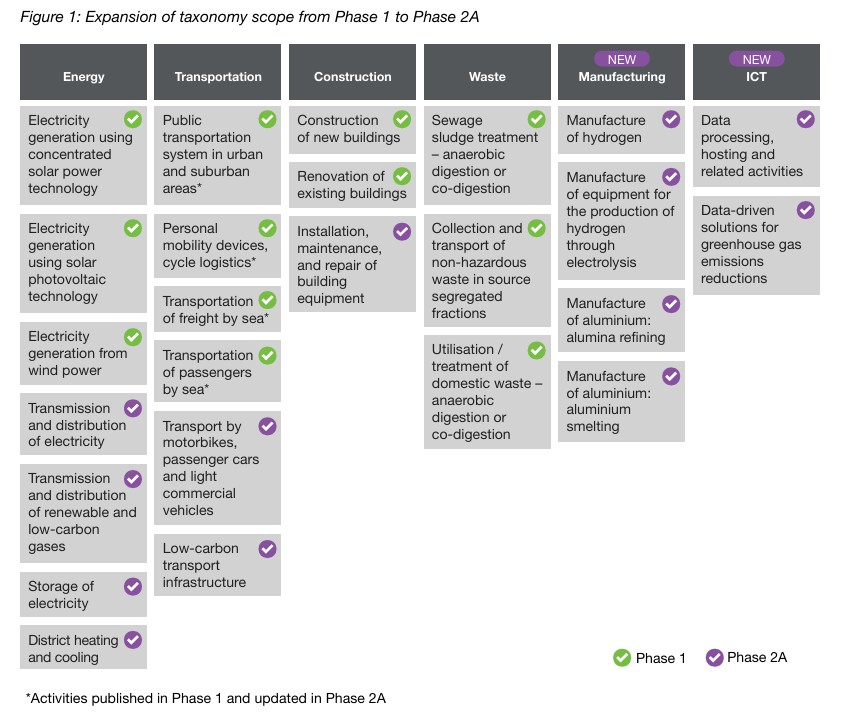

In May 2024, Hong Kong released the first phase of the sustainable finance taxonomy, which focuses on identifying and defining twelve economic activities in four areas: energy, transportation, waste management, and construction. The reason for prioritizing these four areas is that their carbon emissions account for a relatively high proportion, which is a necessary issue to address in the low-carbon transition. The first stage of the sustainable finance taxonomy system referred to the Common Ground Taxonomy published by the International Platform for Sustainable Finance, ensuring its compatibility with the taxonomy of mainland China and the European Union.

Introduction to Sustainable Finance Taxonomy Phase 2A

The sustainable finance taxonomy phase 2A has added two new areas based on four areas, namely manufacturing and information communication and technology industries. These fields belong to carbon intensive industries and have a significant impact on low-carbon transition:

- Manufacturing industry: Hydrogen production and manufacturing, electrolytic hydrogen equipment production and manufacturing, alumina refining, aluminum smelting.

- Information communication and technology industry: Data processing and hosting, greenhouse gas emission reduction data-driven solutions.

In addition, the second stage has also added some new green activities in the previous three fields, further expanding its scope of application. New green activities include:

- Energy: Power transmission and distribution, renewable energy and low-carbon gas transmission and distribution, power storage and regional heating and cooling.

- Transportation: Motorcycle, passenger car, and light commercial vehicle transportation, low-carbon transportation infrastructure.

- Architecture: Installation, maintenance, and repair of building equipment.

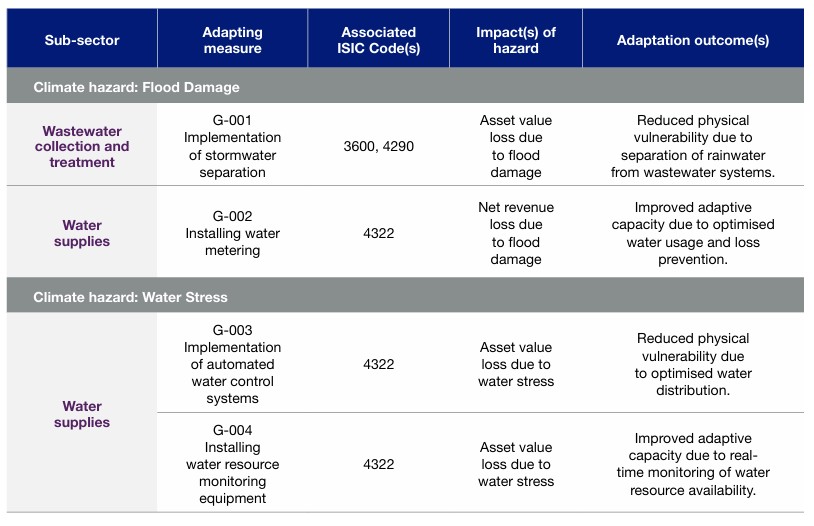

The sustainable finance taxonomy phase 2A covers stakeholders such as financial institutions, enterprises, investors, and governments, and responds to market dynamics, technological progress, and policy priorities. Compared to the focus on climate change mitigation activities in the first phase, the second phase has added a climate change adaptation framework. The taxonomy refers to the Climate Bonds Resilience Taxonomy, and plans to develop climate change adaptation measures that are tailored to the characteristics of Hong Kong in stages. In the early stages of the taxonomy, with a focus on the water resources sector, the following adaptation measures were developed:

- Flood disasters caused by climate disasters: rainwater separation, water metering installation.

- Water scarcity caused by climate disasters: automatic water control systems, water resource monitoring equipment.

Reference:

HKMA Publishes Hong Kong Taxonomy for Sustainable Finance Phase 2A