Listed Companies Climate Disclosure Report

EY releases 2025 Singapore listed companies climate disclosure report, aimed at summarizing the development of climate information disclosure in Singapore.

Singapore requires all listed companies to disclose climate information based on ISSB standards starting from fiscal year 2025, with some high carbon emitting industries already mandated to disclose climate information in fiscal year 2024.

Related Post: Singapore Exchange Releases Climate Disclosure Report for Listed Companies

Climate Disclosure Policy of Singapore Listed Companies

Starting from the 2022 fiscal year, Singapore listed companies are required to disclose in accordance with Taskforce on Climate-related Financial Disclosures (TCFD) recommendations and are allowed to use the Comply or Explain method (mandatory disclosure is required for the finance, agriculture, energy, materials, and transportation industries). In September 2024, the Singapore Exchange announced the strengthening of its sustainability reporting system, requiring all listed companies to disclose climate information based on ISSB standards starting from fiscal year 2025.

The Singapore Exchange requires listed companies to disclose in accordance with IFRS S1 and IFRS S2 issued by ISSB. The TCFD recommendations previously used by listed companies are consistent with ISSB standards in terms of core themes (governance, strategy, risk management, and metrics and targets). Starting from the 2026 fiscal year, the Singapore Exchange will release Scope 3 greenhouse gas disclosure rules, and starting from the 2027 fiscal year, listed companies’ Scope 1 and Scope 2 greenhouse gas data will require limited external assurance.

Climate Disclosure of Singapore Listed Companies

98% of listed companies disclosed climate information in the fiscal year 2024, an increase of 2 percentage points compared to the fiscal year 2023. 32% of listed companies disclosed based on 11 TCFD recommendations, an increase of 12 percentage points. The average number of TCFD recommendations mentioned by listed companies is 9, an increase of 1 compared to the same period last year. The analysis based on the core themes of TCFD is as follows:

Governance

There are two TCFD recommendations related to governance, namely the board’s oversight of climate risks and opportunities, and the role of management in assessing and managing climate risks. The disclosure of the above two recommendations by listed companies in the fiscal year 2024 accounts for 99% and 98%, and in the fiscal year 2023 it accounts for 99% and 91%. 42% of listed companies have disclosed climate risk monitoring, management, and supervision mechanisms based on ISSB standards, 55% have disclosed the skills and capabilities required for climate regulation, and 17% have disclosed the relationship between ESG performance and board and executive compensation.

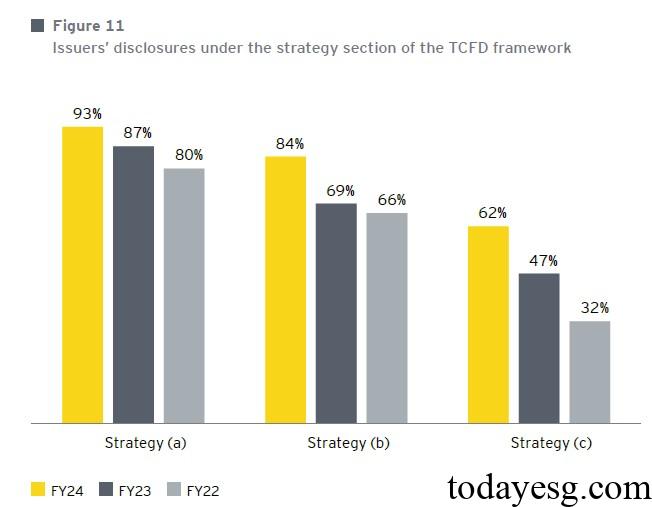

Strategy

There are three TCFD recommendations related to strategy, namely describing short-term, medium-term, and long-term climate related risks and opportunities, describing the company’s business, strategy, and planning, and describing the company’s adaptability under different climate scenarios. The disclosure of the above three recommendations by listed companies in the fiscal year 2024 accounts for 93%, 84%, and 62%, while in the fiscal year 2023 it accounts for 87%, 69%, and 47%. In terms of the financial impacts of climate change, 85% of listed companies disclosed qualitative impacts, 1% disclosed quantitative impacts, and 14% disclosed both qualitative and quantitative impacts. 47% of listed companies have disclosed their transition plans, and 36% have committed to net zero emissions.

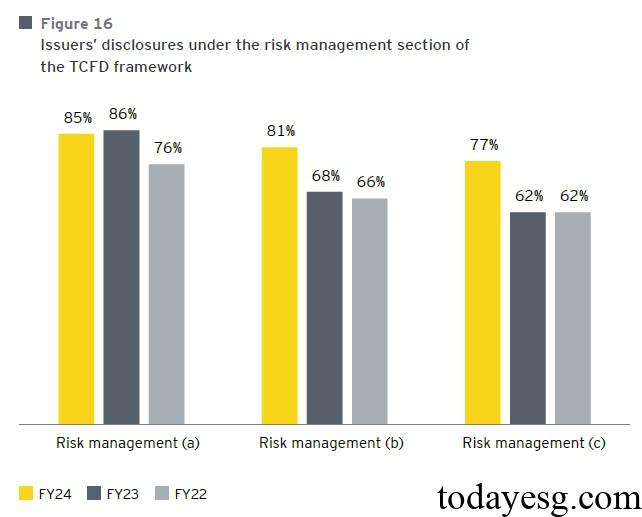

Risk Management

There are three TCFD recommendations related to risk management, namely describing the climate risk identification and assessment process, describing climate risk management, and describing how to incorporate climate risk management into the risk management system. The disclosure of the above three recommendations by listed companies in the fiscal year 2024 accounts for 85%, 81%, and 77%, while in the fiscal year 2023 it accounts for 86%, 68%, and 62%.

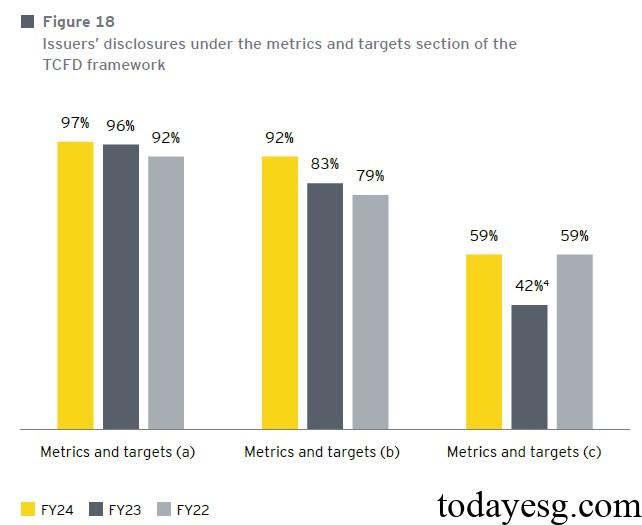

Metrics and Targets

There are three TCFD recommendations related to metrics and targets, namely describing climate risk assessment metrics, disclosing Scope 1, Scope 2, and Scope 3 greenhouse gas emissions, and describing climate risk management targets. The disclosure of the above three recommendations by listed companies in the fiscal year 2024 accounts for 97%, 92%, and 59%, respectively, while in the fiscal year 2023 it accounts for 96%, 83%, and 42%. In terms of greenhouse gas emissions, Scope 1, Scope 2, and Scope 3 disclose proportions of 93%, 96%, and 45%, respectively. In terms of greenhouse gas emission targets, Scope 1, Scope 2, and Scope 3 targets account for 50%, 56%, and 16%, respectively.

Reference:

Transparency in Focus: State of Climate Reporting in Singapore