2025 Sustainable Investment Trends Report

The US Sustainable Investment Forum (USSIF) releases 2025 Sustainable Investment Trends Report, which aims to summarize the development of the US sustainable investment market and look forward to future trends.

In 2025, there are fluctuations in sustainable investment policies, regulations, and market environments in the United States, and investors need to weigh the financial performance, long-term value creation, and risk management of sustainable investments.

Related Post: US SIF Releases 2022 Sustainable Investing Report

Introduction to Sustainable Investment Market in US

The total size of the sustainable investment market in the United States is $6.6 trillion, accounting for 11% of the entire market, an increase of $100 billion compared to last year. Despite an increase in absolute value, the percentage of sustainable investment in the market has decreased compared to the total market size, growing from $52.5 trillion to $61.7 trillion. In terms of measuring market size, the definition of sustainable investment, information disclosure by asset management companies, and investor communication methods all have an impact on statistical data. This survey included 270 respondents, with asset managers (59%), asset owners (14%), and research institutions (10%) accounting for a relatively high proportion.

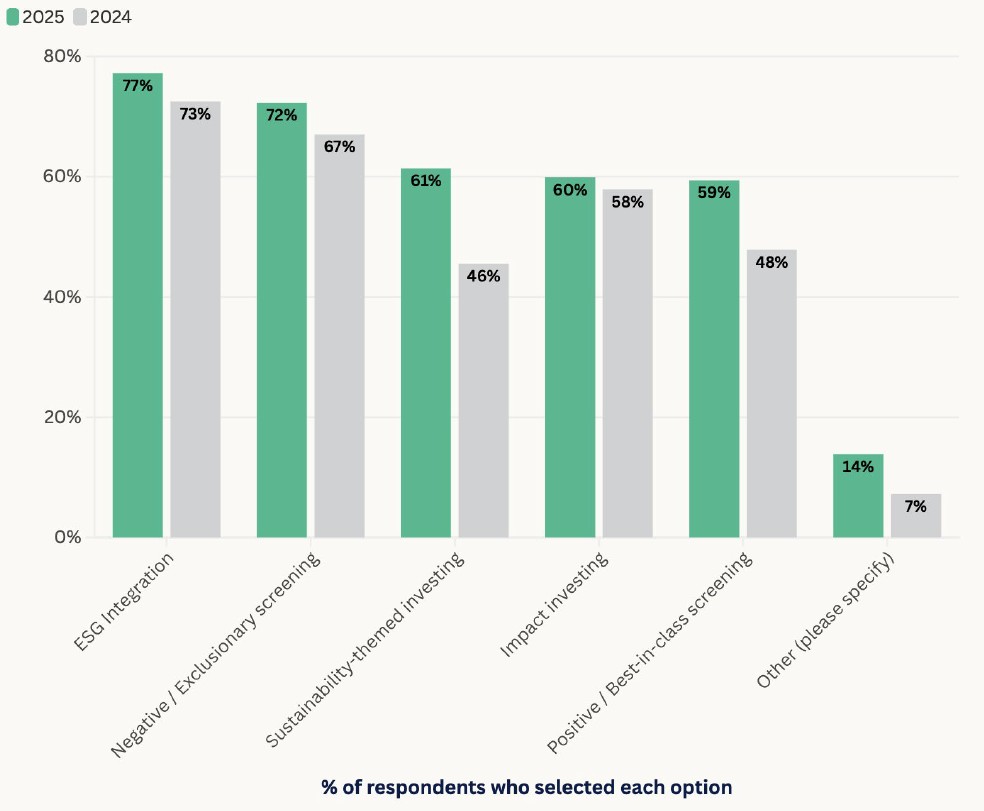

In terms of changes in the regulatory environment, 46% of respondents stated that they were not affected, 29% of respondents clearly focused on financial substance, and 24% gave up using ESG terminology. 10% of respondents have reduced communication channels, budgets, and staffing related to sustainable investment due to these impacts. 53% of the respondents in this survey believe that sustainable investment will significantly increase in the next two years, a decrease of 20 percentage points compared to last year. Half of the respondents believe that their institution will not increase sustainable investment in the next year, and 2% plan to reduce sustainable investment. In terms of sustainable investment methods, respondents mainly use ESG integration (77%), negative screening (72%), thematic investment (61%), impact investment (60%), and positive screening (59%).

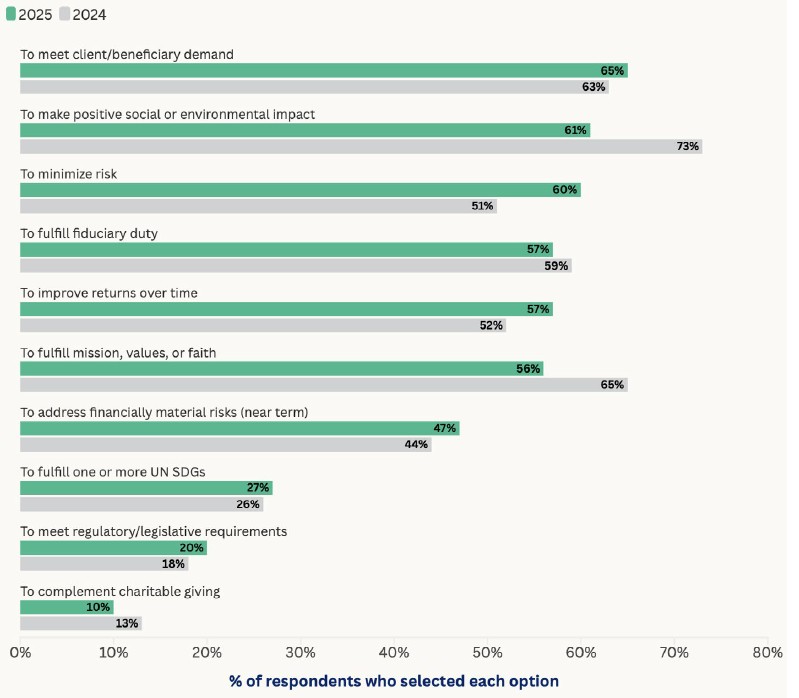

Among the reasons for choosing sustainable investments, meeting customer requirements (65%), generating positive environmental and social impacts (61%), and reducing risks (60%) are relatively high. The main reasons why respondents plan to increase sustainable investment are climate change (52%), customer demand (41%), and the frequency and degree of climate events (38%). Half of the respondents have improved their communication methods for sustainable development, such as reducing ESG terminology, describing financial substance, and specific action plans. These impacts have also been reflected in the information disclosure of listed companies. As of October 2025, only 74% of the S&P 100 index constituent stocks have released sustainability reports, lower than 90% in recent years, indicating that investors and companies are facing more uncertainty.

In terms of choosing a sustainable disclosure framework, respondents mainly use their own disclosure framework (69%) and pay attention to the United Nations Sustainable Development Goals (50%) and the United Nations Principles for Responsible Investment (49%). Measuring the fit of sustainable investment according to the United Nations Sustainable Development Goals, SDG 13 Climate Action (74%), SDG 7 Affordable and Clean Energy (70%), and SDG 8 Decent Work and Economic Growth (55%) rank high. Overall, the alignment between the market and sustainable development goals has improved, but the global funding gap for sustainable development goals remains between $5 trillion and $7 trillion annually.

Outlook for the Sustainable Investment Market in US

The respondents have a relatively optimistic attitude towards the sustainable investment market in the United States, with 69% believing that sustainable investment will continue to develop and 5% believing that the field of sustainable investment will gradually shrink in the future. Some investors believe that sustainable investment should only focus on the impact of environmental, social, or governance risks, that is, single materiality. Other investors believe that sustainable investment also needs to consider the impact of investment decisions on the environment and society, that is, dual materiality. These differences indicate that the industry needs a clear definition and disclosure standard to assess the effectiveness and necessity of the two viewpoints.

For the future development of the sustainable investment market, respondents believe that it is necessary to clarify the investment value of ESG and demonstrate that considering ESG factors can lead to better financial results. Compared to short-term returns, the long-term driving factors of sustainable investment will accelerate future development.

Reference: