ESG Financial Markets Report

Association for Financial Markets in Europe (AFME) releases 2025 Q1 ESG Financial Markets Report, aimed at summarizing the performance of European ESG bonds, funds, and other financial products.

In 2025 Q1, the European Union released a proposal to simplify ESG regulatory policies, aiming to reduce the burden of corporate ESG information disclosure and promote the development of sustainable financial markets.

Related Post: European Commission Released a Proposal to Simplify Multiple Sustainable Regulations

ESG Bonds and ESG Loans in Europe

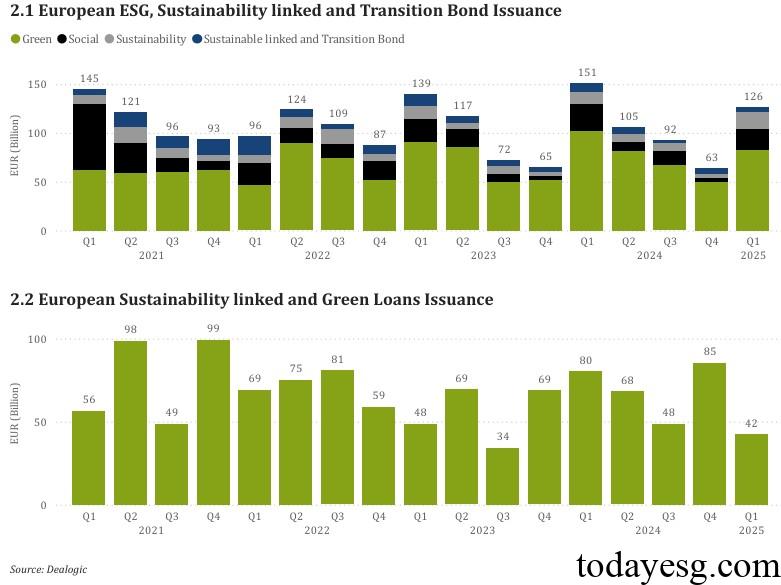

The issuance scale of European ESG bonds (including green bonds, social bonds, sustainable bonds, and sustainability linked bonds) in the first quarter of 2025 was 126 billion euros, a year-on-year decrease of 17%. The issuance scale of ESG loans (including sustainable linked loans and green loans) was 42 billion euros, a year-on-year decrease of 47%. However, in the first quarter of 2025, the scale of EU green bond issuance still ranks first in the world, followed by the Asia Pacific region and the Americas region.

The existing scale of ESG bonds in the EU in 2025 remains basically the same as in 2024, mainly due to the similarity in scale between the newly issued ESG bonds and the ESG bonds due in this quarter. More than 90% of existing ESG bonds are investment grade bonds, over half are corporate bonds, and many bonds have a maturity of less than five years and more than ten years (60%).

Carbon Pricing, Emissions and Trading in Europe

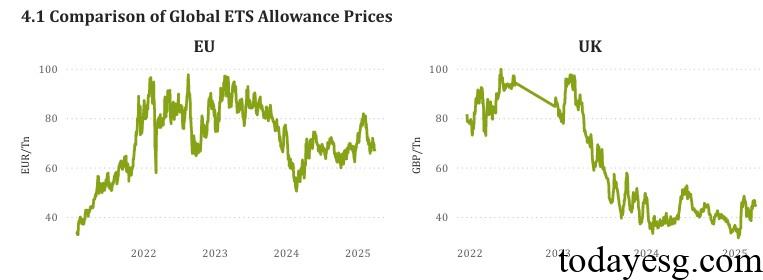

In the first quarter of 2025, EU carbon prices and UK carbon prices increased by 11% and 14% respectively, but their long-term trends are different.

The EU carbon price has continued to rise since reaching a phase low in 2024, peaking at 82 euros per ton in January before falling back to 67 euros per ton at the end of this quarter. The UK carbon price has continued to decline since reaching a peak of nearly 100 pounds per ton in 2023, reaching a low of 31 pounds per ton in January and currently recovering to 45 pounds per ton. Based on forward futures contracts, carbon prices in the EU and the UK may continue to rise in the next two years.

The EU Emissions Trading System is the world’s second-largest carbon trading market, accounting for 2.6% of global greenhouse gas emissions. The first place is China’s carbon emissions trading system, accounting for 9.3% of the total emissions. Currently, all carbon emission trading systems worldwide cover 24% of global greenhouse gas emissions. In Europe and the UK, the number of quotas in the carbon emissions trading system has been decreasing year by year since 2013, and the amount of carbon dioxide emissions involved decreases year by year.

ESG Funds in Europe

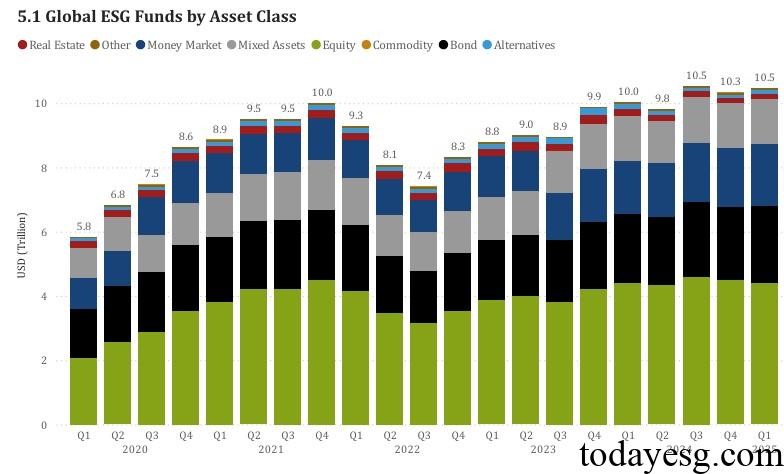

The total size of global ESG funds in the first quarter of 2025 was $10.5 trillion, a year-on-year increase of 4%, mainly due to the increase in money market and bond market. The total size of European ESG funds exceeds $4 trillion, accounting for over 40% of the global total. The total size of ESG funds denominated in EUR exceeds $4.5 trillion, followed by USD (over $3 trillion). The global ESG fund inflow in the first quarter of 2025 was $80 billion, mainly from the European market.

Reference: