Nature Finance Taxonomy

The World Bank releases multilateral development bank nature finance taxonomy, which aims to list various activities that qualify for natural finance and help with the work of multilateral development banks.

The World Bank has released the MDB Common Principles for Tracking Nature Finance, which supports the goals of the Global Biodiversity Framework.

Related Post: World Economic Forum Releases Nature Finance Report

Background of Nature Finance Taxonomy

Natural finance refers to finance activities that contribute to curbing and reversing natural losses, and the objectives of these finance activities include:

- Restoration and protection of biodiversity or ecosystem services.

- Reduce direct drivers of biodiversity or ecosystem service loss.

- Integrate nature-based solutions across various economic sectors.

- Design and implement natural related policies and tools that can achieve the above goals.

The nature finance taxonomy method aims to provide a standardized reference list of various activities that meet the conditions of natural finance and can comply with the environmental and social risk management policies of multilateral development banks. In addition, natural finance can bring positive and inclusive social benefits, helping people who rely on biodiversity and ecosystem services.

Introduction to Nature Finance Taxonomy

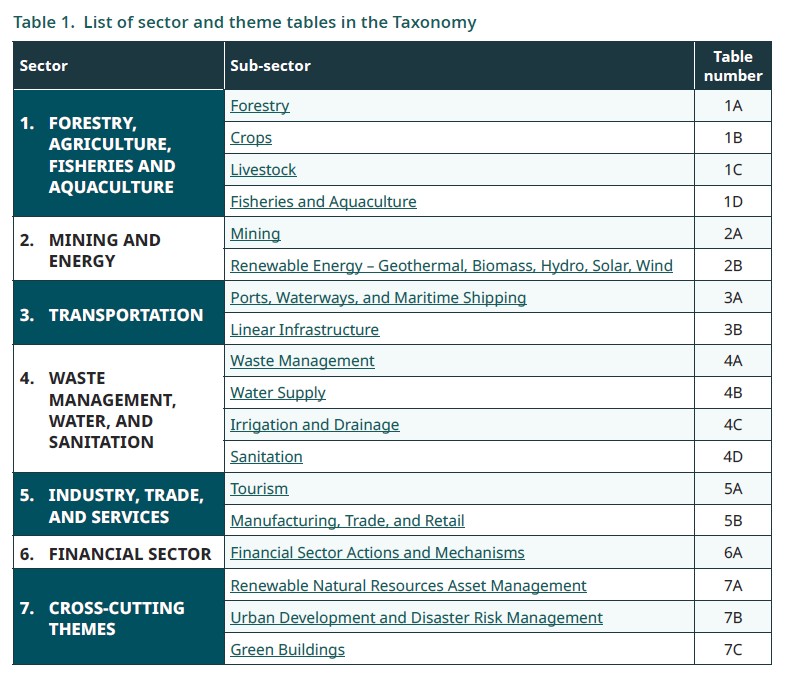

The nature finance taxonomy covers multiple fields, including:

- Forestry, Agriculture, Fisheries, and Aquaculture.

- Mining and Energy.

- Transportation.

- Waste Management, Water and Sanitation.

- Industry, Trade, and Services.

- Financial sector.

- Cross-cutting themes.

Each field contains different sub themes, for example, cross domain themes include:

- Renewable natural resource asset management.

- Urban development and disaster risk management.

- Green building.

Multilateral development banks can use taxonomy to conduct pre-evaluation of finance activities. As taxonomy is still in its initial stage, multilateral development banks can also track unlisted activities if their objectives are consistent with those of the taxonomy. To promote interoperability, the taxonomy system also refers to the International Finance Corporation Biodiversity Finance Reference Guide and the Joint Report on Multilateral Development Banks’ Climate Finance, which can provide information for a wider range of capital markets and help natural investment-related investors screen eligible activities.

The nature finance taxonomy specifies activities in specific fields and requires these activities to meet general requirements:

- Can not exacerbate natural losses, nor hinder the achievement of other environmental goals.

- If the activity is related to natural sustainability certification, these certifications need to be recognized and audited.

- Ecological restoration activities should not involve invasive species and should prioritize local species.

Reference: