Asian Net Zero Transition Bond Market Report

The World Economic Forum releases the Asian net zero transition bond market report, aimed at analyzing the role of the bond market in net zero transition and proposing recommendations to promote the development of Asian bond market.

In order to achieve the net zero target, the global market requires over $3 trillion in net zero investment annually. As representatives of emerging markets and developing economies, the Asian bond market faces a significant financing gap. How to expand the size of the Asian bond market and provide sufficient funds for net zero transition is a key concern for stakeholders.

Related Post: International Capital Market Association Releases Asian Sustainable Bond Market Report

Role of Asian Net Zero Transition Bond Market

The World Economic Forum predicts that emerging market and developing economies need to spend $600 billion to $1 trillion annually on net zero investment by 2030, despite currently owning only 10% of global total fortunes. In addition, the debt burden of emerging markets and developing economies is gradually increasing, with their total debt scale exceeding $100 trillion, accounting for one-third of the global debt. Meanwhile, these economies may continue to emit over 5 billion tons of carbon dioxide in the next 20 years, while developed economies will reduce their carbon emissions by 2 billion tons.

Although preferential financing from multilateral development banks is a key source of funding for the net zero transition, the bond market still plays an important role in achieving the net zero goal. International Energy Agency believes that over 70% of net zero investment in Asia needs to be borne by private capital, with 60% of them coming from debt financing. The bond market not only needs to provide more financing, but also match the long-term investment period of net zero investment with long-term bonds to attract global sustainable development investors.

The Development of Asian Net Zero Transition Bond Market

The Climate Bonds Initiative categorizes labelled bonds into two types. The first type is Use of Proceedings bonds, where funds raised are only used for specific projects such as green bonds, social bonds, and sustainable bonds. The second type is Impact Bonds, which means that the raised funds are not limited in purpose but need to be related to ESG Key Performance Indicators.

For issuers, labelled bonds can enjoy a green premium, enhance their reputation, and attract more investors with a preference for sustainable development. However, external review, certification, and information disclosure of labelled bonds may incur additional costs.

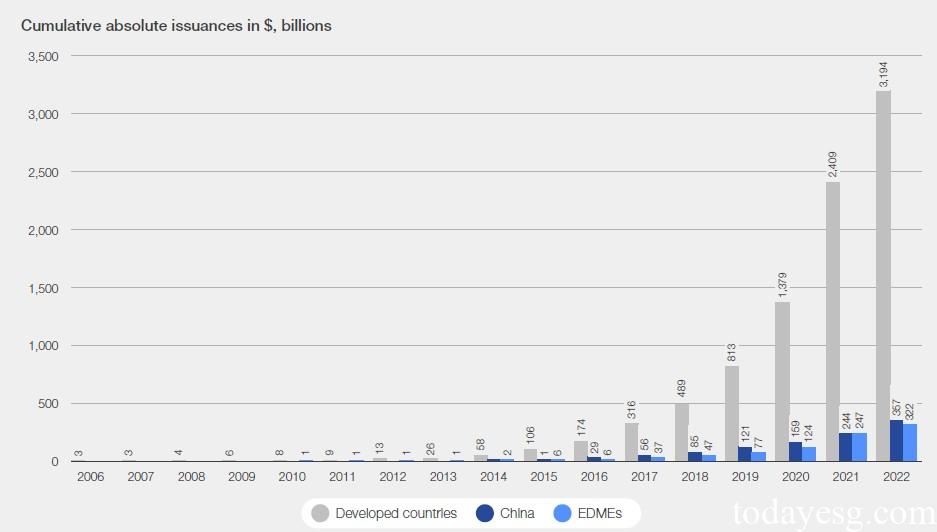

The development of the Asian labelled bond market is closely related to the net zero transition. The labelled bonds issued by the Asian Development Bank are the first batch of labelled bonds issued by emerging markets and developing economies, but the development of labelled bonds in the Asian market has been relatively slow. Taking ASEAN as an example, its labelled bond issuance currently accounts for 23% of the global emerging markets and developing economies, and 2% of the global labelled bond market. Most of the labelled bonds in the ASEAN region are issued by multilateral banks such as the Asian Development Bank, rather than by enterprises, which makes the market supply of labelled bonds in Asia have great potential for development.

How to Promote Asian Net Zero Transition Bond Market

The World Economic Forum believes that all stakeholders in Asia should work closely together to reduce the cost of issuing net zero transition bonds and increase the yield of bond issuance. For example:

Issuers: Issuers needs to understand investors’ preferences for net zero assets and reduce the likelihood of greenwashing. Issuers also needs to establish a net zero bond issuance and disclosure mechanism to prepare bond issuance procedure.

Investors: Investors can engage with issuers and disclose the premium they are willing to pay for net zero bonds, in order to promote net zero bond issuance and increase transparency of information between investors and issuers.

Regulators: Regulators can increase subsidies for sustainable projects to reduce the cost of net zero investment. Regulators may also consider adding requirements for long-term investors (such as pension funds and sovereign wealth funds) to allocate net zero assets, in order to increase market demand for net zero bonds, and consider providing certain tax exemptions for these assets.

Reference:

Labelled Bonds for the Net-Zero Transition in South-East Asia