2025 Q2 Global Sustainable Bond Market Report

The World Bank releases 2025 Q2 Global Sustainable Bond Market Report, which aims to summarize the development of the global sustainable bond market.

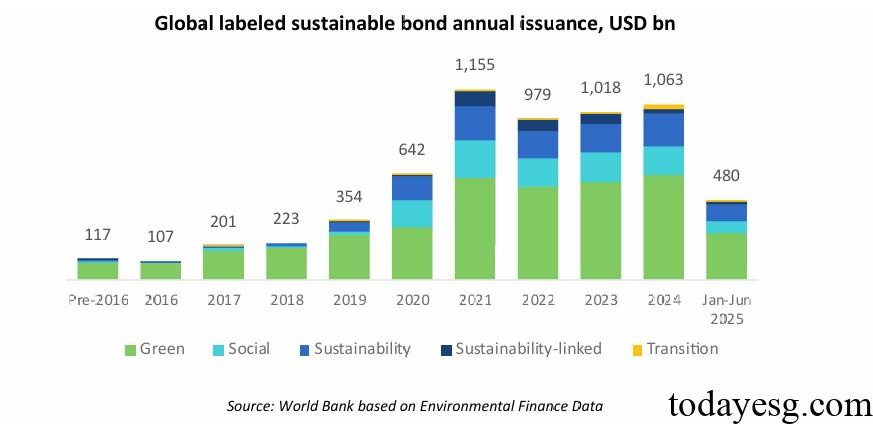

According to World Bank, as of June 2025, the total issuance scale of global green bonds, social bonds, sustainable bonds, sustainability-linked bonds, and transition bonds has reached $6.3 trillion.

Related Post: Climate Bond Initiative Releases 2025 Q1 Global Sustainable Bond Report

Global Sustainable Bond Market Development

The global scale of sustainable bond issuance in the first half of 2025 is 480 billion USD, with green bonds accounting for the highest proportion in the sustainable bond market, reaching 68.3% in the second quarter of 2025. The proportion of green bonds in developed economies and emerging market economies is 66% and 68%, respectively. The proportion of public sector participation in green bonds in developed economies and emerging market economies is 43% and 26%, respectively.

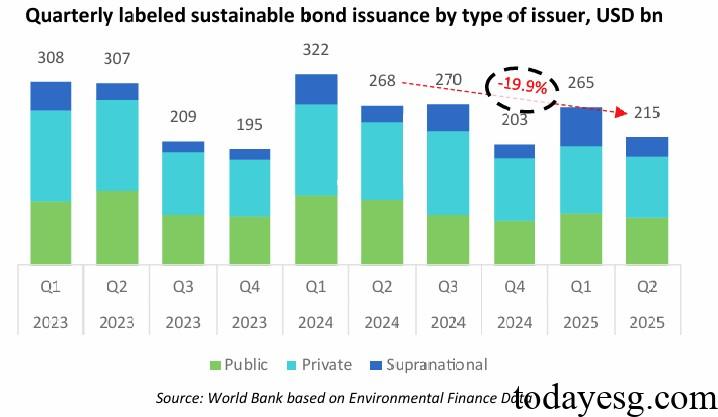

The global issuance scale of sustainable bonds in the second quarter of 2025 was $214.6 billion, a decrease of 19% compared to the previous quarter and 20% compared to the same period last year. The issuance of green bonds, social bonds, sustainable bonds, sustainable linked bonds, and transition bonds decreased by 15%, 27%, 32%, 0.2%, and 79% year-on-year, respectively. The issuance of sustainable bonds in developed economies and emerging market economies decreased by 22% and 40% respectively year-on-year.

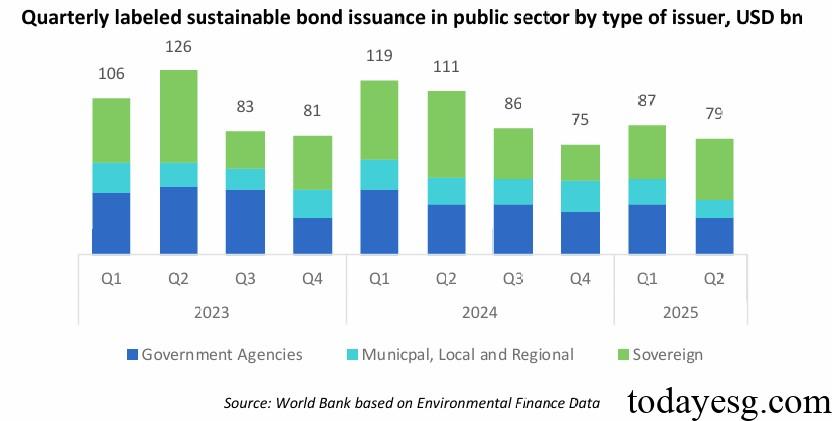

Public Sector Sustainable Bond Development

The scale of public sector sustainable bond issuance in the second quarter of 2025 was 79 billion USD, a year-on-year decrease of 29%. The issuance of sustainable bonds in the public sector accounts for 34% of the global total, with green bonds accounting for 59% of the total public sector issuance. Government agencies have the largest proportion of issuance in the public sector (46% overall, 32% in 2025 Q2), while the proportion of issuance by sovereign states is increasing (35% overall, 52% in 2025 Q2).

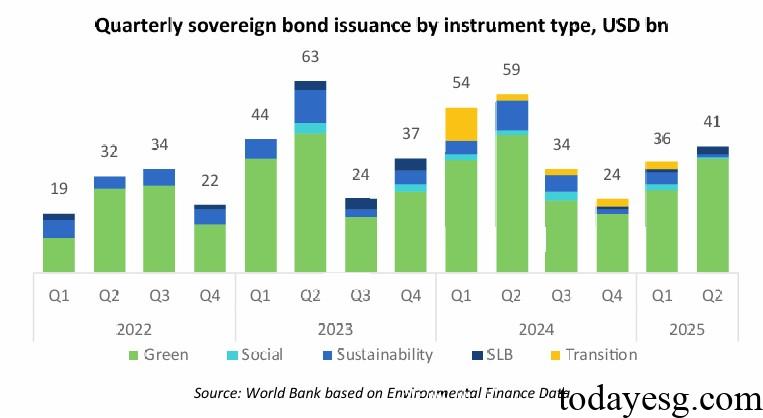

Sovereign Sector Sustainable Bond Development

The issuance scale of sustainable bonds by sovereign states in the second quarter of 2025 was $41.2 billion, an increase of 14% month-on-month and a decrease of 30% year-on-year, involving 23 jurisdictions. Currently, 61 jurisdictions worldwide have issued sustainable bonds with a cumulative issuance size of $748.5 billion. Green bonds are the most important type of sustainable bond, with an issuance scale of $37.7 billion in the second quarter of 2025, accounting for a cumulative proportion of 78%. The total issuance scale of emerging market economies is $178 billion, accounting for 2.8% of the global total, with sustainable bonds (46%), green bonds (26%), and social bonds (19%) accounting for a relatively high proportion.

Reference: