Green and Sustainable Fintech Proof of Concept Funding Support Scheme

The Financial Services and Treasury Bureau of Hong Kong launches the Green and Sustainable Fintech Proof of Concept Funding Support Scheme, aimed at providing funding to companies offering practical green and sustainable fintech solutions.

Hong Kong has planned to launch the Green and Sustainable Fintech Proof of Concept Funding Support Scheme in the first half of this year in the green future plans of the 2024-25 fiscal budget report, promoting the development of green financial technology enterprises and helping Hong Kong achieve green transition.

Related Post: Hong Kong Releases 2024 Green Future Plan

Introduction to Green and Sustainable Fintech Proof of Concept Funding Support Scheme

The Green and Sustainable Fintech Proof of Concept Funding Support Scheme will involve five aspects of green financial technology research and application, including:

- Green & Digital Finance and Investment: assist financial institutions in providing green and sustainable financial products. For example, green tokenized bonds, green derivatives, green investment funds, green credit scoring algorithms, green financial planning, and digital savings solutions linked to green behavior.

- ESG Disclosure, Compliance & Regulatory Reporting: help enterprises and financial institutions complete ESG information disclosure and helps regulatory agencies monitor whether these reports meet requirements. For example, climate information disclosure and compliance of listed companies, regulatory technology, and supplier reporting.

- Carbon Trading, Analytics and Technology: support the development and trading of carbon products, and assists businesses and financial institutions in collecting and analyzing carbon emission data. For example, carbon credit trading, carbon registry and trading infrastructure, carbon accounting, and carbon emission tracking.

- ESG Data, Intelligence and Analytics: provide ESG data analysis, ratings, and indices. For example, ESG data collection and aggregation, enterprise ESG rating, and green index.

- ESG / Climate Risk Modeling & Assessment: promote ESG and climate related risk assessment and management. For example, bank climate modelling, scenario analysis and stress testing, portfolio climate modeling and analysis.

Qualified green and sustainable fintech projects must be directly related to the aforementioned aspects, solve practical problems, and currently have no similar use cases in the market, while demonstrating strong commercial potential. Some basic research related to this field or experimental designs that do not have practical value do not meet the application requirements.

The applicant needs to register a company in Hong Kong and have a three-month business operation experience, as well as acting like a practitioner in green and financial technology related activities. The applicant must have a qualified project sponsor, including financial institutions, listed companies, etc. These sponsors may not directly invest in the project, but must demonstrate active participation and commitment, and must sign a written agreement with the applicant.

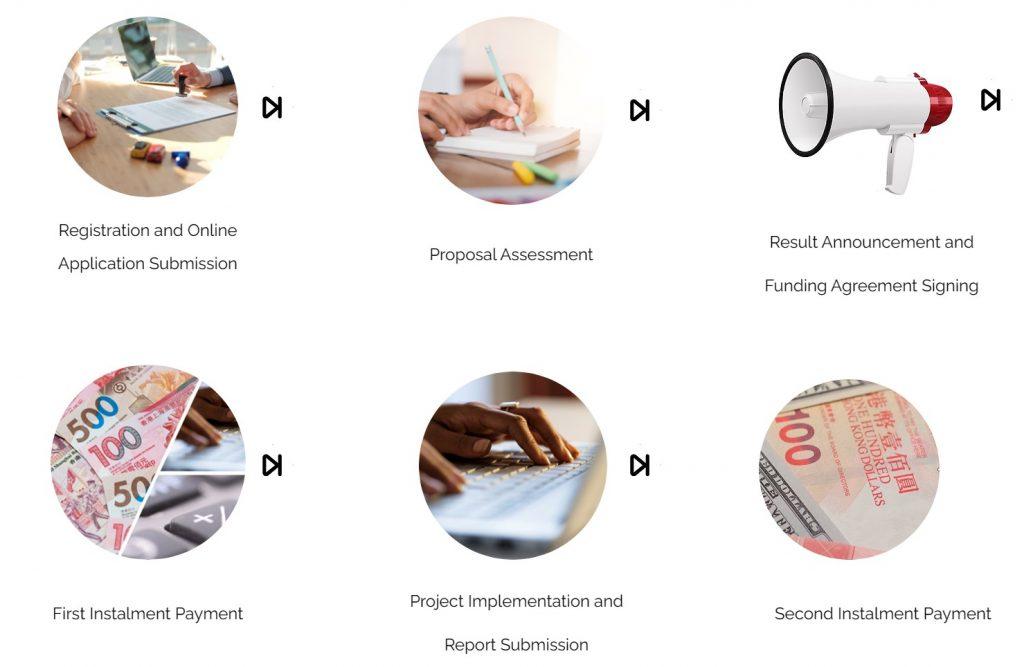

After meeting the above requirements, applicants can submit documents to Hong Kong Cyberport to participate. The selection criteria include the impact, innovation, commercial potential, functionality, and reasonableness of details of the project. Successful project will receive a maximum funding of HKD 150000, with the first funding to be disbursed after the project is approved, and the second funding to be disbursed one month after the project is completed and all information is submitted. Applicants can submit up to five projects for selection, each of which will be independently evaluated and receive separate funding after successful approval. There is no limited number restrictions for qualified sponsors.

The application period for the Green and Sustainable Fintech Proof of Concept Funding Support Scheme is from June 28, 2024 to September 20, 2024. Applicants can browse information, download the registration form, and submit their application on the Cyberport’s website. After receiving the documents, Cyberport may need about six weeks to decide whether the application is successful.

Reference: