Voluntary Biodiversity Credit Position Paper

The World Wildlife Fund (WWF) releases a position paper on voluntary biodiversity credits, aimed at summarizing the development of the global voluntary biodiversity credit market.

The voluntary biodiversity credit comes from Goal 19 under Global Biodiversity Framework proposed by COP15, which can play an important role in biodiversity conservation in appropriate environments.

Related Post: World Economic Forum Releases Biodiversity Credits Report

What is Voluntary Biodiversity Credit

Biodiversity credit is an important tool to address the funding gap for biodiversity, with a global funding gap of $700 billion annually. The Global Biodiversity Framework recommends that signatories raise at least $200 billion annually through innovative initiatives such as ecosystem service payments, green bonds, biodiversity offsets, biodiversity credits, and benefit sharing mechanisms. The World Economic Forum believes that the global demand for voluntary biodiversity credits will reach $2 billion by 2030 and $69 billion by 2050.

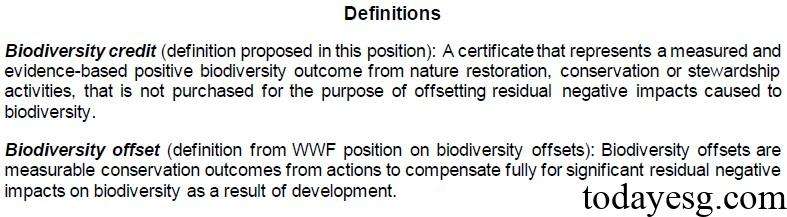

Although the market is optimistic about the prospects of voluntary biodiversity credits, there is currently no consensus on the definition and application of voluntary biodiversity credits. The World Wildlife Fund believes that some stakeholders have confused the relationship between biodiversity credits and biodiversity offsets, which have existed since the 1970s. The World Wildlife Fund provides definitions for biodiversity credit and biodiversity compensation:

- Biodiversity credit: a certificate representing the positive biodiversity outcomes generated by natural restoration, conservation, or management activities, whose purchase purpose is not to offset the negative impact on biodiversity.

- Biodiversity compensation: a measurable conservation outcome that fully compensates for the negative impact of development on biodiversity.

WWF Voluntary Biodiversity Credit Position

The World Wildlife Fund believes that biodiversity credit is rapidly developing, and its current position is based on two perspectives: the buyer and the project of voluntary biodiversity credit:

For voluntary biodiversity credits buyers:

- No offsets: The buyer cannot use voluntary biodiversity credits to offset negative impacts, nor can they use them as a substitute for their own mitigation actions on climate, water resources, or natural impacts.

- Buyer eligibility: The buyer is required to assess and disclose their impact, dependence, and risks on biodiversity in accordance with regulatory policies or voluntary frameworks, while adopting reliable natural transition plans and setting scientific natural goals.

- Buyer claims: The buyer needs to comply with the principles of claims that can be made at the time of purchase, and voluntary biodiversity credit needs to be traceable from the buyer to the origin of the project.

- Transaction: Due to the lack of global regulation in the biodiversity credit market, voluntary biodiversity credit products need to have a sound regulatory framework before they can be traded in the secondary market.

For voluntary biodiversity credit projects:

- Human rights based approach: The project needs to respect the rights of local residents, provide fair and just benefits, and include them in the benefit sharing mechanism.

- Biodiversity importance: The project needs to focus on the areas where biodiversity is most important, which need to comply with terms such as Key Biodiversity Areas.

- Aligning with national/sub-national biodiversity priorities: The project needs to promote biodiversity priorities, such as aligning with the National Biodiversity Strategy and Action Plan.

- Measurement: Projects must have measurable biodiversity outcomes while reducing monitoring costs.

- Additionality and durability: Projects should have additivity and durability, while using validation principles that are consistent with the project background and type.

For voluntary biodiversity credits buyers and projects:

Governance: Voluntary biodiversity credits must comply with the WWF Environmental and Social Safeguards Framework, provide open, comprehensive, and transparent information, and establish effective monitoring, reporting, and verification systems. The initiative regarding voluntary biodiversity credits needs to be consistent with the WEF High Level Governance and Integrity Principles for Voluntary Biodiversity Credits Markets.

Reference: