2025 Corporate Climate and Nature Progress

CDP releases report on 2025 Corporate Climate and Nature Progress, aimed at assessing global companies’ disclosure, goal setting, governance, strategy, and progress in the climate and nature sector.

CDP believes that climate and nature actions are closely related to global environmental and economic development. If climate action is not taken, global GDP may decrease by $38 trillion by 2050. Currently, 25000 companies worldwide have disclosed information through CDP, accounting for 67% of the total global enterprise market value.

Related Post: World Economic Forum Releases Global Climate and Nature Cooperation Report

Corporate Climate and Natural Progress in 2025

CDP has drawn the following conclusions based on corporate climate and natural information disclosure:

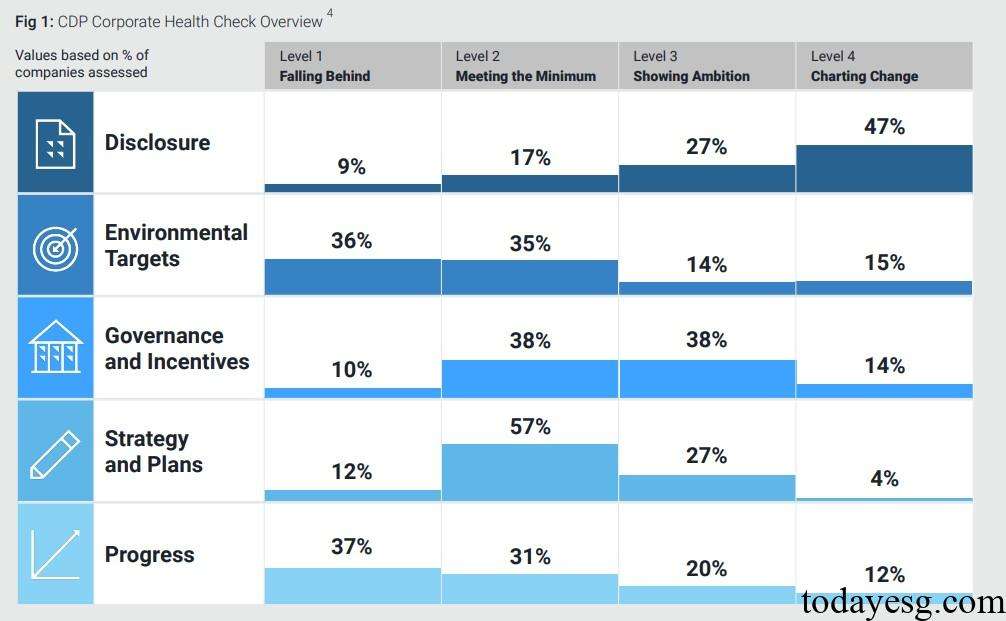

Climate and nature targets are relatively weak: 49% of companies only meet the minimum standards in terms of climate and nature indicators, and only 10% of companies demonstrate strong climate and nature targets. In five different dimensions, companies perform better in governance and disclosure, but weaker in actual progress and goal setting. CDP believes that companies need to prioritize climate and nature issues in the future and prepare for increasingly stringent regulatory policies.

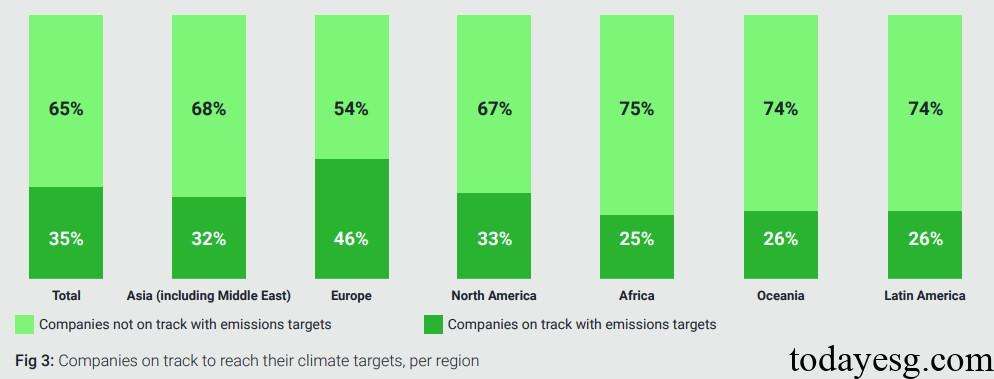

One third of companies can achieve their carbon reduction targets: 35% of global companies are able to achieve their carbon reduction targets, with Europe (46%), North America (33%), and Asia (32%) ranking high. Despite the increasing global carbon emissions year by year, companies that have consistently disclosed information since 2016 have reduced Scope 1 by 2% annually. However, reducing Scope 2 and Scope 3 carbon emissions is still a necessary action to achieve the 1.5-degree Celsius warming target. To achieve the 2030 carbon emissions target, companies need to reduce their carbon emissions by 7% annually, and to achieve the 2050 target, companies need to reduce their carbon emissions by 3% annually.

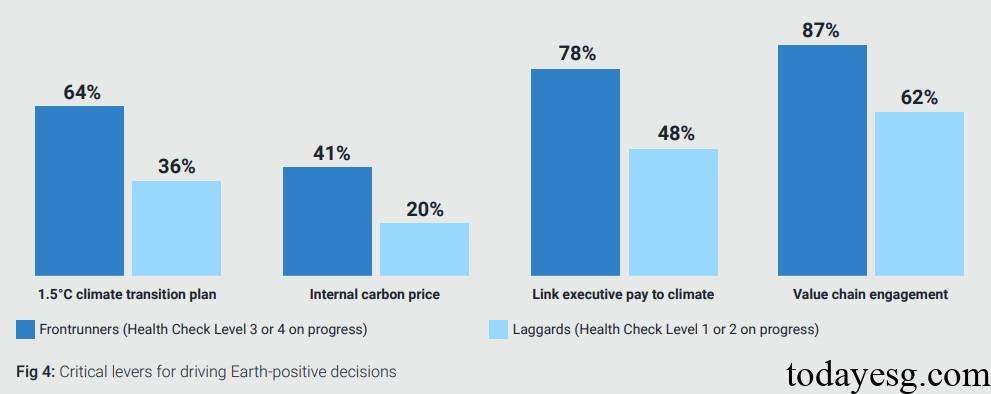

Incorporating climate and nature issues into the board of directors can achieve positive results: CDP compares leading and lagging companies in the climate and nature field and finds that developing transition plans, setting internal carbon prices, linking executive compensation to climate goals, and engaging in the value chain can help companies. These data indicate that incorporating sustainability into corporate governance and placing it under the responsibility of the board of directors has a positive impact on the climate and natural development of businesses.

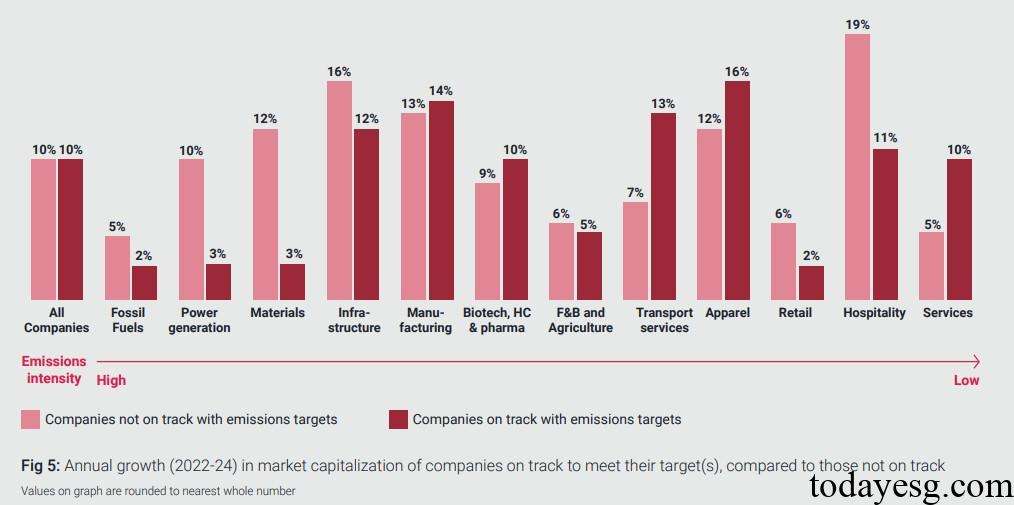

Enterprises can balance sustainable development and financial performance: Some companies believe that green transition may have a negative impact on profits, but CDP finds that companies that have made progress towards climate goals have similar average market value growth rates to those that have not, both at 10% per year. However, there are differences in the growth rates of the two types of enterprises in different industries. CDP believes that the global green market size will grow from $5 trillion in 2024 to $14 trillion in 2030, allowing businesses to achieve greater financial returns through sustainable business models.

Reference: