Global Climate Action Report

The World Trade Organization (WTO) releases a global climate action report, aimed at summarizing the current status of global climate actions and climate policy tools.

The Global Climate Action Report is jointly written by the World Trade Organization, the Organization for Economic Co operation and Development (OECD), the International Monetary Fund (IMF), the United Nations, and the World Bank.

Related Post: World Economic Forum Releases Closing Climate Action Gap Report

Current Status of Global Climate Action

To achieve the global warming target of the Paris Agreement, greenhouse gas emissions need to be reduced by 43% by 2030, 60% by 2035, and become net zero by 2050. However, the Global Stocktake shows that the current Nationally Determined Contributions (NDCs) of each country are not sufficient to achieve this goal. Under the current carbon emission path, global greenhouse gas emissions are expected to increase by 5% by 2030, reaching 52 billion tons.

The World Trade Organization believes that increasing climate financing and developing low-carbon technologies are key to achieving the global warming goals of the Paris Agreement. Global climate financing needs to expand sixfold by 2050, with most of it requiring investment in the energy sector. Emerging market economies require climate investments of $1.2 trillion to $1.7 trillion annually. To achieve this goal, countries need to consider adopting climate policy tools, incentivizing markets to achieve technological innovation, and improving energy efficiency.

Global Climate Policy Tools

There are mainly two types of global climate policy tools, namely carbon pricing tools and non carbon pricing tools. Carbon pricing tools are a direct solution to the problem of market failure in carbon emissions. They encourage the market to choose cost-effective carbon reduction technologies through the principle of polluter pays. Non carbon pricing tools supplement carbon pricing tools through market management policies, infrastructure construction, and other means to improve market efficiency. These policies need to consider factors such as fiscal impact and spillover effects.

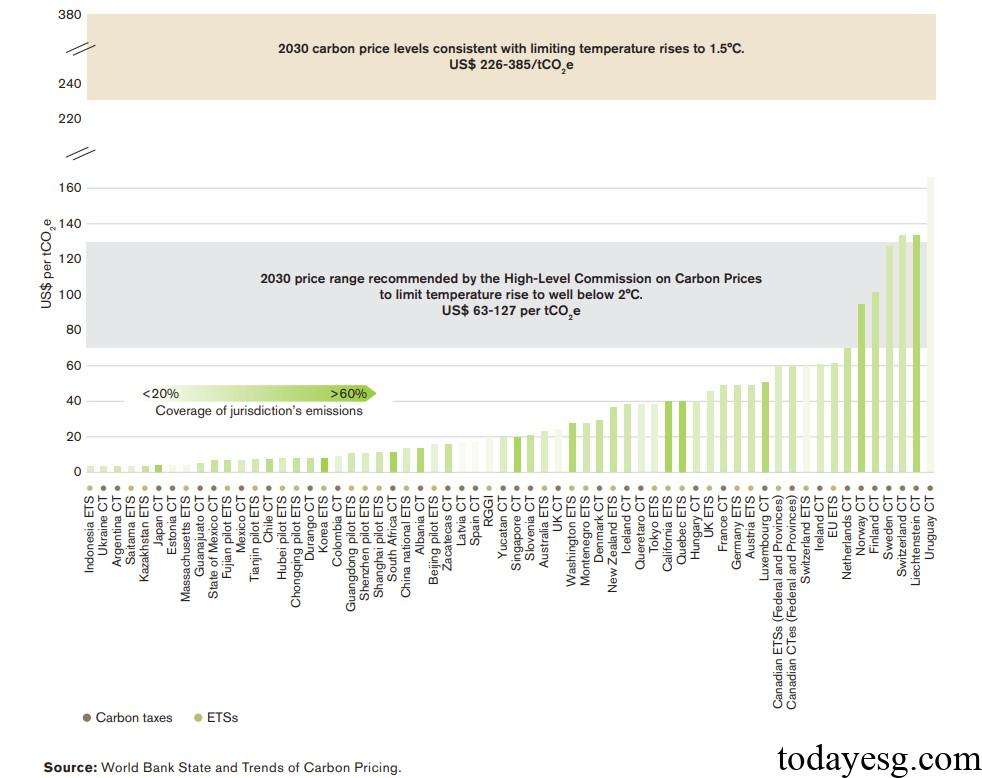

Currently, there are 75 carbon taxes and emission trading systems in operation worldwide, covering 24% of global carbon emissions, an increase of 10 percentage points compared to 2020. Most carbon pricing tools are implemented in high-income countries, while carbon pricing in middle-income countries is generally lower than in high-income countries. However, the vast majority of carbon pricing is insufficient to achieve the global warming target of the Paris Agreement, with only 1% of carbon pricing tools able to limit warming to 2 degrees Celsius, and all existing tools cannot limit warming to 1.5 degrees Celsius.

Climate Policy Spillover Effects

Climate policies can generate positive cross-border spillover effects, including reducing greenhouse gas emissions, lowering the cost of climate transition, providing climate policy experience for other countries, increasing demand for green products, and changing trade patterns. These spillover effects enable countries and companies with lower carbon emission costs to gain market share through green comparative advantages. Some low-income countries will gain technology spillovers, acquire more cash green technologies, and use them for their own low-carbon transition. Some jurisdictions are also considering the impact of climate policies on security, such as promoting diversification of renewable energy supply.

However, the spillover effects of some climate policies may lead to carbon leakage. Climate tools such as carbon pricing will increase the production costs of domestic enterprises, leading to the transfer of these productions to countries with lower carbon costs. This phenomenon is considered a negative spillover effect that may reduce the actual effectiveness of climate policies. Currently, most jurisdictions are adopting the Border Carbon Adjustment method, such as the Carbon Border Adjustment Mechanisms implemented by the European Union, to reduce the risk of carbon leakage.

Reference: