Natural Finance Report

The World Economic Forum (WEF) releases nature finance report, aimed at providing recommendations for businesses on nature strategy and nature finance action plan.

The World Economic Forum believes that there is an annual financing gap of $700 billion in nature conservation worldwide, with only 5% of Fortune 500 companies having a nature strategy and over 80% having a climate strategy. The market needs to combine nature conservation with financial performance in order to expand nature financing and achieve global biodiversity goals.

Related Post: UNEP FI Releases Recommendations for Financing Nature-based Solutions

Nature Strategy and Natural Finance

Nature strategy is an important part of sustainable development strategy, which can reduce the impact of business activities on the environment and ensure the sustainable use of resources. Nature strategy is also an important part of natural financing, as it can guide the market to allocate funds towards nature friendly projects. Common natural strategy can be divided into three parts, namely:

- Baseline: natural impacts, dependencies, risks, and opportunities, including the location of material impacts, the impact of natural risks and opportunities on business activities, and stakeholder mapping.

- Targets: Natural goals set by the enterprise, as well as key performance indicators developed to achieve those goals.

- Nature Finance Action Plan: In order to achieve natural goals, companies need to develop a Nature Finance Action Plan that outlines how to restore, regenerate, avoid, and reduce negative impacts on nature, as well as how to align their actions with the regulatory disclosure frameworks.

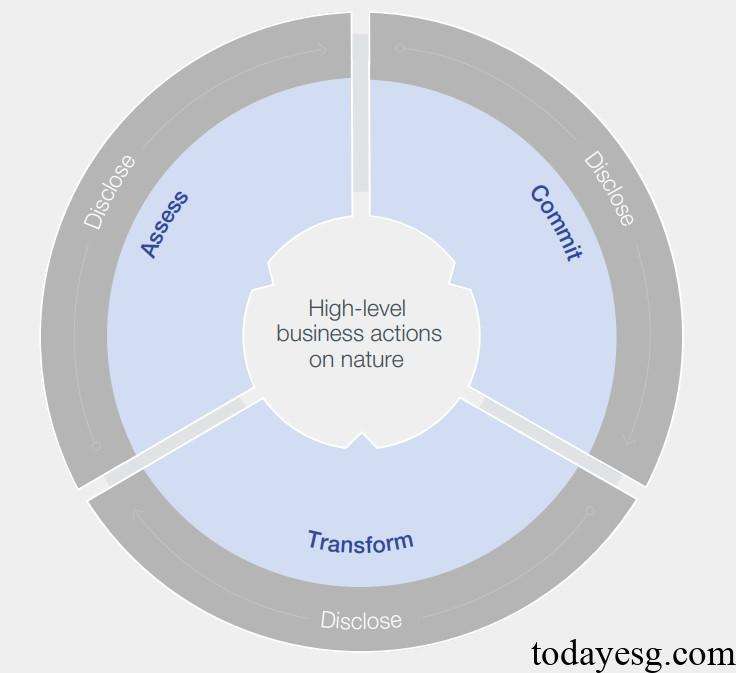

The World Economic Forum believes that natural strategy can also be measured using the ACT-D framework, which refers to:

- Assess: Measure and evaluate the priority order of natural material topics related to the enterprise.

- Commit: Set transparent and scientific natural goals.

- Transform: Transform business models to reduce the negative impact of business activities on nature.

- Disclosure: Disclose natural related information publicly.

The development of nature strategy depends on the resources, data, and stakeholder requirements allocated to it by the enterprise. The enterprise needs to understand the actions it should take and quantify the impact of these actions. Enterprises can refer to the Guide on Scenario Analysis published by the Taskforce on Climate-related Financial Disclosures (TNFD) to study the potential relationship between natural losses and climate change.

How to Develop a Nature Finance Action Plan

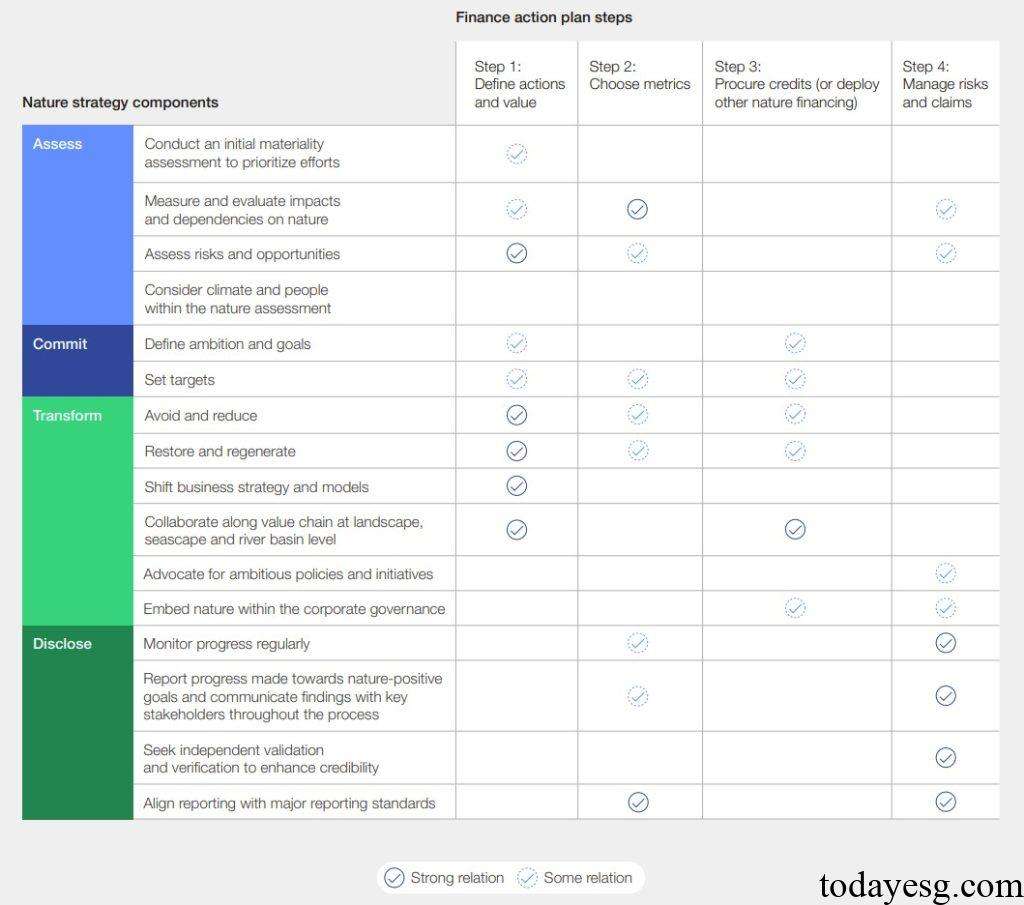

In addition to developing nature strategy, companies also need to develop nature finance action plans in order to translate nature strategy into concrete actions. The World Economic Forum believes that the Nature Finance Action Plan can be divided into four steps, namely:

- Define actions and values: Enterprises need to list possible actions and evaluate these actions based on qualitative and quantitative factors in order to determine the scope of action (within the enterprise or on value chain). Enterprises also need to consider whether to take natural actions together with their partners.

- Identify metrics: Enterprises need to define scientific metrics to measure the impact of natural actions. Enterprises need to consider the information they already have and identify the primary solutions that can have a positive impact on nature.

- Obtain biodiversity credits with integrity: When companies adopt biodiversity credits as their natural financing option, they need to consider the strategic, operational, and reputational risks that exist during the process, and identify biodiversity credits with high credibility.

- Manage risks and claims: Enterprises need to consider the risks of purchasing biodiversity credits, confirm their scope, boundaries, accuracy, and transparency. When a claim occurs, companies need to understand relevant cases in order to gain communication experience.

The World Economic Forum believes that there is a close connection between nature strategy and nature finance action plans, and companies can refer to the following mapping to maintain the coherence between them.

Reference:

Nature Finance and Biodiversity Credits: A Private Sector Roadmap to Finance and Act on Nature