2025 Institutional Investors Sustainable Investment Report

The Morgan Stanley Institute for Sustainable Investing releases 2025 Institutional Investors Sustainable Investment Report, which aims to summarize the sustainable investment perspectives of asset owners and asset managers.

Morgan Stanley surveys over 900 global institutional investors, with North America, Europe, and Asia Pacific accounting for one-third each. Asset owners account for two-thirds and asset managers account for one-third.

Related Post: Morgan Stanley Releases 2025 Individual Investor Sustainable Investment Report

Institutional Investors Sustainable Investment

In terms of the duration of sustainable investment, 94% of respondents have implemented it for at least one year, and over half of respondents have implemented it for more than five years. For asset owners with a management scale of $50 billion, over two-thirds have implemented it for more than five years. 86% of asset managers and 79% of asset owners plan to increase their sustainable asset size within the next two years, which is 6 percentage points and 1 percentage point higher than in 2024, respectively.

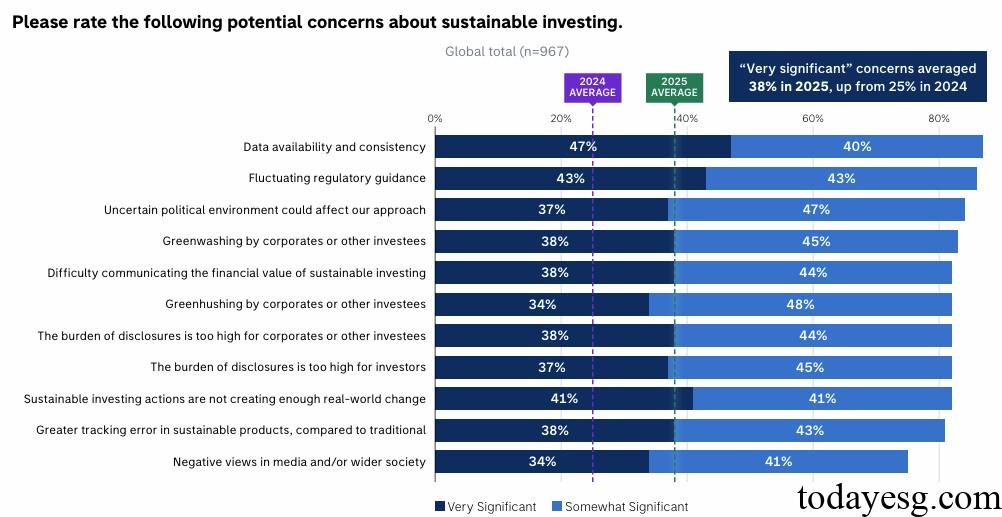

The reasons for asset owners and asset managers increasing the scale of sustainable assets are different. Asset owners are concerned about the financial performance (22%), track record (18%), and sustainable opportunities (14%) of sustainable investments. Asset managers focus on customer needs (42%) and the custody requirements of asset owners for sustainable assets (39%). Institutional investors believe that the challenges of sustainable investment include data availability and consistency (87%), regulatory policy changes (86%), and uncertain external environments (84%). Investors’ attention to these issues in 2025 (38%) is higher than last year’s (25%).

The relationship between asset owners and asset managers is closely related to sustainable investment, with 88% of asset managers believing that sustainable investment is a key differentiating factor in acquiring customers. 90% of asset owners consider sustainable investment an important factor when choosing asset managers and require them to have sustainable investment policies. 78% of asset managers and 74% of asset owners believe that sustainable investing can reduce portfolio risk.

Institutional Investors Sustainable Investment in Regions

Morgan Stanley has studied the sustainable investment situation of institutional investors in North America, Europe, and the Asia Pacific region:

- North America: 90% of asset owners and 85% of asset managers plan to continue increasing sustainable investments. Focus on renewable energy (30%), energy efficiency (30%), and inclusiveness (25%).

- Europe: 82% of asset owners and 80% of asset managers plan to continue increasing sustainable investments. Focus on energy efficiency (28%), renewable energy (27%), and climate change adaptation (24%).

- Asia Pacific: 85% of asset owners and 72% of asset managers plan to continue increasing sustainable investments. Focus on renewable energy (31%), energy efficiency (26%), and climate change adaptation (26%).

Reference:

Morgan Stanley Sustainable Signals Institutional Investors 2025