Retirement Plan Sustainable Investment Survey

The Morgan Stanley Institute for Sustainable Investing releases retirement plan sustainable investment survey, aimed at analyzing the attitudes of companies and individuals towards sustainable investment in retirement plans.

This survey includes 99 companies and 390 individuals from 11 industries based on the Global Industry Classification Standard (GICS).

Related Post: Morgan Stanley Releases 2025 Individual Investor Sustainable Investment Report

Retirement Plan Sustainable Investment Situations

Personal Survey

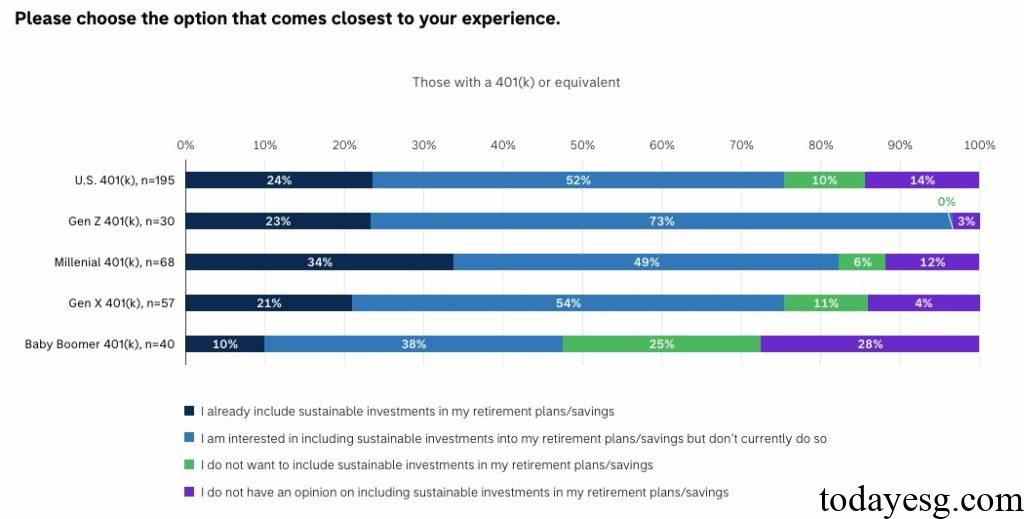

25% of individuals have already incorporated sustainable investments into their retirement plans, while the remaining 50% are interested in incorporating sustainable investments into their retirement plans in the future. This trend is most evident among the younger generations of Generation Z and Millennials (23% and 34%) and is relatively low among the elderly population of Generation X and Baby Boomers (21% and 10%). This indicates that sustainable investment is more widely accepted among young people. In terms of the reasons for choosing sustainable investments, financial return (41%) is the most important factor, followed by alignment with personal values and reducing the ESG risk of the investment portfolio.

Company Survey

83% of companies have provided sustainable investment products in their employee retirement plans, with 32% offering a wide range of choices and 51% offering limited options. 22% of individual respondents believe that the company does not provide sustainable investment products, and 42% are not aware of the product information provided by the company. 62% of companies believe that the demand for sustainable investment from employees is not widespread or low. This indicates a significant information asymmetry between the company and its employees, with employees generally believing that the company does not provide sustainable investment options and that employees are not interested in sustainable investment products.

Sustainable Investment Challenges for Retirement Plan

Individual respondents believe that greenwashing risk, data transparency, and investment performance are important challenges for sustainable investment. This viewpoint is like the findings of Morgan Stanley’s 2025 Individual Investor Sustainable Investment Survey. Company respondents believe that employee needs, departmental mastery of sustainable knowledge, and investment performance are important challenges for sustainable investment. The key to addressing these challenges lies in the need for companies and individuals to communicate sustainable investment information and improve communication efficiency.

From the analysis of retirement plan types, holders of 401 (K) have less understanding of the sustainable characteristics of their investment portfolio. 55% of 401 (K) retirement plan holders are unaware of how much of their savings are being used for sustainable investments, especially among the elderly population (75% baby boomer and 67% Gen X). This proportion is also higher than that of non-retirement plan holders, according to the 2025 Sustainable Investment Survey, 32% of investors are not familiar with it.

Reference: