Global Green Economy Report

The World Economic Forum (WEF) releases global green economy report, aimed at analyzing growth opportunities for the green economy.

The World Economic Forum believes that the green economy is a trillion-dollar market and one of the world’s largest growth opportunities.

Related Post: London Stock Exchange Group Releases 2025 Green Economy Investment Report

Global Green Economy Development

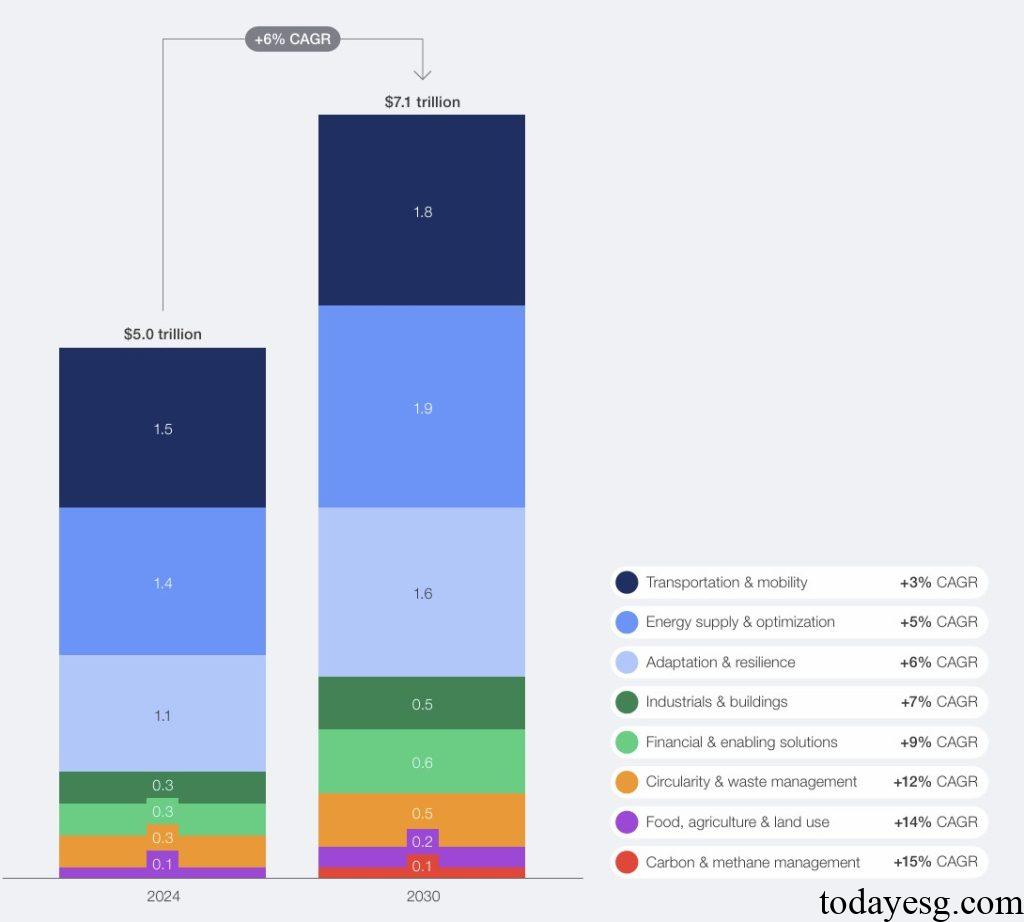

The global green economy market size has exceeded $5 trillion by 2024 and is expected to reach $7 trillion by 2030, with an average annual growth rate of 6%. This growth is attributed to years of sustained technological advancements and global climate action. Green economy can be divided into two categories: climate change mitigation and climate change adaptation, accounting for 78% and 22% respectively. In the current $5 trillion market, the transportation industry ($1.5 trillion) and the energy industry ($1.4 trillion) account for a relatively high proportion.

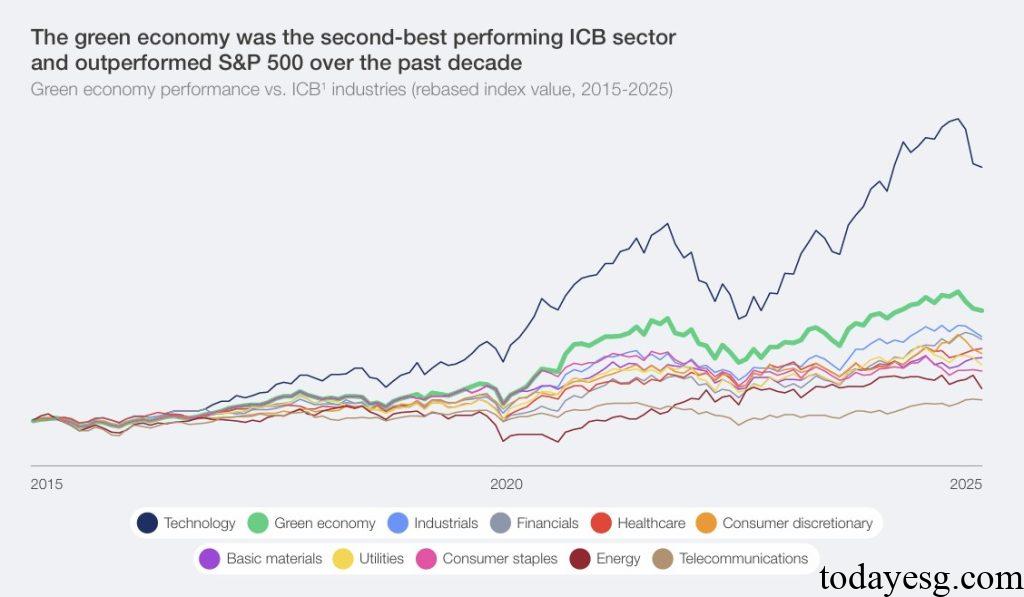

The performance of the global green economy industry is generally better than that of the general industry. In the past decade, the average annual growth rate of listed companies in the green economy industry has reached 15%, which is 4 percentage points higher than the S&P index and second only to the global technology industry. The total market value of the global green economy industry has increased from $2 trillion to $8 trillion, while the total market value of the S&P index has increased from $17 trillion to $50 trillion. This growth benefits from climate action by both the public and private sectors.

Characteristics of Global Green Economy

The World Economic Forum believes that the characteristics of a global green economy include:

- Decarbonization solutions that already have cost advantages: Current decarbonization solutions can reduce half of global carbon emissions, and some slightly higher cost solutions can also reduce carbon emissions by 20%. Renewable energy is one of the world’s largest green technology markets, with photovoltaic power generation costs decreasing by 90% since 2010, offshore wind power costs decreasing by 50%, and lithium iron phosphate battery costs decreasing by 90%. Most photovoltaic and wind energy projects already have the potential for large-scale deployment in the absence of subsidies.

- The market for deep decarbonization technology is growing: It is not possible to achieve net zero solely with mature solutions. In some industries that are difficult to reduce emissions, biofuels, carbon capture, utilization, and storage technologies are growing, but these technologies have high costs and slow actual progress. These deep decarbonization technologies require more support in terms of energy consumption, raw material supply, and infrastructure. As application costs decrease, the market for deep decarbonization technology will continue to expand.

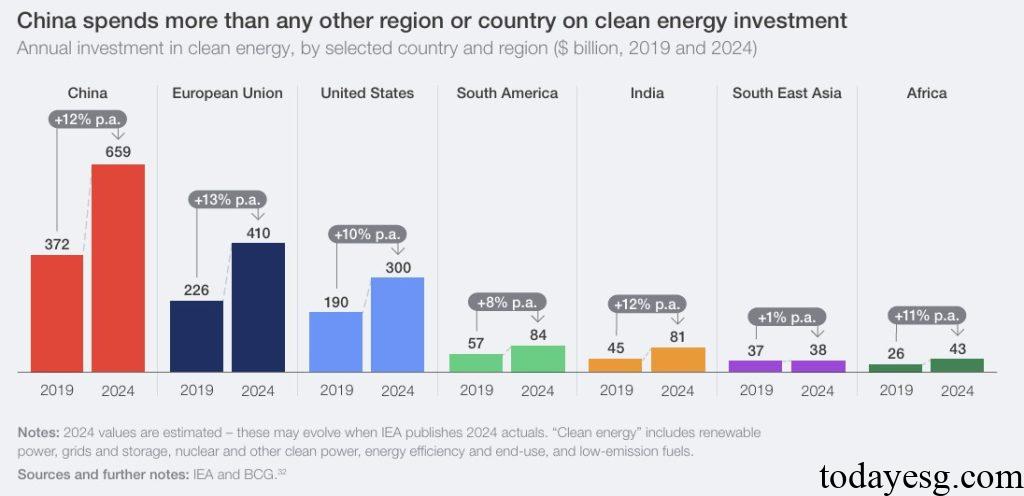

- China leads global green growth: China is in a leading position in terms of funding investment, technological innovation, and construction scale in the green economy. From 2019 to 2024, China’s investment in clean energy increased from $372 billion to $659 billion, with an average annual growth rate of 12%. Since 2020, the scale of China’s photovoltaic market has doubled, and the scale of wind power has doubled. China has the world’s largest electric vehicle market and the most charging stations, making it a leader in global transportation electrification.

- Energy independence has become a driving factor for low-carbon investment: Many countries around the world are increasing their investment in renewable energy to reduce dependence on energy supply chains. For example, the EU’s REPowerEU and Green Deal Industrial Plan plans to reduce fossil fuel imports and increase the development of low-carbon hydrogen energy and battery value chains.

- The climate adaptation market is expanding in developing economies: Against the backdrop of climate change, the importance of adapting to climate change solutions is increasing. Developing economies are more susceptible to extreme weather conditions and have relatively weaker climate resilience, thus requiring greater efforts to enhance their ability to adapt to climate change.

Reference: